Treehouse Foods, Inc. (THS) recently pulled back to a key level of support after hitting a new multi-year high above $50 in mid June. With a solid 16% earnings surprise from early May and a bullish next-year projection of 13%, this company and its shares have some solid upward momentum.

First-Quarter Results

Shares of THS got a boost in early May when the company reported better than expected Q1 results. Revenue for the period was up 12% from last year to $397 million. Earnings also came in strong at 59 cents, 16% ahead of the Zacks Consensus Estimate. Treehouse has been very solid over the last year, with an average earnings surprise of 21% over four quarters.

On the earnings call, CEO Sam Reed touched on the growth of private label food providers, saying, “Our strong first-quarter results support our belief that private label will continue to grow twice as fast as brands, as it has for the last two decades.”

Looking forward, the company said that although it expects input costs to continue rising, it shouldn’t have any material impact on earnings.

Estimates Up

The encouraging tone and higher guidance lifted estimates, with the current year adding 3 cents to $2.72 and the next year also adding 3 cents to $3.06, a solid 13% growth projection.

Valuation

With some nice gains in hand, shares are trading at a premium to their peers, with a forward P/E multiple of 17X against 15X.

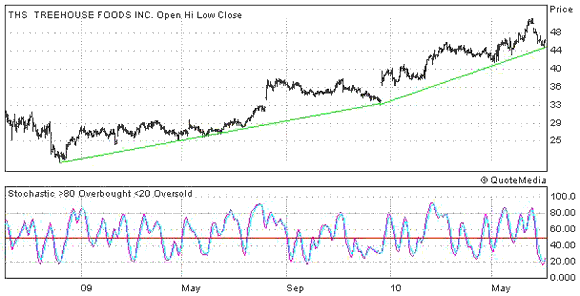

The Chart

THS hit a new multi-year high in mid June before pulling back to a key level of support on general market weakness. The stochastic below the chart is indicating that THS is trading in over sold territory, take a look below.

Read the Mar 5 THS article here

Last Week’s Momentum Zacks Rank Buy Stocks

UAL Corporation (UAUA) recently rebounded from a key trend line after hitting a new multi-year high above $24 in mid June. Estimates are up huge over the last few months and the valuation picture could hardly be any better with a forward P/E of 5X. Read Full Article.

Banco De Chile (BCH) continues to pressure its multi-year high at $66.20 after posting an awesome 43% earnings surprise in late April. Estimates have since been on the rise, with the next-year estimate now projecting bullish 28% growth. Read Full Article.

Dolby Laboratories, Inc. (DLB) recently hit a new multi-year high just above $69 as the company continues to expand into growing markets like iTunes, mobile handsets and Blu-ray DVD’s. Even though estimates are on the rise and the next-year estimate is projecting 15% earnings growth, the valuation picture is in line with its industry peers. Read Full Article.

Forrester Research, Inc. (FORR) continues to pressure its multi-year high just above $33 after reporting a solid 25% earnings surprise from late April. With estimates on the rise and a bullish 28% next-year growth projection, analysts are optimistic on the longer-term picture too.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply