I finished up my tax return this weekend. I did it myself, using Turbo Tax, and ran it by our new accountant (because I left BusinessWeek in 2009 and started a new business, the return is more complicated than in previous years).

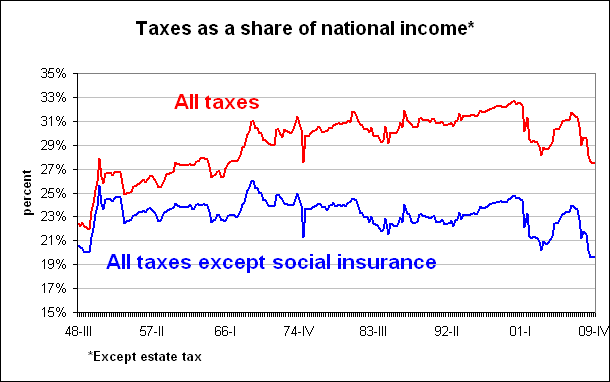

Now that’s done, I can take a look at the bigger tax picture. Just for fun, I calculated total taxes paid by Americans as a share of national income. Total taxes includes federal, state, and local income taxes, corporate income taxes, property taxes, sales taxes, social security and medicare taxes, and every other kind of tax (except for the estate tax).

The top red line tracks total taxes as a share of national income–in effect, the average tax burden for the whole economy. In the fourth quarter of 2009, the average tax burden for the whole economy was 27.5%–the lowest since 1966. That shows the combined effects of the Great Recession and the tax cuts. If we leave out social insurance taxes, the trend is even stronger–the average tax burden, omitting social insurance taxes, is the lowest in the post-war era.

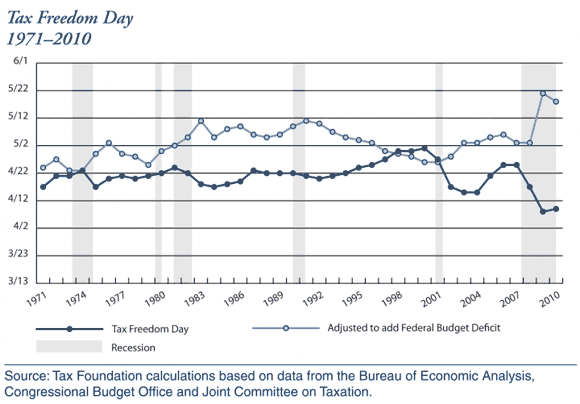

These calculations are similar to the ones done by the Tax Foundation in its calculation of Tax Freedom Day, the day where Americans have ”earned enough money to pay this year’s tax obligations at the federal, state and local levels”. Take a look at the Tax Foundation’s chart.

In fact, Tax Freedom Day is earlier now than it’s been in the past forty years, suggesting that the burden of taxes is lower.

The question, then, is why is there so much opposition to tax increases. Part of it is the distributional question–the average tax burden and Tax Freedom Day both measure the average over the whole economy, rather than for any individual.

But more important, I think, is the pervasive weakness in the private economy, which makes the burden of taxes feel heavier. I’m going to write more about this.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply