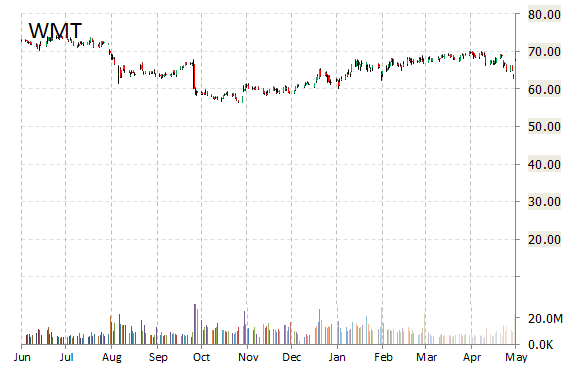

Wal-Mart Stores Inc. (WMT) was reiterated a ‘Neutral’ by MKM Partners analysts on Friday. The broker raised its price target on the stock to $67 from $65. WMT was also raised to $81 from $70 at Nomura, and to $69 from $66 to RBC Capital Markets following earnings.

The Bentonville, AR-based wholesale and retail giant handed in 1Q17 earnings of $0.98 per share on revenue of $114.99 billion, beating Wall Street estimates of $0.88 per share on revenue of $112.68 billion. Wal-Mart’s same-store sales rose 1% for the quarter, above estimates of 0.5% growth.

In terms of guidance for 2Q17, WMT expects EPS to be in the range of $0.95 – $1.08 versus consensus of $0.98 per share.

Wal-Mart stock gained $0.91 to $70.11 in midday trading.

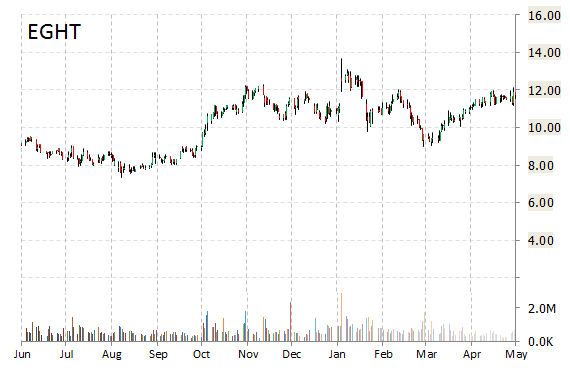

8×8 Inc. (EGHT) was reiterated as ‘Buy’ with a $15 from $14 price target on Friday by Dougherty & Co. following solid results for the 2016 fiscal fourth quarter. EGHT was also raised to $13 from $12 and maintained as ‘Overweight’ at Barclays.

After yesterday’s market close, the San Jose, CA-based communications technology company reported earnings of $0.03 per diluted share, in-line with analysts’ estimates. Revenues rose 31.7% from last year to $57.33 million. Analysts expected revenues of $54.4 million.

For FY17, 8×8 Inc issued revenue projection of $249 to $253 million, compared to the consensus revenue estimate of $245.58 million.

EGHT is currently up $0.95 to $12.69 on 1.74 million shares.

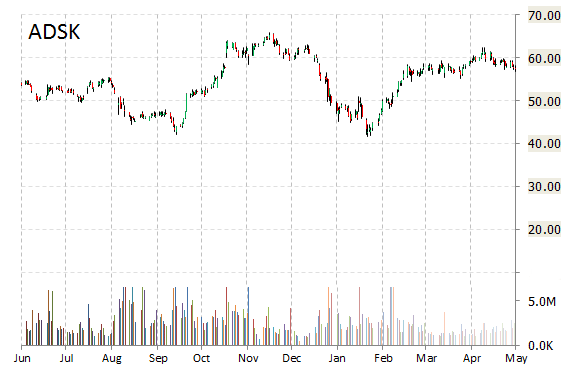

Shares of Autodesk, Inc. (ADSK) are down $1.40 at $56.12 in late trading following disappointing guidance for the 2016 second quarter.

After the market close, the San Rafael, CA-based design software and services company provided EPS guidance of ($0.18) – ($0.11) versus consensus of ($0.07) per share. The company also issued revenue projection of $500 to 520 million, significantly below estimates of $542.26 million.

In its quarterly report, the company said it lost ($0.10) per share, well below the ($0.14) per share analysts were expecting. Revenue fell 20.8% year-over-year to $511.9 million, below views for $513 million.

Despite the 2Q results, Canaccord Genuity this morning raised its price target on Autodesk shares to $60 from $55, and reiterated a ‘Hold’ rating.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply