Another holiday trading extravaganza!!!

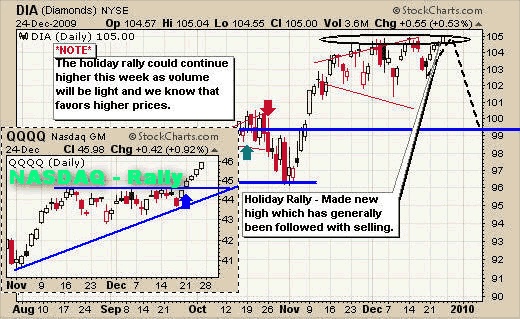

Last week the market fell into its regular holiday tradition of light volume, as institutions and big traders enjoyed the holidays thus allowing prices to drift higher. We still have one more week of light trading volume before this year and holiday season is officially over.

Trading during low volume times is regularly misinterpreted. Many traders figure they should not be trading this time of the year but from my experience, the last two weeks of the year are amazing for short term swing plays or day trading. The market seems to be much more predictable when the large program traders are not involved.

Also the more speculative plays (small and mid cap stocks) always seem to out perform as buyers bid the prices higher into the light selling volume. This is most likely why we are seeing the NASDAQ and Russell 2000 indexes making some nice gains of late.

Take a look at the charts…

Broad Market & NASDAQ Low Volume Rally

Diamonds Trust, Series 1 (DIA)

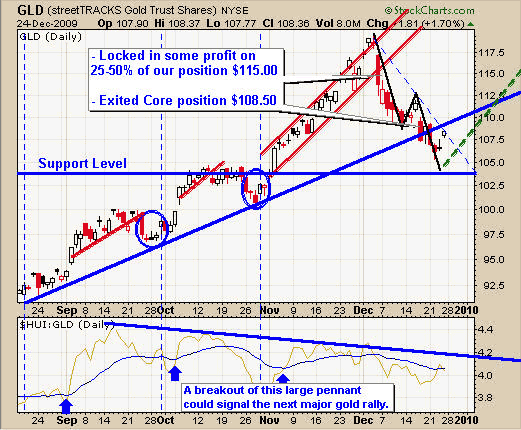

GLD ETF Trading – Daily Chart

Gold prices broke down as expected in early December and are now nearing a possible bottom. The past 3 weeks have provided some very exciting day trades shorting spot gold prices. In the next few weeks I will be starting to provide more spot gold charts and intraday price action for all the international traders and futures traders.

I did not provide the chart of silver as it trades very similar to gold. When the time comes I will provide detailed analysis for entry and exit points for members.

SPDR Gold Trust (GLD)

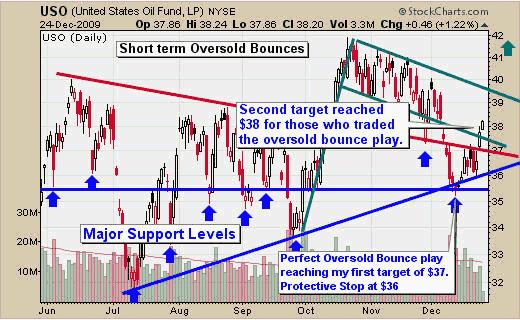

Crude Oil USO Trend Trading

USO fund had a very nice pullback in early December and I pointed out a spec play at $35.50 with targets set at $37, $38 and $40. So far the first two profit taking targets have been reached.

Sorry for all the lines on the chart but sometimes it’s the only way to remember where all the crucial levels are for trading pivot points.

United States Oil Fund LP (USO)

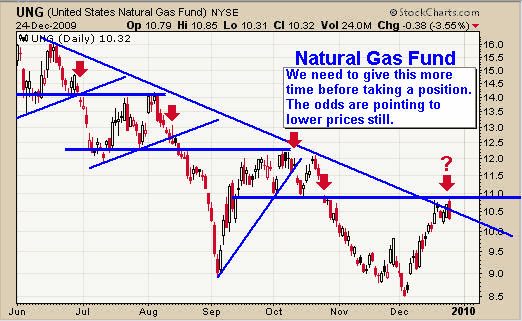

Natural Gas UNG Trend Trading

Natural gas trades like a bucking bronco. It’s a tough ride if you do not understand market psychology and apply strict money management to your positions.

Last weeks price action closed with a bearish candle after testing resistance twice. We could get a short trade this week depending on what happens from here. Let’s keep our eyes open for a low risk setup.

United States Natural Gas Fund, LP (UNG)

Market Trends Trading Conclusion:

This year has been fantastic for making money, but next year will most likely be much more difficult if we see the market top and head south or trend sideways. The market topping is not an event; rather a process and trend following systems will start having more losing trades than winners as the market momentum shifts from up, to sideways then down.

Don’t get me wrong, I am not saying I think its going to roll over and head south, cause quite frankly no one knows what its going to do from this point forward. This is the reason we are in cash and patiently awaiting new low risk opportunities to place our money. The joy of trading with technical analysis is that you don’t care which direction the markets go because the analysis, if done correctly, allows you to profit in all market conditions using different trading strategies.

The board market, in my opinion, is way overbought due to the holiday rally. But we must remember there is another low volume week as we approach New Years and this could extend the rally more. Smaller trading positions should be used until we enter the New Year and volume steps back into the market.

Gold and silver are in a short term down trend and trading near a resistance level. We could see prices drop quickly or rally from here. So we are letting things unfold before making a commitment.

Oil continues to move higher and last weeks weakening US dollar helped give oil a boost.

Natural gas is trading at resistance and looks ready to head back down. The daily and 30 minute chart did not setup a signal to short Natural Gas, but it was very close.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply