I’ve written several times about the Bad Bank plan. I believe its critical to restoring confidence in our financial system, and while I don’t expect it to “fix” the recession, I do think its a necessary ingredient to the U.S. economy finally moving forward. I’ve made some loose proposals in the past about how the Bad Bank could work, but after continued thought, I’m proposing an even more detailed idea. Again, this is in the spirit of exchanging ideas, I’d love to hear your comments.

I’ll start with some assumptions.

- Banks and other financial institutions have two flavors of problem assets: loans which are not marked to market and securities which are.

- The point of the Bad Bank is to improve bank balance sheets both in terms of reduced leverage as well as visibility.

- Buying assets at so-called “market” levels does not serve the above purpose.

- While protecting tax payers is obviously important, creating a Bad Bank which doesn’t materially improve financial conditions is a waste of time and money.

Note that because loans and securities are being accounted for differently, it creates a material difference in how much the Bad Bank must pay to actually improve a bank’s balance sheet. More on this later.

We start by hiring four asset managers. Say its PIMCO, Blackrock, Fidelity, and Accrued Interest (of course! Its my damn plan). Each would be given $100 billion to manage, and would also be given access to a Fed-based credit line of $200 billion each. The loans would be TALF-style, no re-margining, term loans that can be repaid at any time. Each firm would be paid a hedge-fund style fee, i.e., with a performance-based element.

For securities, banks and other financial institutions (I’d open it up to pretty much anyone) there would be weekly auctions. On Monday, firms would submit the securities they’d like to sell. There would be some kind of limit on how much any one bank could put out for the bid on any given week just to keep it manageable. The four firms would then be required to put some kind of bid on each item on Friday. No passing. No more of this “there is no market” stuff.

The sellers would be permitted to put a reserve price, but on no more than half of the bonds offered for sale. What wouldn’t be helpful is for firms to put their entire liquidity portfolio out for the bid and then pull everything back after getting a price. That wouldn’t improve transparency at all.

The price though won’t come in cash, but in stock. More on this later.

Now for the really tricky part. Loans. I’m talking your old-fashioned bank-held whole loans. Mrs. Smith’s mortgage. Those are not marked to market, and thus are currently held at par less some reserve for loan losses. Bank of America, for example, only has a 3.5% allowance for losses on their home equity portfolio. As mentioned above, unless these assets are purchased near book value, there’s no point in buying them at all.

So here is my radical solution. The Bad Bank buys all non-delinquent residential loans at full face value.

Now wait, don’t get too angry just yet. Banks who wish to sell residential whole loans to the Bad Bank must build pools of loans that meet certain criterea. This would be relatively easy for residential loans. For example, if Bank of America wants to sell $100 billion in home equity loans to the Bad Bank, they can’t just sell the $100 billion of ugliest shit they have. There would be min/max average FICO, OLTV, average loan size, etc. required. We wouldn’t have to make these restrictions overly stringent, but it would assure that the Bad Bank wouldn’t wind up with just toxic waste.

Commercial loans and delinquent residential loans would go through the same bidding process as securities. This probably means that banks won’t be selling many of these loans, but that’s OK. We don’t need to completely bleach bank balance sheets, just a good rinse off will do.

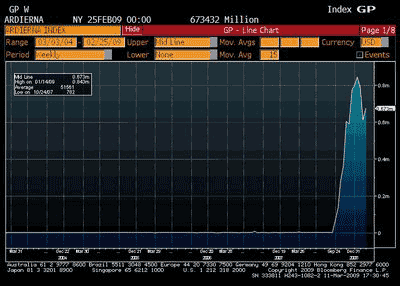

As I said above, banks wouldn’t get cash, at least not in whole. They’d get stock. Remember that banks aren’t suffering for a lack of cash. Banks have some $673 billion in excess reserves…

What they lack is certainty and transparency. So the government buys securities and commercial loans at whatever the bid-determined price is in exchange for stock in the Aggregator Bank. For loans, the bank would get 75% of the face value of their loans in shares and 25% in a subordinated residual.

The principal value of the common stock of the Aggregator Bank would be fully guaranteed by the Treasury. It would pay a dividend equal to all interest on all securities as well as 75% of the interest from whole loans. The other 25% would be retained and potentially paid back to the original bank (the subordinated interest holder), assuming the loan portfolio as a whole met some pre-determined performance standard.

Notice that if the selling bank realizes reasonable performance on their loans, then they are no worse off for having participated in the program. This incentives “good” banks to participate, thus freeing up loanable funds. If loan performance is poor, then the Aggregator Bank retains the excess interest and principal to mitigate tax payer losses.

Notice that this plan doesn’t involve any real cash outlay. The Aggregator is trading stock for assets, with the government standing behind the Aggregator’s stock. Over time, the government should hold an IPO of the Aggregator’s shares, with banks permitted to sell their shares for cash at whatever price the market will bear. Over time, share buy backs would be held with principal returned from the loans. At some point there would have to be some sort of closing transaction as eventually the entire loan portfolio would have paid off.

Now I know what the complaints will be. Tax payers take most of the risk and don’t have a lot of upside. True. Problem is that in order to actually fix the problem, tax payers have to take most of the risk. You can’t erase risk from the system, only redistribute it. If you want less risky banks, then tax payers have to front the risk. Honestly with my plan, tax payers take on less risk that simply handing cash over to banks, which is what we’ve been doing so far.

In fact, I fear its a misplaced desire to “protect” tax payers which will ultimately cause the Bad Bank to fail. If the Bad Bank only buys good loans or only buys bad loans at punitive levels, it won’t help the situation.

Leave a Reply