6) The Fed will NOT hike the Fed funds target rate this year. While this view is shared by many, it is not a universal consensus (here’s lookin’ at you, Morgan Stanley!) and, more importantly, is not currently in the price. (FFZ0 prices effective funds at 0.89%.) The dovish tone of last night’s minutes would appear to support this non-prediction, as would the recent slew of articles comparing 2010 to 1937.

Still, it’s worth exploring the rationale for the non-prediction in a bit more detail. It’s become evident from the conditionality of the FOMC statements that the committee is still operating with an output gap framework….with an emphasis on the slack in the labour market, given the dual mandate. The Fed’s observed that the economy needs to add 150,000 jobs a month just to “stay still”, as it were. And while payrolls may turn positive as soon as Friday, it will be some time (potentially years!) before job gains are sufficient to close the yawning chasm of the U-6 output gap.

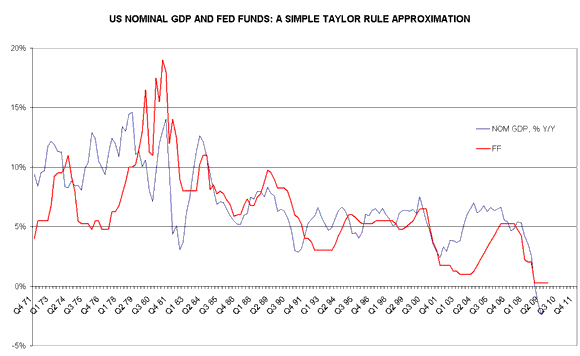

More generally, Macro Man’s simple Taylor rule proxy (comparing Fed funds with y/y nominal GDP growth) still shows that policy rates are too tight. Note that after the last couple of recessions, Fed funds had not only gone accommodative but been there for some time before rate hikes ensued.

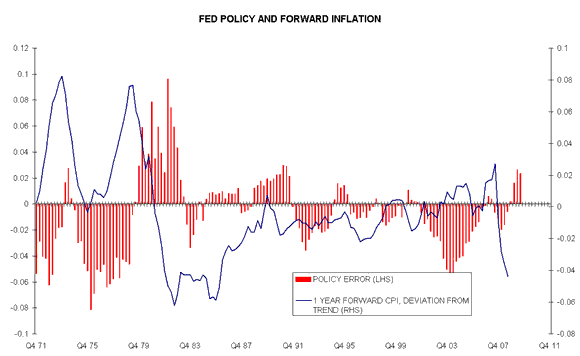

And what of inflation? Well, expectations may tick up along with the oil price, though bear in mind that if oil gets too high, it will put the kibosh on growth. In any event, the FEd continues to focus on core, rather than headline inflation…and many forecasters are looking for core CPI to head top or below 1% during 2010. Hardly cause for alarm! And even if we do look at headline, there is a negative correlation between the Fed’s “policy error” (i.e., the difference between Fed funds and nominal growth) and subsequent moves in inflation relative to trend.

Will the Fed adjust its library of special programs? Sure. Will they drain reserves at some point? Probably. Might they start selling securities? Possibly, though the minutes suggest that the risk is skewed in the other direction, at least for now. But will they hike rates this year? Nope.

7) There will NOT be a hung Parliament in the UK this year. This is another trendy political forecast which has a much greater likelihood of success that the Congressional one discussed on Tuesday. The outrageous gerrymandering of electoral districts by the current Labout government means that the Tories need to get 6% more votes than Labour simply to win the same number of seats.

Really, the quirky nature of the British voting system means that the outcome of the election has more to do with how many votes Labour loses than how many the Tories gain. This forms the basis of the non-prediction, as Macro Man expects Labour to get absolutely shellacked, despite the growth of the public sector as an employer. Gordon Brown has lost so much credibility that there have been rumblings of a leadership challenge; more viscerally, things are now so bad in the UK that pensioners are now burning books to keep warm. Add in the fact that the Labour Party is essentially bankrupt, and will be heavily outspent by the Tories, and Macro Man expects Cameron & co. to sneak in with a modest majority.

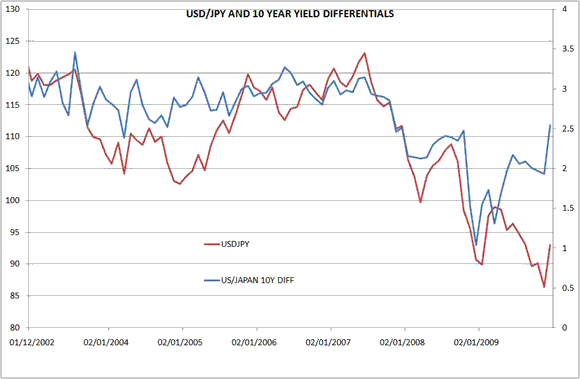

8) The MOF/BOJ will NOT intervene in USD/JPY. This one makes a welcome reappearance to the list of non-predictions. Since Macro Man scribbles down his list a few days ago, things have become a bit spicy on the yen front, as Fin Min Fujii (“laissez-faire-san”) has stepped down and been replaced with Naoto Kan. The latter’s policy seems to have shifted to “Can the yen weaken? Yes it Kan!”

From Macro Man’s perch, the very fact that the authorities now seem to give a hoot about the level of the yen make it less likely that USD/JPY will slide into the abyss. Perhaps more importantly, interest rates (traditionally a strong driver of USD/JPY) are providing a very bullish signal. Last year’s divergence between USD/JPY and rate differentials was caused by Fujii’s policy of neglect vis a vis the yen; now that he’s gone, Macro Man would expect that gap to close without prompting from the authorities.

9) US 2 year yields will NOT reach their 2009 lows. Those lows, reached in late November, just about tickled 60 bps. While those levels were reached only 5-6 weeks ago, the successful passage of the turn of the year and focus on moderately improved economic data should preclude a return to the low end of the yield range. Call the huge rally in 2’s lat November during the Dubai crisis as 2009’s version of the huge 2008 long-end squeeze. The move towards the issuance of more coupon securities and the winding down of QE security purchases will, in Macro Man’s view, leave US fixed income trading within a range that is modestly higher than that observed in 2009 as markets inject more of a risk premium into government bonds in reaction to expected (eventual) rises in both inflation and interest rates.

10) The SPX will NOT close 2010 more than 20% away from 2009’s closing price of 1115. Macro Man was called a “tail-seller” in the comment section of the first half of these non-predictions, and this final one literally sells the tails of the index price distribution for 2010. Macro Man looks for some sort of automatic stabilizers to affect the equity markets this year. If prices rise too much, markets will assume that everything is hunky-dory and begin to price policy tightening, which should be enough to send equity prices back down. Conversely, if stocks tank, we’ll hear more rumblings of an extension of QE, which should support stocks along the same lines of the last nine months.

Looking at recent history, we can see this sort of dynamic at work. The SPX fell 23% in 2002, rose 26% in 2003…..but just 9% in 2004. The index fell 6% in 1990, rose 26% in 1991…but rallied just 4% in 1992. No, the analogues aren’t perfect, but they’re close enough. Macro Man looks for a year of choppy trade after the screaming trends of the past few years.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply