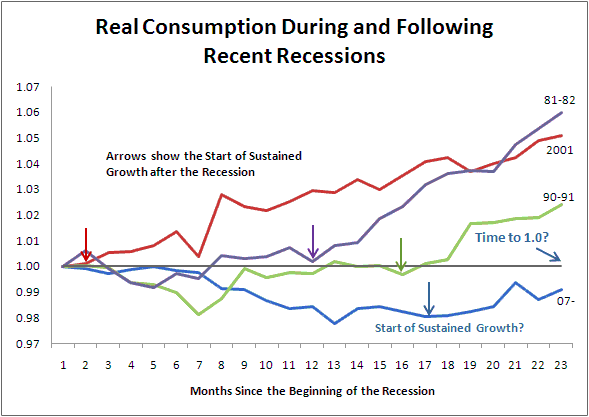

Mark Thoma wonders about whether consumption will come back any time soon.

The graph below making the rounds uses the Federal Flow of Funds data to look at the ratio of Household Debt to GDP–the ratio rose from around 60 percent as recently as 15 years ago to more than 100 percent now.

If households begin reducing their leverage back toward the long-term average, it will depress consumption for three reasons:

Debt service payments will rise when interest rates rise, and so discretionary income will be lower than it was when households had less leverage ( we are getting some relief right now because of very low interest rates on debt tied to LIBOR or the prime rate).

Households will not take on new borrowing to support spending.

Households will in fact be amortizing their current debt (meaning they won’t spend).

The counter-argument is that average household net worth relative to GDP remains quite normal by historical standards. But here is where the skewed distribution of wealth is a problem. I am reasonably sure that when the next Survey of Consumer Finances is released for 2010, median household net worth will be down. Corelogic says that one in four households with mortgages has negative home equity–this would be about 18 percent of owner households (about 30 percent of owners have no mortgage). If we combine this with the fact that 1/3 of the country rents, this means that the median households has little or no home equity. The median household is not loaded with financial assets, either. According to the 2007 Survey of Consumer Finances, only half of families have a retirement account, and only 21 percent owned stocks. Put this all together, the median household is not in great shape financially, and the median household consumes a higher share of its income than higher income households.

One more back of the envelope calculation on getting us back to a steady state. Suppose the steady state household debt to GDP ratio is 70 percent. If the national economy uses 5 percent of its income to pay down that debt (which is about 7.5 percent of current consumption), at an interest rate of 8 percent, it would take 8.5 years to de-lever down to the steady state ratio.

Graph: Economist’s View

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply