In today’s personal income report from the BEA, real personal consumption was up by 0.3%, which according to many commentators was a sign that the economy was improving. Bloomberg had a short piece with the headline:

U.S. Stocks Rise as Consumer Spending Boosts Economic Optimism

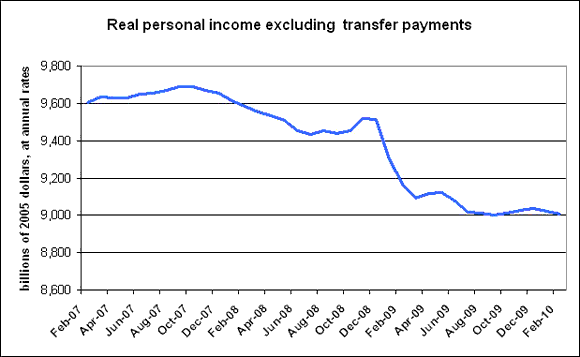

But I look at the numbers and say something very different. I see that real personal income, leaving out transfer payments, fell in February for the second straight month. So I would have written the headline a different way:

Consumers Keep Spending Because the Government is Giving Them Money

The private sector shows no sign yet organically generating growth. That is to say, the real personal income generated by jobs and private businesses and investments is falling, once we omit the effect of government transfer payments, such as unemployment insurance, Social Security, Medicare, and Medicaid. Here’s a little graph:

Not a good sign, by my lights.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply