In his latest note to clients former Merrill Lynch North American economist David Rosenberg says things will continue to deteriorate if the personal consumption & housing sub-component doesn’t start showing some signs of life.

In his latest note to clients former Merrill Lynch North American economist David Rosenberg says things will continue to deteriorate if the personal consumption & housing sub-component doesn’t start showing some signs of life.

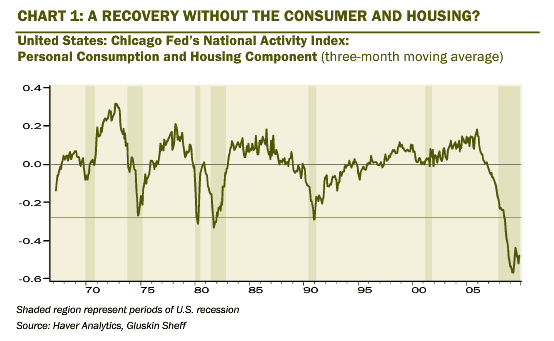

A RECOVERY WITHOUT THE CONSUMER AND HOUSING?

Gluskin Sheff: “Hey — these two sectors combined account for only 75% of the economy. Who needs ‘em? Below is the three-month moving average of the Chicago Fed’s National Activity Index (CFNAI) — the personal consumption and housing subindex to be exact. Look at Chart 1 and please tell us if it depicts an economy in recovery mode. This subindex is still mired deep in recession terrain, with all deference to the latest set of GDP data. The other three components — sales, production, and employment to a lesser extent — have done virtually ALL of the heavy lifting to get us to where we are overall on the CFNAI, which is an economy barely going at all. Absent a turn in this subcomponent, the other three cannot carry us much further.

The bottom line is that if the personal consumption & housing sub-component doesn’t start showing some signs of life, it’s game over as far as the recovery story goes. Exiting recessions, this subcomponent sits, on average, at -0.09. It printed at -0.48 last Thursday, and has not printed better than -0.43 since December 2008. In other words, it is going nowhere fast, and the other components can’t carry the ball forever. ”

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply