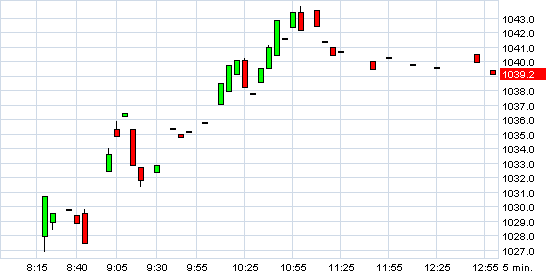

Gold hit new record highs above $1,040.15 per ounce on Tuesday, topping the previous record of $1,033.90 in March 2008. Momentum buying sparked by the weaker dollar pushed the metal through that level. The precious metal lifted after a report — later denied — suggested that Saudi Arabia and other countries were in talks to abandon the greenback in oil trade in favor of a currency basket plus gold. Also pressuring the greenback was the decision by the Reserve Bank of Australia to boost its cash rate by a quarter of a percentage point to 3.25%.

“Gold is acting like the ultimate currency,” said Chip Hanlon, the president of Delta Global Advisors Inc… “Central banks are following the same monetary course and trying to stimulate and inflate their way back to growth. Everyone’s concerned about the dollar, but it’s not like you can hate the dollar and fall in love with the euro or the yen.” [Bloomberg]

Gold seems to have found support in the low $1K/oz level and looks set for higher-highs. With the hedge funds and the ETF market becoming increasingly positive on gold, and as investors keep moving into dollar-denominated commodities, such as gold ; we wouldn’t be surprise to see the precious metal print the tape at above $1200 in a matter of months, if not weeks.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply