Mark Thoma asks a very good question:

“I hadn’t looked at this for awhile—should I interpret the return of the inventory-sales ratio to near normal levels as good news?”

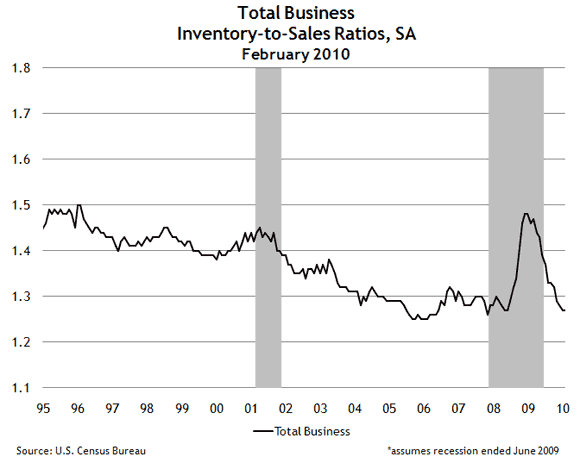

Here’s the picture Thoma was looking at, updated to incorporate today’s U.S. Census Bureau release on February manufacturing and trade inventory and sales:

Tim Duy has taken a look at these data and comes to this conclusion:

“Increasingly, the recovery looks sustainable—sustainable in the sense that a double dip recession looks unlikely. As Bloomberg reports, this is the message of the inventory cycle, which appears to have largely run its course. Inventories surged as the recession intensified, leaving firms scrambling to bring output in line with the new level of sales. Now, firms have inventories under control.”

I have been pondering those data as well, ever since the advance fourth quarter gross domestic product report indicated that 3.4 percentage points of the then-reported 5.9 percent annualized growth rate was accounted for by a slowing in the pace of inventory decumulation. (The numbers have subsequently been revised to 3.8 percentage points of a 5.6 percent growth rate.) It certainly appears that inventory-sales ratios have reverted to the prerecession norm, justifying Duy’s sense that inventories will not be a big part of the economic story as we move through 2010.

That conclusion does rest, of course, on the likelihood that a downward trend in the ratio truly did break in the middle part of the decade. As the chart shows, the same pause in the trend occurred in the mid-1990s, only to commence its southward trek on the other side of the 2001 recession.

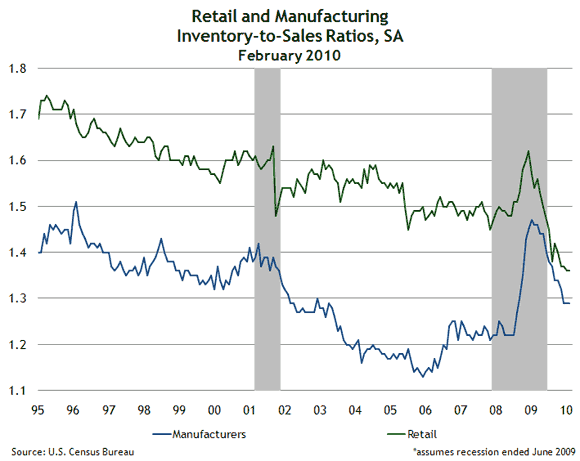

But the situation is even more curious than that. If you dig a little deeper, you find that not all inventory-sales ratios tell the same story. In particular, inventory-to-sales ratios at the retail level look very lean relative to prerecession levels while manufacturer’s inventories still appear to be relatively bloated.

What, exactly, is that chart trying to tell us? Does it represent some shift in supply-chain management, with inventory holdings being pushed down from the retail level to manufacturers? If not, can we expect some resurgence in retail inventories (as the Duy-cited Bloomberg article suggests), coupled with continued decumulation at the manufacturing level? And what would be the net effect of such developments on aggregate inventory levels?

Those are good questions, too. If you have any insights, I’d love to hear them.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply