Is this as good as it gets? For the time being at least, it seems to be.

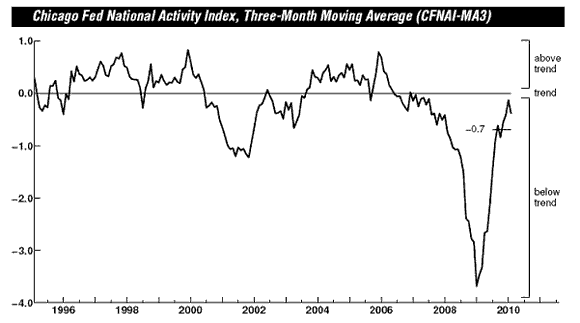

The Chicago Fed national Activity Index fell from -0.04 in January to -0.64 in February, leaving it well above the recession trough, but still below the normal or trend value of zero.

Source: Federal Reserve Bank of Chicago

A negative value for this index is not that uncommon during an expansion, but not what we’d like to be seeing at this point, either.

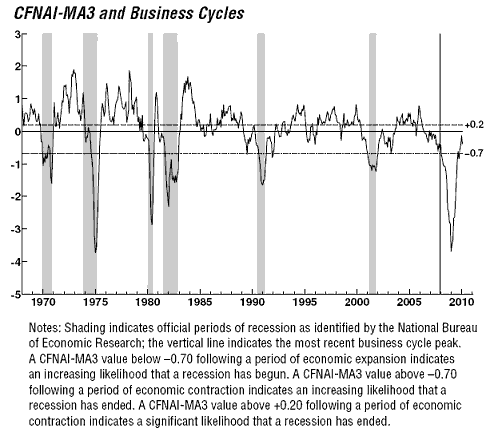

Source: Federal Reserve Bank of Chicago

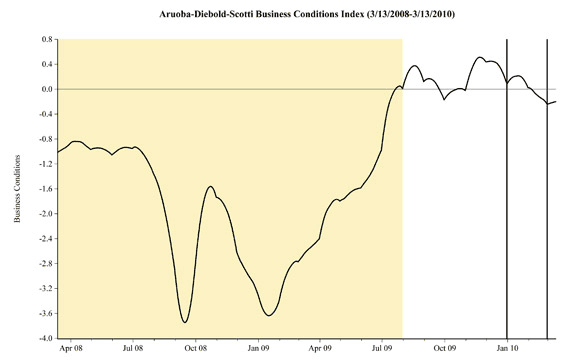

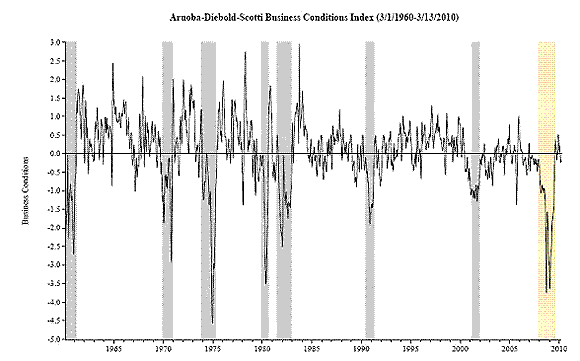

The Aruoba-Diebold-Scotti Business Conditions Index is also up significantly from its recent trough, but has been trending back down into negative territory with the last few weeks’ data on new claims for unemployment insurance.

Aruoba-Diebold-Scotti Business Conditions Index

Again, a negative reading is not that unusual, but not what we want to be seeing.

Source: Federal Reserve Bank of Philadelphia

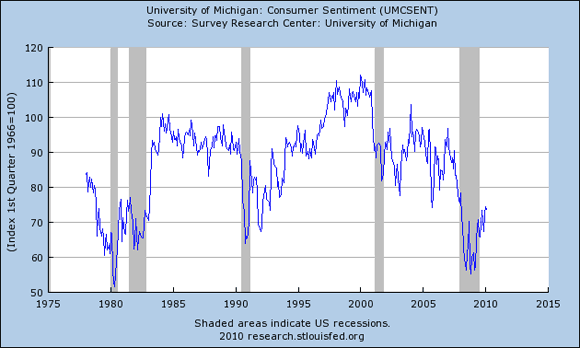

Consumer sentiment has rebounded from its low point of the recession, but is still floundering at very low levels.

Source: Federal Reserve Bank of St. Louis

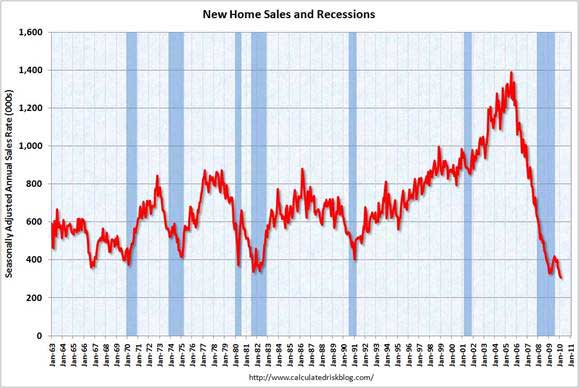

The same could be said of autos. And seasonally adjusted new home sales in February were at the lowest level since the series began in 1963.

Source: Calculated Risk

And for the rest of the year? Bill McBride ([1], [2]) is predicting sluggish and choppy growth– in other words, more of the same.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply