The dollar is on an absolute tear, now already back up to 77.85, strength is mostly against a weak Euro. This is exactly the type of bounce that occurs when everyone is convinced that the dollar has no future whatsoever. And it doesn’t, at least not in the longer run, but crowded trades can quickly turn into a rush for the exits. Bonds also rose sharply overnight, going to show that there are still decisions to be made. They can keep interest rates low if they desire, at least for awhile, by letting the speculation in equities drain.

Amazingly oil is holding up fairly well against the force of the dollar, I think oil has turned into an economic weapon and is involved in the dealings of Dubai, Citigroup, Abu Dhabi. Just yesterday this article came out discussing the possibility of a new Middle East currency; The Arab states of the Gulf region have agreed to launch a single currency modelled on the euro, hoping to blaze a trail towards a pan-Arab monetary union swelling to the ancient borders of the Ummayad Caliphate.

Gold has moved down significantly, giving up the past two days worth of bounce.

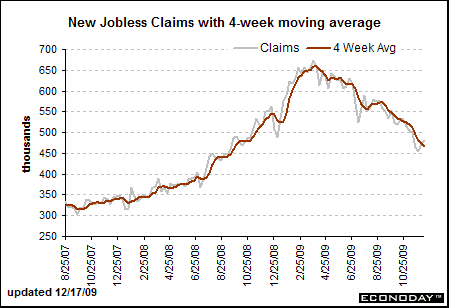

Weekly unemployment data came out higher than expected with the headline number at 480,000, the consensus was looking for 465,000. Econoday tries to paint a rosy picture, but they fail to mention the number of people who have fallen off the back of the rolls, those numbers are exploding right now and that’s what is bringing the continuing claims number down:

Highlights

Initial jobless claims rose slightly in the Dec. 12 week to 480,000 vs. expectations for 465,000, a mild disappointment that doesn’t derail the trend which points to a bottoming for the labor market. The four-week average, especially important to watch during the calendar and seasonal effects of the holidays, points to improvement with a 16th straight decline, down 5,250 to the lowest level since September last year at 467,500. For the last several months, initial claims have been making their way down from the mid-500,000 level.

Continuing claims have at the same time been making their way down from the low 6 million level, at 5.186 million in the Dec. 5 week and taking the four-week average down more than 100,000 to 5.318 million. The unemployment rate for insured workers is unchanged at 3.9 percent, well off the summer peak of 5.2 percent. Though contraction in continuing claims reflects in part the expiration of benefits, much of it also reflects new hiring.

Today’s report, despite the higher-than-expected headline, points to ongoing improvement in the labor market including strength for December’s employment report. Markets showed little reaction to the report.

Baloney, what new hiring? I have read several reports that because of slow holiday sales that many stores have been laying off their seasonal temps early.

You want to talk about unemployment and a Depression? Detroit now has nearly 50% unemployed – Nearly half of Detroit’s workers are unemployed.

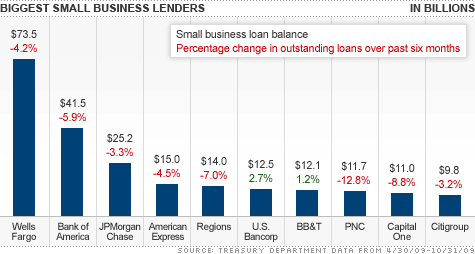

Remember how Obama is trying to “force” the banks to lend to small businesses? Of course that’s just all talk as small businesses were overbuilt and it’s now difficult for a small business to qualify for a loan using more conventional methods which follow a credit bust. Here’s an article saying that small business lending is down $1 billion in the month of October alone: Another $1 billion in small business credit vanishes.

And in the world of no morals and ethics and bizzaro picks for Nobel Peace Prizes and Time Man of the Year, we learn that the AP has voted Tiger Woods Athlete of the Decade! Yet none of the media sources seem to be putting that one on their front pages? Heck, what he did as disgusting as it is, isn’t even in the same league as the damage to people’s lives that Bernanke has inflicted. Yet again, though, it would seem that as long as you’re dominate in your sport, and on that basis Tiger deserves athlete of the decade, that having shown a lack of moral standards doesn’t keep one from still winning awards. Frankly I’m surprised that his sponsors are actually dropping him. His behavior is too bad, he was definitely in the running to surpass Jack Nickolas as the greatest golfer who ever lived, but now I’m afraid that no matter what he does on the course his legend will never rise above Jack’s.

No, you don’t hear me talk much about sports, that’s because I view our current sporting leagues as one of the signs that the fall of the empire is near. Sporting activities are great, but the amount of money involved in stadiums, paychecks, television, sponsors, etc. has poisoned them. Golf was one of the last bastions of sanity, but now even the Tiger induced bubble in golf has been, shall we say, “pricked.”

We’re still in the range, but back towards the middle of it. 1,090 is the support pivot here, a break below 1,080 and a close there would be very bearish. Keep in mind that tomorrow is options expiration and we have Leading Indicators and Philly Fed coming out at 10 Eastern. While we’re in this range, I’m practicing patience, and no, I’m not playing Christmas Music yet!

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply