A warning to all you exposed to the dollar carry trade, either directly or indirectly. A group which includes:

- Anyone borrowing in USD to buy short-term assets in another currency.

- Anyone borrowing short-term in USD to buy long-term USD assets, i.e., every U.S. bank.

- Any U.S.-based company selling their product to non-USD consumers.

- Anyone invested in a U.S. company who is borrowing short-term in USD and buying long-term assets and/or selling products in non-USD currencies. That is, anyone long U.S. stocks or U.S. corporate bonds.

- Any U.S.-based investor long any non-USD asset, i.e. any investor in foreign stocks or bonds.

So basically anyone holding anything other than cash.

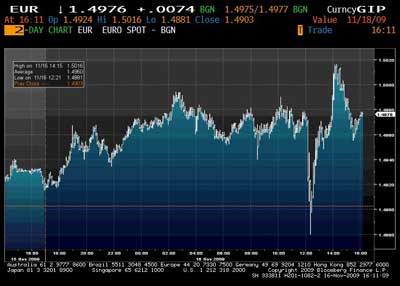

Below is the intra-day chart on USD/EUR.

(click to enlarge)

What the hell happened yesterday? Bernanke made a passing reference to the dollar. That’s it. Here’s the whole quote:

The foreign exchange value of the dollar has moved over a wide range during the past year or so. When financial stresses were most pronounced, a flight to the deepest and most liquid capital markets resulted in a marked increase in the dollar. More recently, as financial market functioning has improved and global economic activity has stabilized, these safe haven flows have abated, and the dollar has accordingly retraced its gains. The Federal Reserve will continue to monitor these developments closely. We are attentive to the implications of changes in the value of the dollar and will continue to formulate policy to guard against risks to our dual mandate to foster both maximum employment and price stability. Our commitment to our dual objectives, together with the underlying strengths of the U.S. economy, will help ensure that the dollar is strong and a source of global financial stability.

Now really, there is absolutely nothing there that suggests the Fed is going to do anything about the weak dollar. In fact, all he’s doing is justifying the recent decline in the dollar. You can think what you want about why the dollar is weak or even whether its desirable or not. Bernanke doesn’t care about the dollar.

And yet with this tiny nod to doing something about the dollar, the euro plummets. Just think about what’s going to happen when the Fed actually hikes rates. There are so many dollar shorts out there. We will be looking at the mother of all short covering rallies. And the carry trade crowd is going to get absolutely crushed.

Will this happen this month? This quarter? This year? I don’t know. How impactful will this event be on financial markets? I think it will be quite large, although whether that means S&P -10% or -20% or -30%, I’m not sure. I’m also not sure that we don’t rise 10% between then and now and only correct back to where we are. I actually think 2-5 year bonds, including Treasuries, are the most exposed U.S. assets, not stocks, but we’ll see.

Either way, I’d love to see the Fed make some kind of move, even if its hiking from 0% to 0.5%, to stem the tide of constant USD selling. The dollar weak crowd is too confident and all that confidence is what causes bubbles. Alas, I don’t think its going to happen.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply