To huge fanfare, Facebook announced the impending release of a new cryptocurrency, “Libra.” Except it isn’t–a crypto, that is. Whereas real cryptocurrencies are decentralized, anonymous, unpermissioned, and lack trusted intermediaries, Libra is centralized, permissioned, non-anomymous and chock-full o’ intermediaries in addition to Facebook. It doesn’t really utilize a blockchain either.

Other than that . . .

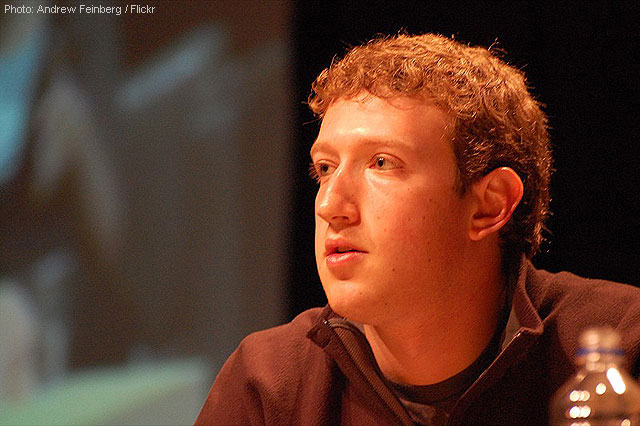

For the best (IMO) take on the “Zuck Buck”, I heartily recommend FT Alphaville’s extended take–and takedown. I’ll just add a few comments.

First, when it comes to finance, there is little (if anything) new under the sun, and that is clearly true of Libra. The Alphaville stories provide several historical precedents, to which I’ll just add another. It is basically like pre-National Bank Act banking system in which banks issued bank notes that circulated as hand-to-hand media of exchange, and which were theoretically convertible into currency (gold prior to the Civil War) on demand. Libra is functionally equivalent to such bank notes, with the main distinction that it is represented by bytes rather than pieces of paper.

Facebook attempts to allay concerns about such a system by requiring 100 percent backing by bank deposits or low-default-risk government bonds, but as historical experience (some as recent as 2008) demonstrates, although such systems are less subject to runs than liabilities issued by entities that invest the proceeds in illiquid assets, they are not necessarily run-proof.

Furthermore, the economic model here isn’t that different from the 19th century bank model because the issuer can profit by investing the proceeds from the issue of the currency in interest bearing assets, and pocketing the interest. Those buying the currency forego interest income, and presumably are willing to do so because of it reduces the costs of engaging in various kinds of transactions.

This type of system faces different kinds of difficulties in low and high interest rate environments. In high rate environments, the opportunity cost of holding the currency is high, which leads to lower quantity demanded. In low rate environments, the revenue stream may be insufficient to cover the costs incurred by the intermediaries. This creates an incentive for asset substitution, i.e., to allow backing the currency with higher risk assets (with higher yields) thereby increasing insolvency and run risks.

I note in passing that low interest rates destroyed the traditional FCM model which relied on interest income from customer margins as a major revenue stream (as Facebook is proposing here). Ask John Corzine about that, and look to the experience of MF Global.

Why introduce this in a low interest rate environment? Maybe this is a kind of loss-leader strategy. The opportunity cost of holding Libra is low now (given low rates), so maybe a lot of people will buy in now. Even though the benefits to the issuers/intermediaries may be low now (because the interest income is low), they may be counting on customer stickiness once there is widespread adoption. That is, those who hold Libra when the cost of doing so is low may stick around even when the cost goes up substantially. That is, Facebook and its partners in this endeavor may be counting on some sort of switching cost or some behavioral irrationality to reduce the interest-rate sensitivity of demand for Libra.

Good luck with that. (For another example of nothing new under the sun, read up on disintermediation of traditional banks when interest bearing money market mutual funds came on the scene.)

I would also suggest that Libra has some disadvantages as a medium of exchange. For one thing, since assets will be held in multiple currencies, it creates currency risk for virtually everyone who uses it. For another, it involves additional cost to move from fiat into Libra and from Libra into fiat. This reduces the value of the Libra as a medium of exchange because of the resulting difference in cost in using it for within-network and off-network uses.

This last point relates to something else in the Libra white paper, namely, the claims that the currency will be a boon to the “unbanked.” This makes zero sense.

The reason that some people don’t have bank accounts is that the cost of servicing them (reflected in fees that banks charge) is below the willingness/ability of those people to pay for those services. There is no reason to believe that Libra reduces the cost of servicing the currently unbanked. Furthermore, the value of the services provided is likely to be lower, and substantially so because inter alia (a) the lack of brick an mortar facilities that low income people need for check cashing/depositing and cash depositing, (b) the restricted network of people with whom they can transact, and (c) currency risk. Relatedly, it’s hard to see how one can move funds into our out of Libra without having access to banking services. I see the unbanked rhetoric as mere SJW eyewash attempting to make this look like some progressive social project.

The arrogance of Facebook is also rather astounding. Again, this is not crypto–it is banking. Yet Facebook presumes that it can do this without the panoply of licenses that banks must have, and without being subject to the same kinds of regulation as banks.

Because why? Trust me? Suuuurrreee, Mark.

Along these lines, note that the most benign interpretation behind Libra is that it is a narrow bank (100 percent reserve banking). But remember the Fed recently denied approval to TNB (“The Narrow Bank”) USA NA even though it was only going to offer deposits to “the most financially secure institutions” and explicitly eschewed providing retail banking services. Yet Marky et al expect the Fed (not to mention banking regulators in every other jurisdiction on the planet) to stand aside and let Facebook offer maybe (but maybe not) narrow banking services (with added currency risk!) to the great unwashed?

On what planet?

Note the furious government reactions to this, not just in the US but in Europe. Zuckerberg et al were totally delusional if they expected anything different, especially in light of Facebooks serial privacy, free-speech, and antitrust controversies.

In sum, in my opinion Libra faces serious economic and political/regulatory obstacles. Having politicians and regulators hate you isn’t bad per se in my book–it can actually represent an endorsement! But the economics of this are incredibly dodgy. My skepticism is only increased by the misleading packaging (crypto! a boon to the unbanked!) and the congenitally misleading packager.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply