The bounce continues today in commodities. One interesting aspect of this April blowout and subsequent bounce is that precious metals have gone from being all look same to all look inverse. These things tend to move with pretty tight correlation since they are both seen as inflation hedges though when things get frightening the platinum group metals (PGMs – Patinum, Palladium and Rhodium) tend to get puked out since they are seen as an inflation hedge but not a viable unit of currency.

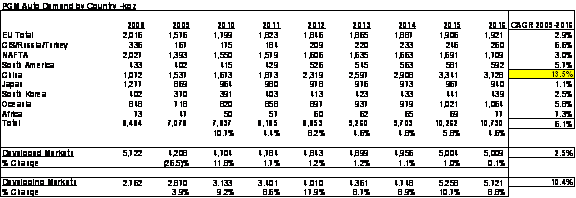

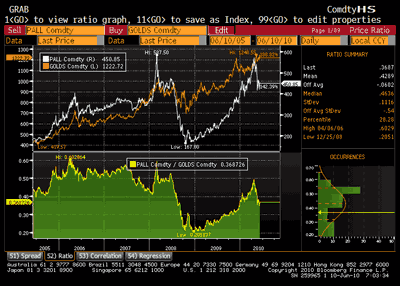

The whole “you gotta be long gold innit” hypothesis rests on the view that people believe currencies will be debased and that the next unit of value we will settle on will be gold, as opposed to beanie babies, copper, or anything else. You begin to wonder what’s so precious about PGMs if they fail this test of being the last thing you bid before you take the shotgun, baked beans and smokin’ Camaro and live out the zombie survivalist fantasy of your choice. Notice the fat tail on the correlation between palladium and gold – it doesn’t do what it is meant to when you most need it to.

(click to enlarge)

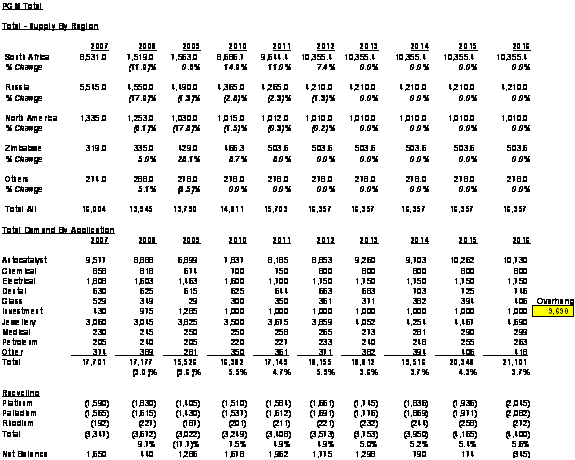

Team Macro Man has never entirely understood why PGMs are considered precious despite their use in jewelry as they really are pretty industrial– autocatalysts, dental fillings, oil refineries and other very non-sexy stuff make up more than 60% of demand. Rhodium can’t even be traded in ETF or futures format and looks very industrial.

(click to enlarge)

To make matters worse for people of a macro trading bent, these metals as a trade have got pretty crowded recently. Places like Brazil, China and India are actually starting to put vehicle emissions standards in place which has led to a lot of funds being long a lot PGMs expecting those standards + growth = a lot more demand for catalysts and PGMs. EM growth, an inflation hedge and government policy for an added boost? Throw in this employee of Chase Manhattan and it would unequivocally be the hottest thing on the street. What could possibly go wrong?

The problem with this trade is that longer term this whole electric car thing is going to crash the party in big way. No internal combustion engine means no fumes means that no autocatalyst is required. The faster that happens the faster this story looks way out of line. Having spent some time going through all these emissions standards you note the below: it’s a great story until 2015 or so when the demand starts to flat line in the developed world and looks saggy in developing markets – and that’s assuming the usual 10-12% growth rate in vehicle demand in China. Any less and expectations in this market are getting ahead of themselves.

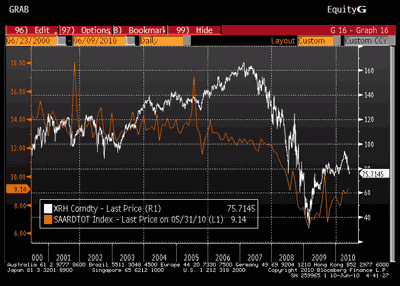

But that’s ok because the supply side looks dire in the short term as the biggest producers are South Africa with its not-so-under-control wage inflation and issues with infrastructure especially Eskom. Even assuming a bunch of project expansions and the like come online the picture looks like this:

Which when you discount for various screw-ups that happen in the mining sector (especially in Zimbabwe) the market does look tight. A few hundred thousand ounces here and there and you might get a shortage. That’s great until you realize that by 2016 the market will supposedly have just shy of ten million ounces in stockpiled PGMs, largely held by people looking to hedge inflation and who will be looking to sell all at once since the rationale for stockpiling this stuff breaks down once you realize that 2020s Camaro is probably going to have engine specs measured in Watts and not litres. What’s worse, by that time, every marginal car on the road will be replacing some other car that (before being crushed into a cube of steel) will have its catalytic converter removed to be reprocessed and – you guessed it – pushed back into supply. Negative feedback’s a bitch ain’t it?

George Soros has recently described gold as the ultimate bubble but gold isn’t facing some looming technical threat that is likely to do really bad things to its demand. So long as people are hoarding shotguns and baked beans they will probably be hoarding gold too. For PGMs that’s a much harder case to make since anyone who sees this a long term inflation hedge is smoking some pretty strong stuff. For those looking to play the short term supply squeeze in the market which is likely to be a feature of the next few years at least, team MM has one thing to say – watch the gap.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply