This is a guest article written by our old friend, Davos. It would seem that a particular posting got his gander up, his blood boiling… and so here is his unbridled, unedited, and unapologetic response:

Robbed Blind by A Lipstick Wearing Pig

“No one in this world, so far as I know – and I have searched the records for years, and employed agents to help me – has ever lost money by underestimating the intelligence of the great masses of the plain people.”

~ H.L. MenckenEach and everyday I’m amazed by the sad amount of truth held within this statement.

I’ve totally shunned TV, I have no cable, no dish, I’ve deleted every mainstream news source from my iGoogle RSS reader and I am now weeding out what I once considered to be the best 25 economic blogs.

Let’s visit the many ways that we are being robbed by the pig wearing lipstick.

Confusion and sexing up the ugly:

Today, on a blog I used to hold in high esteem was an article entitled “Who’s Afraid Of a Falling Dollar?”

Me.

That’s who.

And it should scare you also!

First we need to take the lipstick off the falling dollar pig and understand what it means. If you have $100,000.00 in your account and the dollar falls in value that $100,000.00 might buy you only $25,000.00 worth of assets.

Would you put your money in a bank that offered you a falling balance? Open an account today with your life savings of $100,000.00 and tomorrow your balance will be $25,000.00.

The incredible part about the article is that it was written by a senior fellow at an institute that is trying to save Social Security.

Sorry Grandma, your $500.00 Social Security check that used to buy you a month’s tuna caught by Japanese fishermen had a really bad fall and now you’ll have to eat saltines all month long.

No more tuna for you.

“A lower dollar is good news for US exporters and foreign importers and bad news for foreign exporters and US importers.”

Really?

Well bad news here. We import 2/3rds of our oil.

Sorry, when you fill up your SUV with your falling dollar you are now on the cusp of bankruptcy because that dollar had a bad fall and only buys 1/4 the amount of gas it used to. When you go to the store and purchase food that has been shipped a minimum of 1,500 miles and farmed in a petrochemically dependent fashion you’re going to be in the same line as Grandma buying saltines.

Bon appétit mon ami(e).

Confusion and sexing up inflation:

“The fear is that a falling dollar would be inflationary.” Right here I am reassured that the author must a.) be Keysnian b.) have taught economics c.) has worked for the “Federal” (a very private bank) Reserve.

Or, d.) all of the above.

Inflation is defined as the size of the monetary supply. The Keynesian economists have convoluted this. The bottom line is if you have a trillion in 100’s and you create another trillion bucks while you have 2 trillion the reality is that the 2 trillion has a value of 1 trillion. Your 100’s are worth 50.

Your dollar fell.

Hard.

He then quotes two recent “Fed” papers. Well, I have short funny video for you…

Here is the Chairman of the Fed who got it 100% wrong.

[video1]HQ79Pt2GNJo[/video1]

“I don’t buy your premise.”

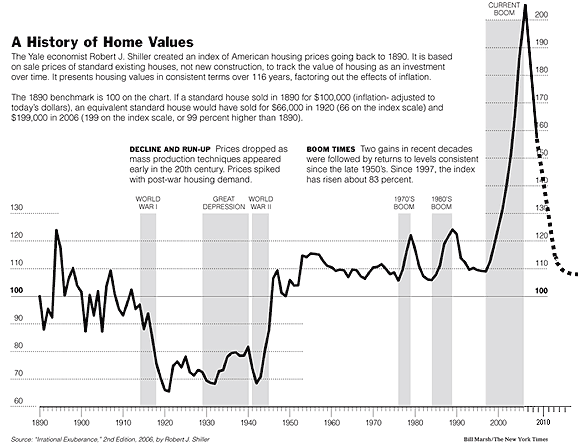

“We’ve never had a decline of houses in a nationwide basis.”

Oh, I thought you studied the great depression?

Just what the heck happened from 1920 to 1945?

Confusion and sexing up unemployment:

“With US unemployment currently at 10 percent, there is no chance that inflation will rise in the near term.”

Really?

First if you go to http://www.shadowstats.com and pay John Williams 89 bucks he will show you that unemployment is at 22%. He corrects the BLS’s Birth Death Model, their Seasonal Adjustment and even is kind enough to count the U3 and the U6 numbers and add them up into one nice percentage.

Something the BLS seems challenged by.

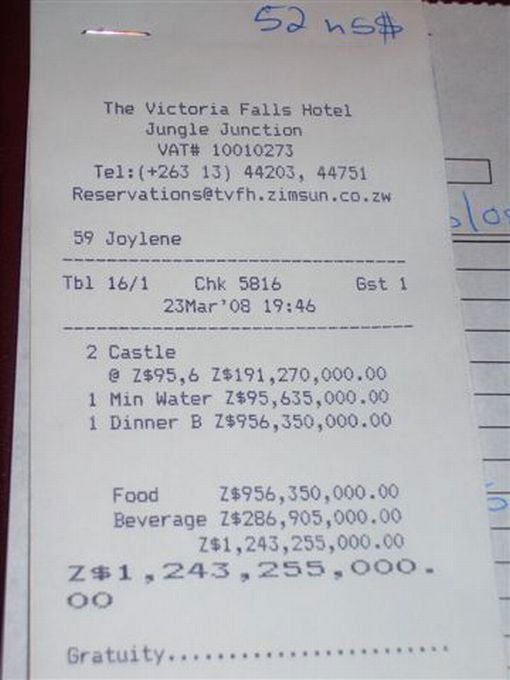

And by what economic model is unemployment a factor in inflation? Zimbabwe had an unemployment rate north of 90% and here is a copy copy of a dinner receipt…

Dinner for one: 1.2 billion.

I suppose that isn’t inflation even by a Keynesian perspective?

I could go on for hours.

“Articles” like these contribute to the success of the robberies committed on the American people each and every day. The give validity to Mencken’s pathetic realization.

Worse, when good blogs publish bad articles smart readers get confused by qualifications and titles and prestigious think tank associations. Comments like: “Zimbabwe is a case of corruption so naked that it defies comparison. Even comparing it to the US is the height of silliness, since the US spent the last year with NEGATIVE YoY price changes.”

Corruption so naked that it defies comparison?

Really?

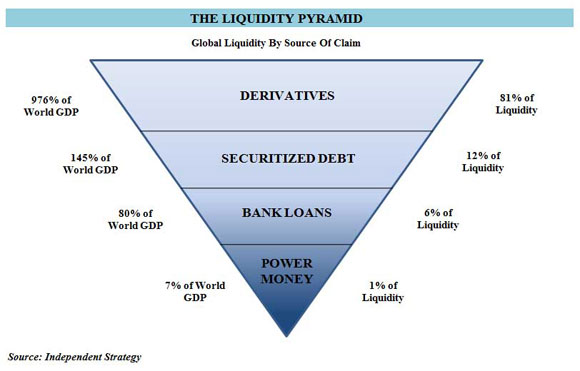

Well maybe we should consider this. The unregulated derivative market is now 55 times the size of all the world’s GDPs 600 trillion in total (audio link).

According to Table 3 OCC.pdf (from our Treasury) 200 trillion of this toxic mess reside here in US banks. Tyler, over at ZeroHedge, ran a piece pegging it at 1,600 trillion (1.6 quadrillion). The subprime mess was 1.5 trillion. It blew up the economy. We now have wave two of the Alt-A and Option Arms rolling to shore. Another 1.5 trillion. A lot of this consists of NINJA loans. Those are no income, no jobs, no documentation. I suppose putting down you make 100k when you don’t have a job doesn’t defy corruption?

Or maybe we want to discuss the stellar way these loans are given AAA ratings?

Naked Short Selling is another great topic while we are on the Bernie Madoff Zimbabwe discussion.

Or we could discuss how we hang those out to dry for uttering regulation and oversight.

Defies comparison?

Yeah.

The bottom line is that we have become numb to what “experts” and reporters tell us.

A recent piece in Bloomberg discussing raising the debt limit is proof. “Tactics such as tapping federal retirement funds would free up roughly $150 billion – about the same amount as the interest payments that come due on Dec. 31.”

As one fellow blogger that I have the utmost respect for put it: “Did you catch the bit in boldface about ‘tapping’ federal retirement funds for short-term cash flow? Sounds so casual, so innocent, don’t it? Think about it, though. Unlike private pension funds, whose trustees have a fiduciary duty under the ERISA Act to safeguard the interest of beneficiaries, fedgov pension funds are mere slush funds for politicians to grab at will. Under the sordid conflicts of interest which are tolerated within our imperial government, the managers of Social Security and federal retirement funds subserviently hand over their reserves to our insolvent government in ad hoc, ‘we’ll pay you back when we can afford to’ transactions. In a private-sector pension fund, such malfeasance would land them straight in jail.

But then, government is all about granting itself the right to commit acts which are illegal for its subjects — such as the Federal Reserve’s 96-year-long currency counterfeiting operation. When the sovereign itself is dishonest, openly bilking its own pensioners, it is idle to talk of ‘reform.’ Organized crime is not amenable to reform. Either you end it, or you trust your security to the nebulous notion of ‘honor among thieves.’ Good luck with that!”

Next time, Davos, tell us what you really think! Oh, and be sure to back it up with more facts, lol, the masses won’t get it otherwise!

Oh, and here’s just one more graphic to bolster your case of an insane world:

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply