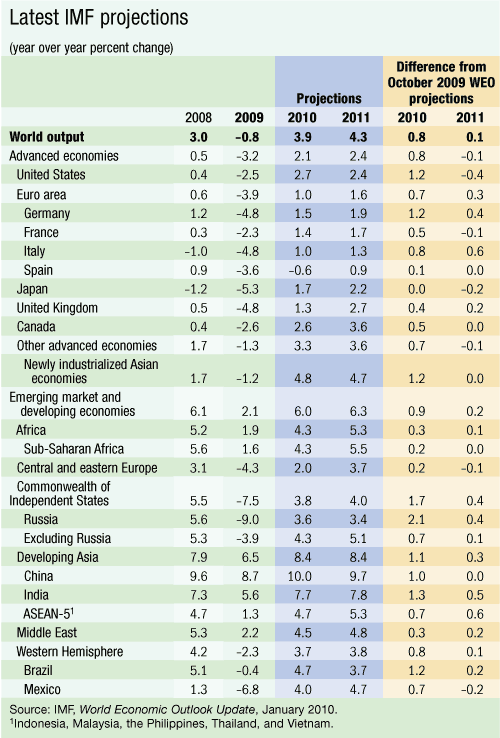

According to IMF’s latest World Economic Outlook, the global economy is recovering faster than previously anticipated. Output in the advanced economies is now expected to rise to 3.9% this year and 4.3% in 2011. The 2010 projection represents an upward revision of ¾ percentage point from the October 2009 forecast.

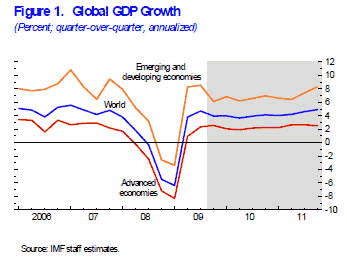

But the recovery, notes IMF, is proceeding at different speeds around the world. In most developed economies the return to economic viability is expected to remain sluggish by past standards, whereas in many emerging and developing economies, activity is expected to be relatively vigorous, largely driven by buoyant internal demand.

“For the moment, the recovery is very much based on policy decisions and policy actions. The question is when does private demand come and take over. Right now it’s ok, but a year down the line, it will be a big question,” said IMF Chief Economist Olivier Blanchard in an IMF video interview.

Here is an overview of the World Economic Outlook projections:

In terms of challenges the IMF sees relative smooth sailing ahead:

“[P]olicymakers are faced with the daunting policy challenge of achieving the rebalancing of demand away from public and toward private sectors and away from economies with excessive external deficits toward those with excessive surpluses, while repairing financial sectors and fostering restructuring in real sectors. Both rebalancing acts are, however, not proceeding without problems. Many advanced economies continue to struggle with repairing and reforming their financial sectors. Concurrently, various emerging economies are grappling with the challenges posed by surging capital inflows, in some cases resisting exchange rate appreciation that could support stronger domestic demand and a reduction in excessive current account surpluses.

Regarding monetary policy, many central banks can afford to maintain low interest rates over the coming year, as underlying inflation is expected to remain low and unemployment high for some time. At the same time, credible strategies for unwinding monetary policy support need to be prepared and communicated now to anchor expectations and dampen potential fears of inflation or renewed financial instability. Countries that are already enjoying a relatively robust rebound of activity and credit will have to tighten monetary conditions earlier and faster than their counterparts elsewhere.

Due to the still-fragile nature of the recovery, fiscal policies need to remain supportive of economic activity in the near term. The fiscal stimulus planned for 2010 should be fully implemented. However, countries facing growing concerns about fiscal sustainability should make progress in devising and communicating credible exit strategies. In many cases, durable exit will require not only unwinding crisis-related fiscal stimulus but also substantial improvements in primary balances for a sustained period. Fiscal adjustment strategies should include: reducing fiscal deficits mindful of the need to protect spending on the poor and foreign aid and reforming entitlement spending, among others measures.

Once private demand has become self-sustained, the sequencing of exit from accommodative monetary and fiscal policy should be guided by a variety of considerations, including whether: high fiscal deficits and debt are raising concerns about sustainability and sovereign risk—which is the primary consideration in many countries; low interest rates might be contributing to asset price bubbles; the exchange rate is under pressure to appreciate or depreciate as well as its position relative to medium-term fundamentals; and how quickly monetary or fiscal policy can be adjusted to changes in domestic demand”.

IMF also notes in its report that it is crucial to address the need to continue repairing the financial sector in advanced and the hardest-hit emerging economies, and that policies are still needed to tackle bank’ impaired assets and restructuring.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply