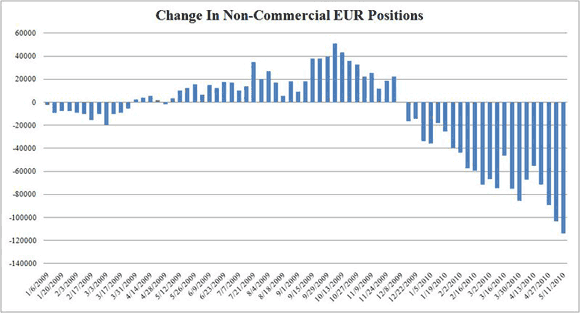

Euroland needs to gather its forces to fend off the woldpack of shorts. As of Friday they had risen to record levels (see chart, courtesy ZH). I have heard reports that European TV news is projecting a fall with no bottom to the Euro.

A huge rescue attempt should commence this evening (Monday am in Europe) as the Wolfpack War continues. As I go to press, the Euro is ticking up slightly down stromgly from its after-market dip Friday, and is a pebby below the Friday close. Ominously, LIBOR rates are ticking up, indicating a lack of trust in sister bank solvency. If we don’t see intervention, Europe has given up already. The contagion from capitulation could happen extremely fast:

What makes this crisis so dangerous is not just that Europe’s banks are still reeling, with wafer-thin capital ratios. The new twist is that markets are no longer sure whether sovereign states are strong enough to shoulder rescue costs.

The implication for stocks – if there is a midnight rescue – is yet another Monday Pump up. We fell Friday in five waves down and bottomed mid-day at Sp1126. The wave structure supports another wave 2 retrace of 50- 62% or into the Sp1150-56 area before rolling over. It might take a few days to conclude, but it should reverse with another day of drama down and push us below Dow10k/Sp1k. Given that Asia opened in the red and futures are down strong (over 100 in the Dow), we might instead get a poor start and an attempted rally into the close Monday.

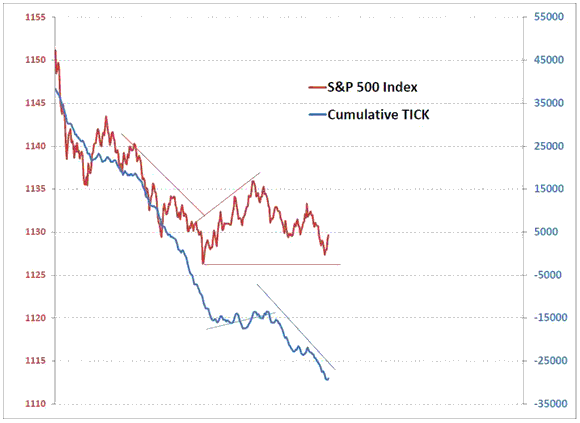

I see more confusion and doubt over this than there should be. I suppose many pundits have become spooked by the rally-that-never-corrects, and expect it to magically restart up towards new highs. This shouldn’t come as news, but – it just had a huge correction that broke out of prior trendlines. It has come back up to test the trendlines, and fallen back below. It had been rising in shrinking volume, and now that it is rolling over, volume is increasing – a classic sign of distribution, where stronger hands are dumping them into weaker hands, who will cut and run should the market drop again. ZH adds that the cumulative tick has decayed much faster than the S&P, an indicator that sellers are hitting bids in a swooning market:

Time to shirk off the doubts and look at the wave structure. If you buy the truncated fifth count, where Thurs was a wave 3 bottom and Friday a wave 5, the subsequent waves look normal:

- The initial bounce off the ‘bot bottom was around 38%, a normal wave 4

- The bounce off the truncated fifth (so far) has been around 62%, a normal wave 2

- A bounce to Sp1156 or so would be another normal 62% retrace, of smaller degree

Stories came out Friday that the ‘bot bottom was not ‘bots alone but Waddell & Reed, a money manager which sold off a large order of e-minis during the ‘bots-gone-wild 15 minutes of fame. This lends credence for treating the Thursday plunge as an Elliott Wave phenom, not a glitch or an anomaly. This makes the drop off Apr26 a “5” whether you call it at the ‘bot bottom on Thursday or at the truncated fifth on Friday. A “5” of this magnitude means a change of trend. We aren’t done, and have more downside to go, and any sharp bounces will now just shake out the timid.

Friday’s STU was pretty clear on this: in four trading days we have retraced the third biggest gap up in S&P history. The biggest on Sep 19, 2008 was retraced in one day. The second biggest on Oct 13, 2008, was retraced in two days. “The inability to sustain’s Monday’s gains is a bearish signal that should not be ignored.” Any small bounce this week should be followed by an even stronger drop than last week!

Neely counts the sharp drop as the start of a triangle. We have a really clear test of NEoWave vs. Elliott Wave. He must count the drop as a “3”, since triangles are a set of five 3-wave moves. (For readers who do not subscribe to Neely, he has the Jan-Feb5 drop an X wave, the rise since wave A, and says we are in a triangle wave B with a C to go to new highs. The sharp drop is leg a of B, the bounce leg b, and we either are still in b or have started leg c.) Neely says higher highs ahead, EWI says the top is in.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply