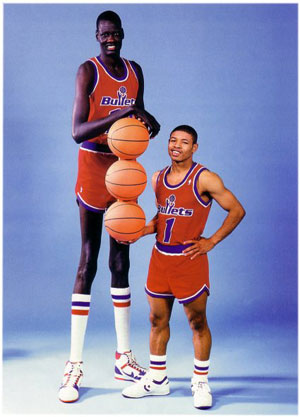

It’s a big, big, big week. Starting off with today’s ISM (well, technically, starting off with yesterday’s China PMI), we’ve got the Fed on Wednesday (the end of the extended period?), the BOE (more QE?) and ECB on Thursday, and of course payrolls on Friday. Throw in the odd corporate bankruptcy, an old-skool bank writedown, and the odd kleptocraric land-grab, and the only thing bigger than this week is 80’s NBA player Manute Bol (pictured, right, with teammate Tyrone “Muggsy” Bogues.)

It’s a big, big, big week. Starting off with today’s ISM (well, technically, starting off with yesterday’s China PMI), we’ve got the Fed on Wednesday (the end of the extended period?), the BOE (more QE?) and ECB on Thursday, and of course payrolls on Friday. Throw in the odd corporate bankruptcy, an old-skool bank writedown, and the odd kleptocraric land-grab, and the only thing bigger than this week is 80’s NBA player Manute Bol (pictured, right, with teammate Tyrone “Muggsy” Bogues.)

Manute, the “Dunkin’ Dinka” from Sudan was, as you may well discern from his physique, something of a novelty player. His offensive skills were, well, offensive and he was a poor rebounder due to his lack of mass. He did excel in one area, however: blocking opponents’ shots with his impossibly long arms. He even led the league twice in that category.

Actually, the end of last week was a bit reminiscent of Manute as well. After the key breakdown in major indices on Wednesday, stocks appeared to execute a Manute-style rejection of the downmove on Thursday….followed by a severe rejection of the rejection on Friday. Got it? Good.

In addition to the veritable Everest of event risk this week, we are also at a fairly critical technical juncture as well. The break of the relevant trendlines and moving averages has been well-flagged, both here and elsewhere. But the recent uptick in the VIX has also taken it to interesting levels. Way back in the day, when Lehman Brothers still roamed the earth, the 30 level on the VIX usually signaled the wash-out point for bear moves in the stock market. As you can see, both before and after Lehman, equities generally turned when the VIX got to 30+, thus sending the VIX itself back down.

(click to enlarge)

So in a sense, this week will provide an interesting laboratory for us to determine if the market truly is more “normal”, or whether the darkest fears of the most ursine bears will be realized. If Macro Man were a sell-side analyst this morning, he’d probably write something like “risky assets are either a great buy or a great sale at these levels…by Friday we’ll know which one.” In practice, it is unsurprising that implied vol across assets is getting pumped up.

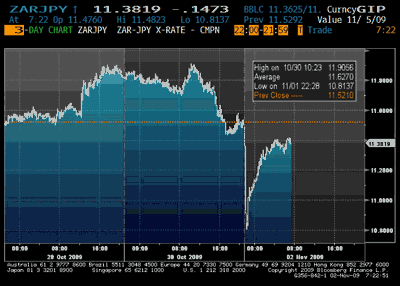

Indeed, the week has already witnessed its first “volatility event.” Unluggy Mrs. Watanabe, perennially poor punter of foreign exchange, experienced a Manute-sized drawdown in her account today. ZAR/JPY, a cross that offers granite-like liquidity at the best of times, was evidently the subject of a horrendously-executed margin call stop-loss run, which sent the cross down 10% from Friday’s highs.

(click to enlarge)

Naturally, it has since recouped virtually all the losses, giving a Manute-sized headache to Mrs. Watanabe and anyone else unfortunate enough to leave a round-the-clock stop loss order in the ZAR.

Anyhow, it’s game on, and this week will set the stage for the end of the year. Macro Man is preparing to take his shots; he can only hope that he doesn’t encounter Manute barring his way to the basket.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply