For the first time since it defaulted on its $40 billion domestic debt in 1998, Russia issued $5.5 billion worth of eurobonds last week. Investors embraced the five-year bond, purchasing $5.5 billion of Russian debt with The Wall Street Journal dubbing the offering Russia’s “triumphant return.”

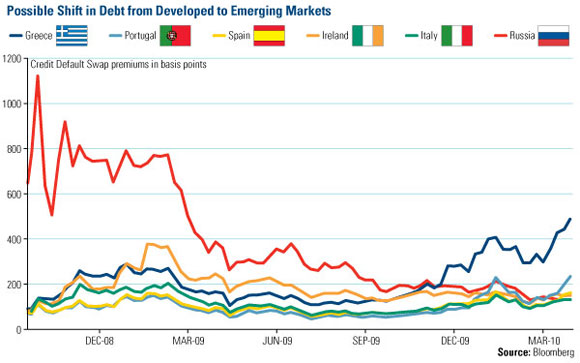

Bloomberg published this interesting chart last week comparing Russia’s credit-default swaps to the PIIGS (Portugal, Italy, Ireland, Greece and Spain). A credit default swap is the cost of insuring debt against default. The riskier the debt, the higher premium the market requires to insure it.

Despite carrying a lower credit rating, this chart shows that investors are valuing Russia’s debt as less risky then these countries. While this reflects the well-publicized debt problems these countries are having, it also shows how far Russia has worked to rebuild its credit the past 12 years.

With foreign exchange reserves of $400 billion, Russia remains a net creditor to the world but the five-year bond issuance is part of a grander strategy. Russia is looking to establish a benchmark yield so its corporations have access to cheaper credit and stimulate business growth.

Is Russia becoming a bastion of safety in a turbulent world? Bond investors seem to think so.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply