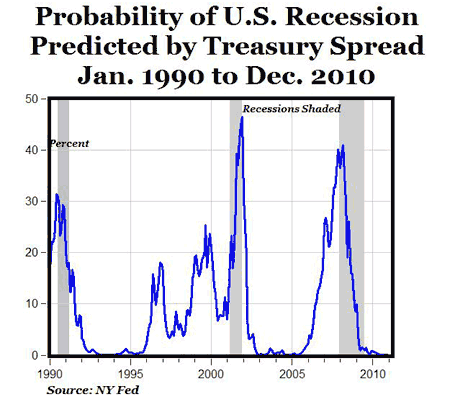

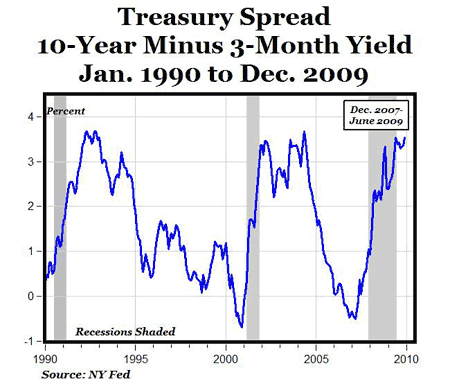

Today the New York Federal Reserve released its updated “Probability of U.S. Recession Predicted by Treasury Spread” with data through December 2009, and the Fed’s recession probability forecast through December 2010 (see chart below). The NY Fed’s model uses the spread between 10-year and 3-month Treasury rates (3.54% spread in December) to calculate the probability of a recession in the U.S. twelve months ahead.

The Fed’s model (data here) shows that the recession probability peaked during the October 2007 to April 2008 period at around 35-40%, and has been declining since then in almost every month. For December 2009, the recession probability is only 0.82% (less than 1%) and by a year from now in December 2010 the recession probability is only .061%, or about 1/16 of one percent.

Further, the Treasury spread has been above 3% for the last eight months (since May), a pattern consistent with the economic recoveries following the last two recessions (see chart below), and the 3.54% spread in December is the highest since May 2004, five-and-a-half years ago. Finally, the pattern of the recession probability index so far this year (going below double-digits and declining monthly) is very similar to the patterns that signaled the end of the 1990-1991 and 2001 recessions.

According to the NY Fed model, the chances of a double-dip recession in 2011? Zero.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply