Although many people are concerned about the possibility of a second economic downturn, I continue to see an economy that is growing, albeit significantly more slowly than we would have wanted.

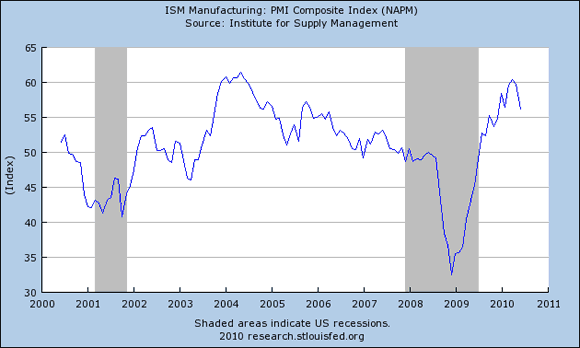

The ISM manufacturing PMI index for June was 56.2, the lowest value since December. But any value above 50 means that a plurality of managers reported that June was better than May. The uninterrupted string of above 50 readings we’ve seen going back to August of 2009 means that mangers have seen improvements month after month. A value of 56.2 is higher than that seen in 80% of the months over the last ten years.

Source: FRED

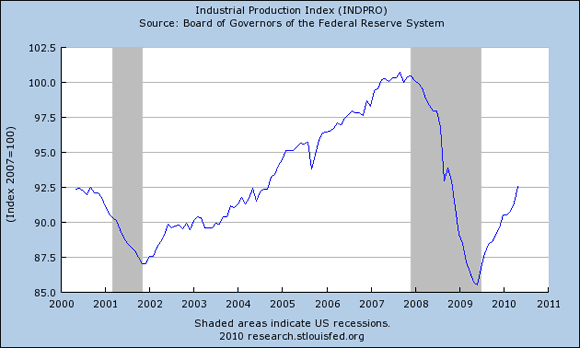

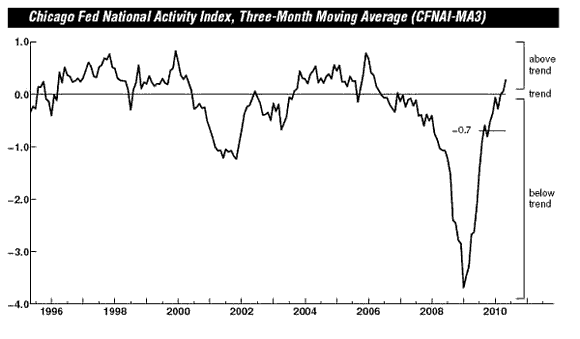

The Federal Reserve’s index of industrial production and the Chicago Fed National Activity Index both paint a pretty favorable picture of continuing growth in May.

Source: FRED

Source: Federal Reserve Bank of Chicago

What about the Bureau of Labor Statistics’ estimate that seasonally adjusted U.S. nonfarm payrolls decreased by 125,000 jobs in June? We discounted last month’s BLS estimate of 431,000 new jobs in May on the grounds that 411,000 of these were temporary Census workers. But if you didn’t count those as a plus in May, you shouldn’t count the elimination of 225,000 of those temporary positions in June as a minus. Net of temporary Census hiring, the U.S. economy created 100,000 new jobs in June. I think that Steven Blitz of Majestic Research has the right perspective:

Adding 83,000 private sector jobs, of which 20,500 are temporary positions, and losing 10,000 state and local government positions, is not the stuff of robust recovery but it also isn’t the makings of a double dip.

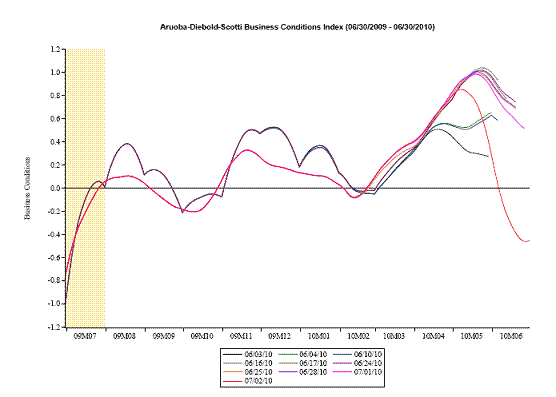

The Aruoba-Diebold-Scotti Business Conditions Index, which feeds off the raw NFP numbers without adjusting for the temporary Census positions, was shocked back into negative readings by the latest BLS report.

Aruoba-Diebold-Scotti Business Conditions Index for the past year, as assessed using different data vintages. Red is the most recent incorporating the July 2 employment report.

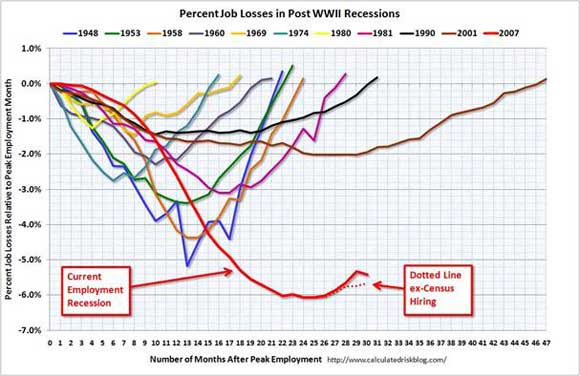

I see employment overall as still growing, not contracting, but the growth is not enough to keep up with growing population, let alone make a dent in the huge number of unemployed.

Source: Calculated Risk

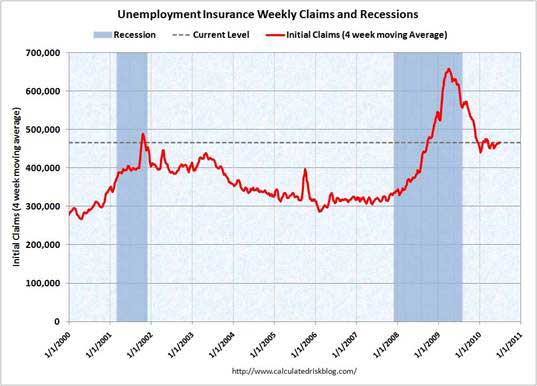

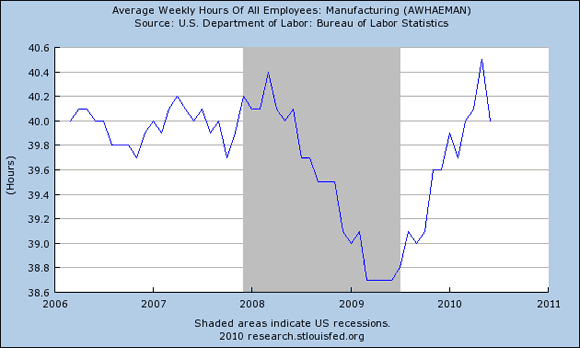

The Conference Board regards nonfarm payrolls as a coincident economic indicator, but new claims for unemployment insurance and average weekly manufacturing hours as leading indicators. New claims have been stuck at a regretfully high plateau since December.

Source: Calculated Risk

And although it can be a mistake to read too much into one month’s figures, whatever you say about the sharp drop in manufacturing hours in June, it can’t be good.

Source: FRED

It’s also safe to say that autos are not yet providing the stimulus to growth that I had thought they could. The seasonally unadjusted number of light vehicles sold in June was below the values for May or March and about the same as April. We still seem closer to the bottom than the top.

Data source: Wardsauto.com

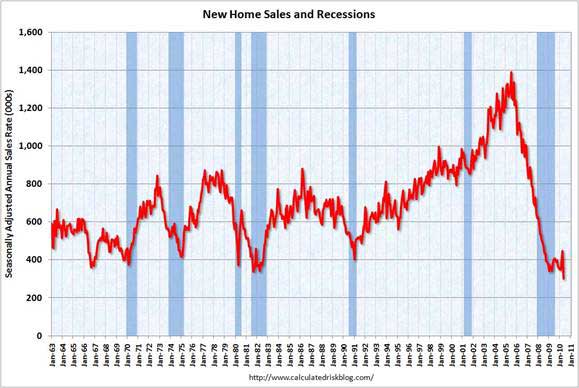

Housing continues to lurch up and down with the expiration of tax credits. New home sales and pending home sales were both at record lows for May, while mortgage purchasing applications were near a 13-year low.

Source: Calculated Risk

Source: Calculated Risk

Historically, a deep recession would usually be followed by a sharp recovery. What’s different this time? Bill McBride notes that it’s harder to recover from a collapsed credit bubble, and two key drivers of many postwar recession recoveries– lower rates from the Fed and resurgence in the housing sector– are not going to help us this time.

What I’m still seeing is what I had been expecting and what I continue to expect for the rest of this year– weak growth, but growth nonetheless.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply