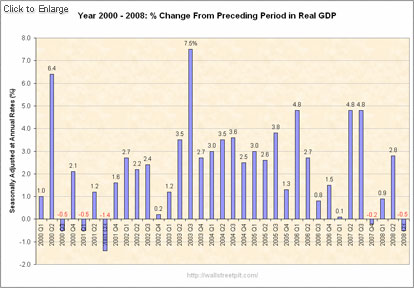

The final revision from the Bureau of Economic Analysis released on Tuesday showed 3Q’08 U.S. real GDP growth slipped at an annual rate of 0.5%. The report compares the three month period that ended Sept. 30 to the preceding quarter.

In the 2Q, real GDP, the broadest measure of the U.S. economy, increased 2.8%. The 0.5% slide in 3Q-GDP marked the biggest drop in seven years. The year-over-year [YoY] rate of growth, which came in at 0.7%, was also the weakest since 2001. The decrease primarily reflected a downturn in personal consumption expenditures, a deceleration in exports, and negative contributions from residential fixed investment, and equipment and software.

- Personal consumption expenditures fell 3.8% (negative 0.2% YoY annual rate) in the third quarter, in contrast to an increase of 1.2% in the second. Spending on autos & light trucks dropped at a 26.6% annual rate. Real spending on apparel fell 13.3% while services spending dipped 0.1%. Spending by consumers fell below the previously estimated 3.7% decrease making a deduction of 2.75 percentage points from GDP in the third quarter. Third-quarter non-durables spending fell by 7.1%.

- Real exports increased at a 3.0% annual rate in the third quarter, compared with an increase of 12.3% in the second. Imports fell at a 3.5% annual rate, recording the fifth quarterly decline in the last six.

- Real residential fixed investment decreased 16.0%, compared with a decrease of 13.3%. Equipment and software decreased 7.5%.

- The drawdown of goods in the third quarter was smaller than the drawdown in the second quarter, allowing private inventories to make a contribution to third-quarter GDP and not a reduction. Inventories added 0.84% to the third-quarter after three consecutive quarters of subtraction. Private businesses decreased inventories $29.6 billion in 3Q, following a decrease of $50.6 billion in the second quarter and a decrease of $10.2 billion in the first.

- Spending by the government increased by 13.8%, above the second quarter’s 6.6% increase. State and local government consumption expenditures and gross investments increased 1.3%.

- Real final sales of domestic product decreased 1.3% in the third quarter, in contrast to an increase of 4.4% in the second.

The GDP chain price index was lowered to 3.9% annual rate in Q3 versus a previous estimate of 4.2% but above the second quarter’s 1.1% increase. The 0.3 percentage points revision was due to a lowered jump in PCE price index. Nominal GDP growth was revised down to a 3.4% from a prior estimate of 3.6%.

Today’s final 3Q GDP report showed real gross domestic product contracted at a 0.5% annual rate. NBER declared the U.S. recession started in Dec. ’07. Yet, real GDP (excluding home building) is still not showing a negative quarter of growth. The 3Q was flat while the four quarter change still registers positive at 1.6%. This will change however in the fourth quarter by perhaps as much as 6% real GDP annual rate contraction.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply