You’ve heard of The Longest Yard. You’ve heard of The Longest Day. Well, this has been the longest week, given the barrage of significant releases, announcements, et al. We conclude today with US non-farm payrolls, after which Macro Man plans to relax over the weekend.

Anyhow, he doesn’t have the energy to conjure a neat tie-in this morning…all he can manage is a collection of random thoughts:

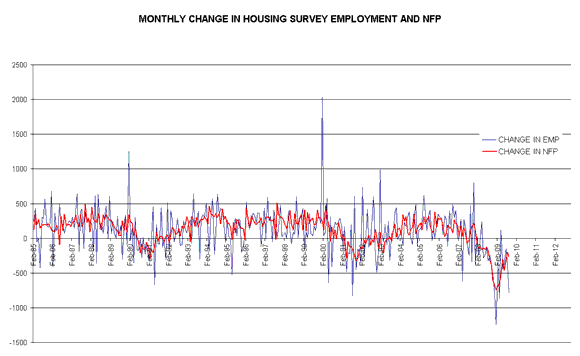

» Very little (short of a positive print) would surprise Macro Man from today’s payroll number. Last month’s household data and the recent jobs hard to get measure from the consumer confidence survey would suggest risks are to the downside. Claims and the ISM employment figure would suggest risks to the upside. Throw in a dash of statistical hocus-pocus, and just about anything is possible. Jan Hatzius at Goldman has been, ahem, unusually accurate recently; for what it’s worth, he’s forecasting -200k and 9.9% on the u-rate…

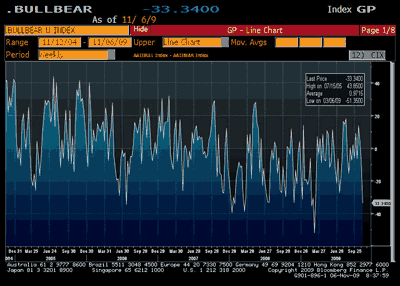

» Is the equity pain trade for a melt-up? The most recent II survey showed a collapse in net bullishness back towards historical lows (excluding March.) Combined with the 30 level on VIX holding, Macro Man’s left to wonder if the liquidity orgy is back on the cards. USD/KRW seems to think so….

(click to enlarge)

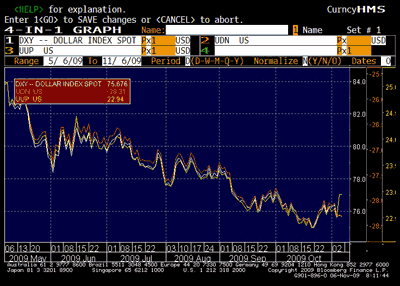

» If you needed any convincing that this market is screwy, the dollar index ETFs should convince you. Wednesday saw an enormous amount of November call buying on the UUP (dollar bullish) ETF. As in, 320,000 lots enormous. Then yesterday, someone tried to engineer an enormous squeeze in the ETF, to the point where it ran out to shares to create! UUP soared 2% on a day when the dollar….didn’t. You can see the effects of the squeeze on the chart below (depiciting UUP, the bearish UDN, and the underlying DXY.) So yesterday, you could bet on the $ going up, make an equal bet on the $ going down, and make money. Yeah, this market is rational….

» So yesterday, the BOE did more QE (£25 bio), JCT was more hawkish than expected (suggesting improved growth prospects and hinting at a not-too-distant embarking on an exit strategy)….and EUR/GBP goes nowhere on the day, net/net. Yeah, this market is rational….

(click to enlarge)

» It has become a cliche (repeated in Macro Man’s own FAQs) to recommend books like Reminiscences of a Stock Operator or Market Wizards to people looking to indoctrinate themselves into trading. But Macro Man is rapidly coming to the conclusion that re-reading those books is a mistake for someone with a mature investment strategy. It seems like every time that Macro Man does so, a cold streak immediately follows. Perhaps, subconsciously, it encourages the reader to deviate from their preferred methodology based on some “pearl of wisdom” contained in the books? Macro Man is curious if other experienced punters have found the same. (And yes, a couple of weekends ago, your author picked up Market Wizards to read while eating a sandwich for lunch…)

» Reader of the comments section have recently been treated to a, ahem, “vigorous” debate between “Gary” and “leftback” on a range of issues, including the differences between pension and hedge fund management. Macro Man is always bemused by the mutual contempt with which large real money guys and hedge fund guys often regard each other.

To the PF guy, the hedge fund guy manages a bit of loose change with the attention span of a gnat…and gets richly rewarded for it. Oh, and he doesn’t have to worry about stuff like liability matching, long run return assumptions, or Jimmy Hoffa. To the HF guy, the pension fund guy has the ease of not marking to market or getting tinned/losing assets after a small cold streak. Responsibility for losses can be dispersed amongst the many heads around the committee table. Benchmarks are for sissies: it’s all about absolute return, baby! (Well, except for 2008, natch…)

Unsurprisingly, there is some truth in these caricatures…but caricatures they nevertheless remain. Ironically, among the greatest PF/endowment managers are those that trade more like HFs. Jack Meyer, et al at Harvard managed a clip of capital that I assume most PF guys would concede was reasonable, but traded many of those assets much more tactically than most PF…with spectacular results.

Of course, they also got paid like HF managers…and some alumni decided that paying 8 figure salaries to a small group of people (who generated a decent chunk of the university’s operating budget, btw) was unacceptable.

And so Meyer, Samuels et. Al left, to be replaced by a group of successively cheaper, more real money-ish managers. And surprise….performance has gotten a lot worse! There is a lot more overlap in the Venn diagram of good PF and HF managers than most would believe….

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply