Cooper Tire & Rubber (CTB) estimates are still climbing as the company prepares for its next earnings report in early August.

Company Description

Cooper Tire & Rubber Co. makes tires for motorcycles, trucks and everything in between. The Ohio-based company has locations in 10 countries, including Europe and Asia.

Estimates Continue Higher

Following the original Zacks Rank Buy feature in May, estimates have continues to inch higher. The full-year consensus for 2010 is up 4 cents to $2.42, and up from $2.08 in the past 3 months.

The Zacks Consensus Estimate for 2011 is up 6 more cents, to $2.51, and up 30 over the past 3 months. Given the $1.96 earned in 2009, growth rates are expected to be 23% this year and 4% next year.

Valuations

Shares of CTB are trading with a single digit forward P/E ratio right now. The PEG is a bit higher at 1.4, but that is not too bad. Cooper Tire & Rubber also has a price-to-sales ration of just 0.4.

As for other metrics, the company is well ahead of its peers. Cooper Tire & Rubber operates with a net profit margin of 2.9%, while the industry averages a half percent loss. The ROE is coming in just above 30% as the industry averages 0%. It may be surprising, but the tire industry is ranked 14th out of 264 on Zacks.com.

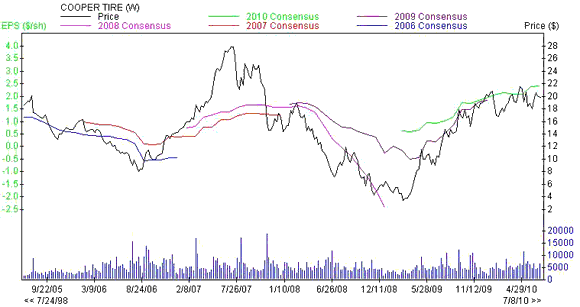

The Chart

Estimates for Cooper Tire have fully rebounded from the recession and are now at the higher levels in 5 years. However, shares were trading about 50% higher when estimates were at similar levels, leaving plenty of room for gains.

Read the May 19th Feature Here

Last Week’s Aggressive Growth Zacks Rank Buy Stocks

Littelfuse, Inc (LFUS) analysts rushed to raised estimates after the company released its revised sales guidance. Demand continues to exceed expectations and the company is able to keep up. Read Full Article.

AmeriCredit Corp (ACF) analysts are raising estimates heading into the next earnings release, which should be in a few weeks. Growth is expected to be exponential and one rating agency has upgraded the company’s debt. Read Full Article.

Finisar Corporation (FNSR) is expected to drastically increase earnings this year and you wont be overpaying for those nice growth rates either. Read Full Article.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply