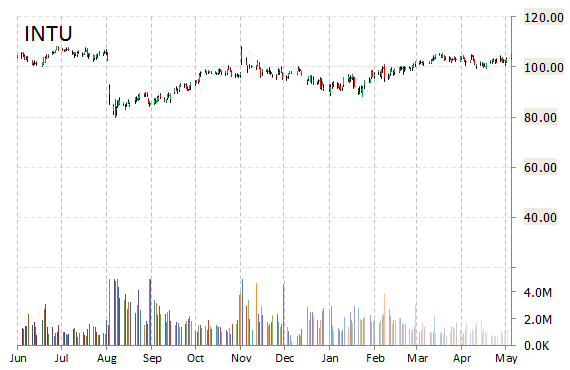

INTU stock posted gains in late trade Monday and nearly took out the session highs going into the close. Shares finished up by 1.54 percent at $104.62 on heavy trading volume.

The maker of QuickBooks and TurboTax reports its fiscal 2016 third-quarter financial results after today’s close.

Expectations for the Quarter

Overall, Intuit is forecast to deliver a year-over-year increase in the top and bottom lines for the quarter ended April 30. Wall Street analysts are on average expecting the Mountain View, CA-based company to post $2.25 billion in sales during the period. This would show a 2.27% increase from the Q315 revenue of $2.20 billion. EPS in Q316 are expected to come in at $3.21, a growth rate of 12.63% from $2.85 per share a year earlier. Meanwhile, EarningsWhisper.com reports a whisper number of $3.25 per share.

As a quick reminder, Intuit (INTU) reported Q216 EPS of $0.25, $0.06 higher than the Street’s consensus estimate. Revenues increased 14.23% year-over-year to $923 million versus the $893.2 million consensus. The company said it benefited from a solid tax season. As it stands, the $26.87 billion market cap firm has beaten the Street’s profit projections in six straight quarters.

The Bottom Line

INTU shares have advanced 2.24% in the last 4 weeks and 7.76% in the past three months. Over the past 5 trading sessions the stock has gained 0.86%. INTU has a median Street price target of $106.00 with a high target of $125.00.

On e year-over-year basis, Intuit Inc. is down 0.85%, compared with a 2.67% loss in the S&P 500.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply