A word on where this market could go this week: sideways. The Q3 GDP report is expected Thurs. Consensus is for around a 3% rise, the first rise since the Greater Recession started in Q407. Christina Romer of the President’s Council of Economic Advisors discussed how the Stimulus pushed up GDP in Q2 by 2-3% and should push Q3 up by 3-4% and into positive territory. I have previously shown an alternative analysis that the impact was less than this, but no matter; that analysis and her comments both come to the same conclusion: we are at Peak Stimulus right now, and the impact will be smaller going forward, down to negligible by next summer and a drag by end of next year.

Given peak stimulus right now, the key is whether the private sector is showing signs of life beyond government life support. This report should give some insight into that. Hence the market may stay in a spiky range through the report, and then bifurcate, meaning pick the direction for the next few months.

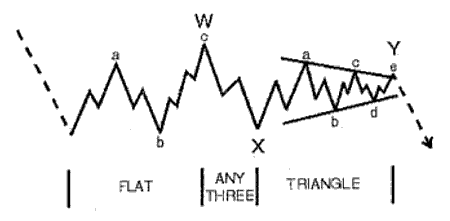

The wave structure is complex. It has broken as a double zigzag since the July bottom, and now may be breaking into a third corrective period, an ending triangle. When a complex correction goes into its third corrective structure, it often ends in a sideways move in the form of a triangle. While triangles are called the penultimate wave, typically in the second to last position (waves 4 or B), they also tend to be the last wave in a complex correction. I suppose this could also be termed an ending diagonal or a Neely terminal; if it emerges it suggests the corrective wave is over and we bifurcate down.

This chart from Prechter’s wave tutorial is illustrative (you may have to be a Club EWI member to see the tutorial).

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply