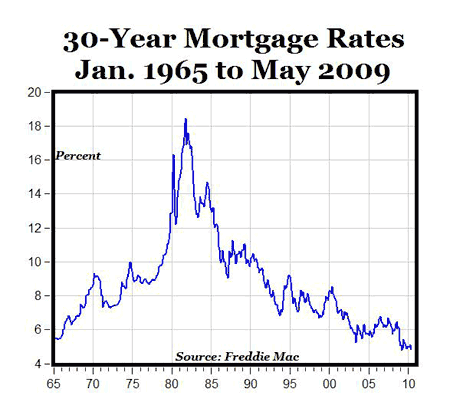

McLean, VA – “Freddie Mac yesterday released the results of its Primary Mortgage Market Survey in which the 30-year fixed-rate mortgage (FRM) averaged 4.84 percent with an average 0.7 point for the week ending May 20, 2010, down from last week when it averaged 4.93 percent. Last year at this time, the 30-year FRM averaged 4.82 percent. Once again, the 30-year FRM has not been lower since the week ending December 10, 2009, when it averaged 4.81 percent.”

MP: Except for a four-week period in November-December 2009 when rates were 4.83%, 4.78%, 4.71% and 4.81%, the 30-year mortgage rate has never been lower than 4.84%, going back to at least the mid-1960s. The record-low mortgage rates should help keep the real estate recovery moving forward, and could also benefit homeowners who take the opportunity to refinance this spring or summer. The record-low 30-year rates are also more evidence that inflationary pressures are non-existent right now.

In other good news for American consumers, gas prices have fallen over the last two weeks by about 11 cents on average, which could act like a huge tax cut if the prices at the pump keep falling. For every one penny per gallon decrease in gas prices, consumers save between $1.42 billion and $1.71 billion annually, see this CD post for the math.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

It is interesting see foreign investment dollars flow back into the US treasury as a result of the European instability thereby keeping our lending rates low. Most of us thought that the 30 year fixed mortgage rate would be between 5.25% and 5.50% by now.