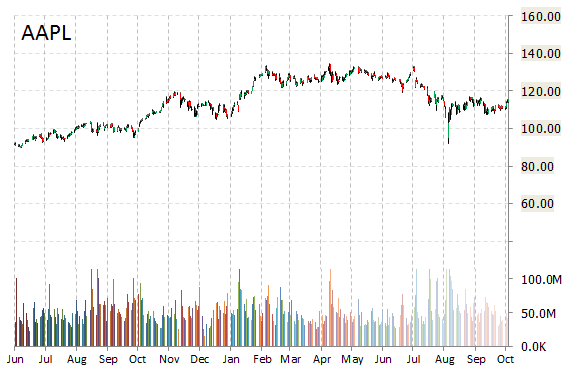

Analysts at Maxim Group are out with a report this morning upgrading shares of Apple Inc. (AAPL) with a ‘Buy’ from ‘Hold’ rating. The firm raised its price target for the company to $167 from $144.

With nearly $225 billion in annual revenue, Apple has a market capitalization of more than $676 billion, and a stock trading at 13.72x times its price/earnings ratio. Ticker has a forward P/E of 12.10 and t-12 price-to-sales ratio of 2.94. EPS for the same period is $8.65.

In the past 52 weeks, shares of Cupertino, California-based company have traded between a low of $92.00 and a high of $134.54 and are now at $118.61.

Shares are up 14.06% year-over-year and 5.97% year-to-date.

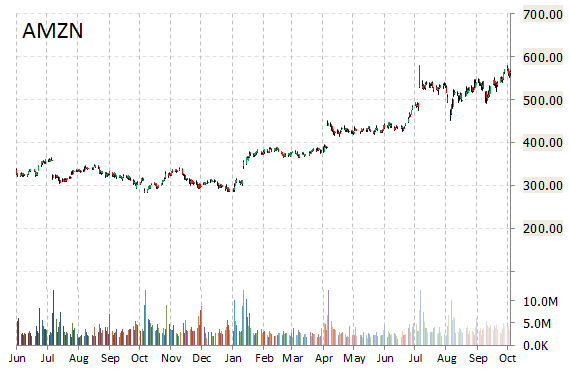

Amazon.com, Inc. (AMZN) was reiterated as ‘Buy’ with a $725 from $665 price target on Friday by Deutsche Bank (DB) after the company reported another impressive quarter. The name was also raised to $720 from $645 at Mizuho, to $800 from $950 at Piper Jaffray, to $800 from $710 at JPMorgan (JPM), and to $777 from $720 at Credit Suisse (CS).

AMZN shares recently gained $39.09 to $603.00. In the past 52 weeks, shares of the e-commerce giant have traded between a low of $284.00 and a high of $619.94.

Shares are up 81.70% since the beginning of the year.

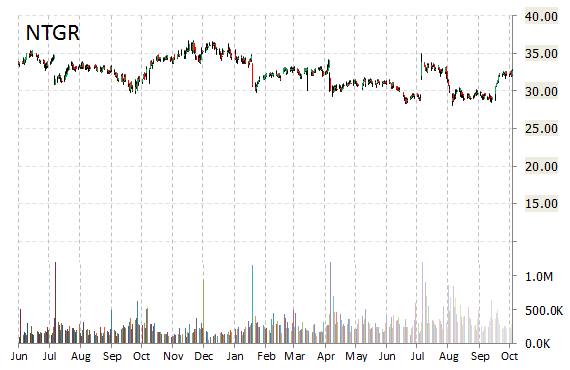

Netgear Inc. (NTGR) was raised to ‘Outperform’ from ‘Underperform’ with $39 price target at Raymond James on Friday.

NTGR is up $9.75 at $42.45 on heavy volume. Midway through trading Friday, 2.73 million shares of Netgear Inc. have exchanged hands as compared to its average daily volume of 306K shares. The stock has ranged in a price between $35.64 to $42.62 after having opened the day at $42.45.

Over the past year, shares of San Jose, Calif.-based company have traded between a low of $28.12 and a high of $42.62.

Shares are up 3.74% year-over-year ; down 8.09% year-to-date.

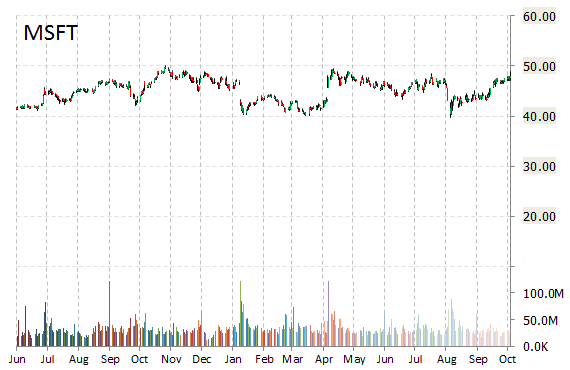

BofA/Merrill (BAC) is out with a report this morning upgrading shares of Microsoft Corporation (MSFT) with a ‘Buy’ from ‘Neutral’ following the company’s better than expected Q1 results.

Microsoft is currently printing a higher than average trading volume with the issue trading 90.08 million shares, compared to the average volume of 33.29 million. The stock began trading this morning at $53.00 to currently trade 10.33% from the prior days close of $48.03. On an intraday basis it has gotten as low as $52.25 and as high as $53.61.

Microsoft’s shares have advanced 9.48% in the last 4 weeks, and 5.24% in the past three months. Over the past 5 trading sessions the stock has gained 2.17%. The Redmond, Washington-based company, which is currently valued at $423.89 billion, has a median Wall Street price target of $51.50 with a high target of $60.

MSFT is up 11.12% year-over-year.

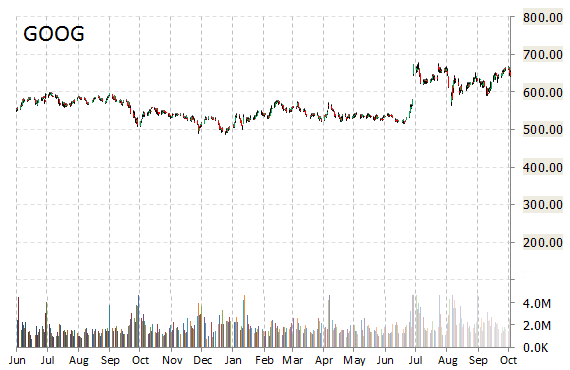

Alphabet Inc. (GOOG) rating of ‘Buy’ was reiterated today at Deutsche Bank with a price target increase of $900 from $840 (versus a $651.79 previous close).

GOOG shares recently gained $59.84 to $711.63. The stock is up more than 22% year-over-year and has gained roughly 24% year-to-date. In the past 52 weeks, shares of Mountain View, California-based search giant have traded between a low of $486.23 and a high of $730.00.

Alphabet closed Thursday at $651.79. The name has a current market cap of $489.38 billion.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply