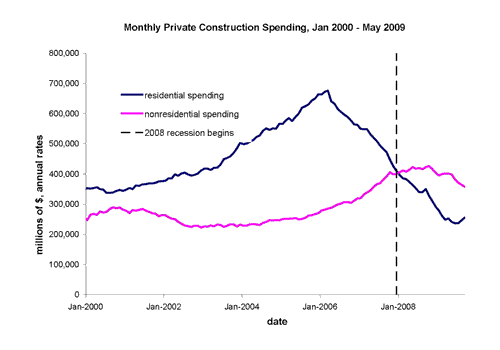

Residential construction spending was higher in September than in August, which was itself higher than in July, which was itself higher than in June.

Interestingly, I predicted last December that the housing market would turn around in the summer of 2009. By now, we have seen enough housing price and construction data to see that prediction was correct.

My prediction was based on the assumption that a credit crunch would not be an housing important factor. In other words, I expected any significant credit market restraint of the housing market to cause the market to turn around later than summer 2009. That’s not to say that credit is flowing easily — just that credit conditions are reacting to the housing market (in particular, its new and lower levels of price and construction) rather than the other way around.

But look at nonresidential construction: it’s fallen significantly since spring. Why?

- Credit crunch?

- housing construction crowding out non-residential construction?

- an expectation that labor will remain low for a while to come.

I am skeptical that a credit crunch is all that important — certainly not the entire story (if it were, why did the housing market turn around as quickly as I predicted?). Housing construction right is now not significant enough to crowd out much non-residential construction. Thus, the bad news is that non-residential investment spending may be indicating more tough times for the labor market. I’m going to write more about that tomorrow on nytimes.com.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply