CARBO Ceramics Inc. (CRR) recently hit a new all-time high above $80 as demand for its products and services remain strong on higher energy prices. With an average earnings surprise of 17% over the last year and a bullish 26% next-year estimate, Carbo has some very nice momentum working in its favor.

Company Description

Carbo Ceramics, Inc. manufactures and supplies ceramic proppants used in the hydraulic fracturing of natural gas and oil wells in the United States and Internationally. The company was founded in 1987 and has a market cap of $1.81 billion.

The driving force behind Carbo’s growing business is the success of its ceramic proppants, which enables crude and natural gas producers to achieve higher recovery rates than sand-based proppants. Even though this ceramic proppant technology has been around for a while, Carbo has seen its sales explode over the last ten years, climbing to $342 million in 2009 from just $93 million in 2000. Carbo demonstrated that its success is alive and well in late April with better than expected Q1 results.

First-Quarter Results

Revenue for the period was up 36% from last year to $123 million. Earnings also came in strong at 82 cents, 24% ahead of the Zacks Consensus Estimate, pushing the company’s average earnings surprise over the last four quarters to 24%.

With sales volumes up 46% from last year to 370 million pounds, Carbo noted that it keeps production at maximum capacity during slower times of the year to help keep pace with short-term fluctuations in demand.

Looking forward, Carbo remains focused on addressing the tight relationship between supply and demand, with its facility in Toomsboro, Georgia expected to add 250 million pounds of production by the end of 2010 and another 250 million pounds by the end of 2011 for a total increase of about 40% over the next 18 months.

Estimates

The solid performance pushed estimates higher, with the current year adding 13 cents to $2.82 and the next year adding 21 cents to $3.55, a bullish 26% growth projection.

Valuation

After the recent string of gains, shares of CRR do look a bit pricey, trading with a forward P/E multiple of 28X, a premium to its peer’s 22X.

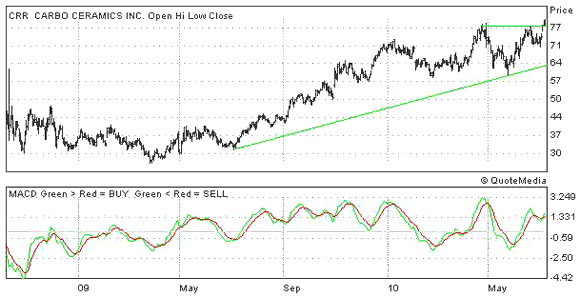

2-Year Chart

CRR recently hit a new all-time high after riding a trend line higher for most of the last year. The MACD below the chart is also bullish, with the short-term average advancing above its long-term counterpart. Look for support from the trend on any weakness, take a look below.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply