Greece finally begged for a bailout. “Greece Declares Unilateral Withdrawal from Reality” was the faux headline of ZH, worthy of the best of The Onion.

The metaphors have moved from Bear Stearns to Lehman to now the grandaddy of all defaults, Creditanstalt, the Austrian default in May 1931 that led to a series of other defaults in Europe and the second wave down after the 1929 crash.

What is perhaps overlooked by many is that Creditanstalt was rescued by capital from the Austrian government, the National Bank and the Rothschild’s, but the announcement of the rescue caused a run which took the bank down. This run drained the government, and by mid-June its credit had run out and it fell.

What is perhaps overlooked by many is that Creditanstalt was rescued by capital from the Austrian government, the National Bank and the Rothschild’s, but the announcement of the rescue caused a run which took the bank down. This run drained the government, and by mid-June its credit had run out and it fell.

The rescue caused the ruin.

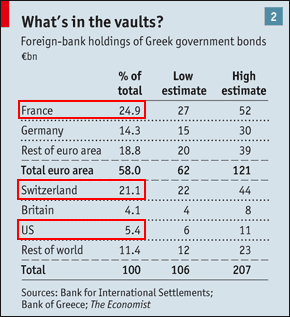

Why the run? The creditors to the bank seized a chance to get out and dump their bad debt on the government. Could that happen this time? Mish provides this chart of the exposure of various banks by country. What if the French and Swiss banks, who are particularly over-exposed, decide to get out and dump their debt onto the IMF?

Curiously, then, the lesson is that the very rescue of Greece may cause its demise. Or, that the private banks will stick the hot potato into the taxpayer’s lap.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply