According to CNBC (First in Business Worldwide):

According to CNBC (First in Business Worldwide):

Global markets have rallied “too much, too soon, too fast” this year but a correction will not happen right away, as a cheap dollar will still encourage investors to seek higher-yielding assets for a few more months, leading economist Nouriel Roubini said Thursday. Roubini, one of the few economists who accurately predicted the magnitude of the financial crisis, said the U.S. dollar will eventually recover some of its losses, but only in “six to 12 months from now, not any time soon.”

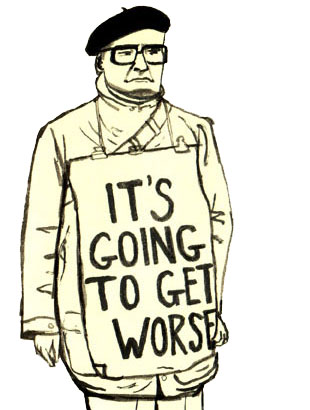

I have nothing against Roubini; doomsayers are a dime a dozen (see my previous post). What I find incredible is how professional columnists at self-proclaimed “leading business networks” mindlessly genuflect at the alter of stopped clocks.

You’ve heard the old joke about how economists have successfully predicted 10 out of the last 2 recessions. Eric Tyson has a nice little piece claiming that Roubini is among these tireless prognosticators; see here. That’s right, Roubini called the recession in 2004, 2005, 2006 and in 2007. As the old saying goes, even a stopped clock is correct twice a day. The puzzle is why there is such a large and persistent demand for stopped clocks.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Everybody is wrong about the market at some point in time. What really matters is that they are right about the market in the long run.