Here are some more assorted musings:

(1) Caroline Baum asks a probing question: if the Fed is not able to identity an asset bubble and prick it in a timely fashion, how then is it able to know what are appropriate spreads in the credit market as it expands it balance sheet to shore up the financial system? In the former case it claims ignorance and refuses to intervene while in the later case it claims prescience and readily intervenes. Baum notes this asymmetry is typical of Fed policy in recent times.

(2) Has the Fed’s independence already been compromised? Nouriel Roubini and Ian Bremmer argue yes and its not because of congressional probbing. Rather, it is because of its bailout of large financial institutions last year. Roubini and Bremmer also explain that if the Fed is not careful it could set the stage once again for the next bubble, a point recently made by Peter Boone and Simon Johnson.

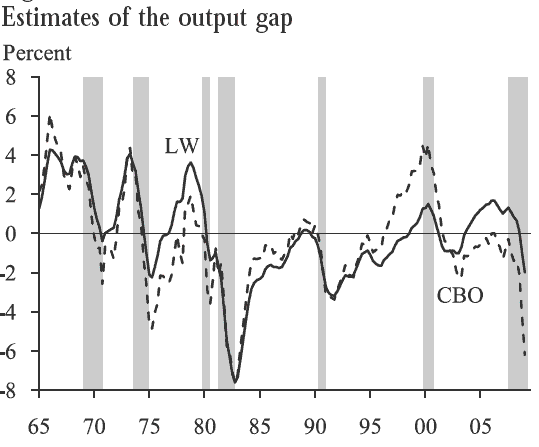

(3) Roberto M. Billi has a new article that examines whether monetary policy was optimal in past deflation scares. He looks at Japan in the period 1990 to 1995 and the United States from 2000 to 2005. Using a Taylor Rule he concludes that monetary policy was too accommodative in the case of the United States. While I concur with his conclusion and have said so before, I also would like to note several things. First, the article assumes that deflation is always economically harmful. Deflation, however, can arise for reasons other than a collapse in aggregate demand. As I have noted before, positive aggregate supply shocks can also generate benign deflationary pressures and this form has far different policy implications than deflation arising from a collapse in nominal spending. Second, when constructing the federal funds rate prescribed the Taylor Rule one needs a measure of the output gap. There are, however, different measures of the output gap and, as result, different implications for the Taylor Rule. A popular version for the United States is the CBO’s output gap measure. John Williamson of the San Francisco Fed , however, argues that the CBO measure is flawed since it doesn’t allow for short-run fluctuations in the growth rate of potential output. Here is his preferred measure (LW) graphed along with the CBO measure:

The CBO measures show a negative output gap during the housing boom while the LW measure shows a positive output gap. The LW makes more sense for this period. Now plug the LW measure into a Taylor Rule and there is even a stronger case that monetary policy was too loose during the housing boom period. Finally, there are other ways to learn the stance of monetary policy. Here is one measure I like.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply