Macro Man is back in the saddle, or at least his office chair, this morning after his first decent night’s sleep in what seems like forever. It’s expiry day today in equity land, and indices are producing the seemingly-obligatory squeeze up, despite the rather poor performance of other measures of risk appetite and/or reflation.

One issue that has captured macro punters’ fancy this morning is yesterday’s price action in Treasury bills. The Feb-10 bill traded to a low yield of 0.005% yesterday, and some bills of shorter maturity reputedly traded at negative yields (though Macro Man in fairness has yet to find them.)

(click to enlarge)

This raises the question of who would purchase bills at zero or even negative yields the week before Thanksgiving? There has been some mumbling that the flow into bills represents some sort of “window dressing”, though why one would start doing so on the 19th of November defies explanation. Why, too, would any bank buy bills when they could simply deposit cash as reserves at the Fed and earn a “tasty” 0.25%? (This is a legitimate query; Macro Man is not intimately acquainted with the regulatory/capital impact of bills versus reserve deposits for bank holding companies.)

Anyone who can shed light on this action is encouraged to do so in the comments section; from a distance, however, it wouldn’t appear to be a particularly healthy phenomenon for bills to trade through zero yield!!

And that in turn would jive with the last 36 hours’ price action, which has suddenly taken on a very “risk off” feel. Equities and FX carry traded poorly from the get-go yesterday, and while the former has managed at least a tepid bounce, the latter still looks pretty poor.

In any event, Macro Man’s Bloomberg inbox has been stuffed to the gills in recent days with analysis purporting to entice him into doing x,y, or z trade on December seasonality. “The euro almost always goes up from [insert cherry-picked date here] through the end of December!” “The January effect has moved to December!” Blah, blah, blah.

The EUR/USD phenomenon is well-known to everyone who trades currencies for a living; on the basis of price action over the last couple weeks, it seems as if every single one of them are long as a result.

There’s also been a lot of mumbling about the potential for an equity rally in December, based on the solid performance of equities thus far this year. Here, at least, we have a sufficiently large data set to do a study that at least borders on statistical significance.

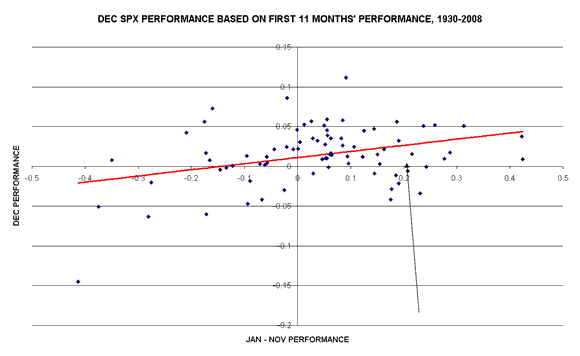

Taking monthly SPX returns since 1930, Macro Man compared the returns of the first 11 months of the year with those of the ensuing December. Sure enough, there is a positive relationship between the two, as illustrated in the chart below.

Macro Man ran the regressions both with and without a constant; both regressions generated statistically significant (t-stat >3, p-value < 0.002) results. Based on the 20% y-t-d returns on the SPX thus far, both regressions suggest December returns of roughly 2%, give or take. That’s broadly in line with the historical average; in the 11 prior cases in the sample of 20% + 11 month returns, the average December return was 1.84% (with eight winners.)

So is Macro Man trading in his ragged furry suit for a nice new pair of horns over the next six weeks? Not quite yet. While the possibility of an equity melt-up/window-dressing orgy is clear and present, your scribe cannot quite shake his feeling that the rally is tired and fundamentals remain poor. The bizarre price action in T bills, be it window dressing or a “shoulder tap” allocation, has left him scratching his head….

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply