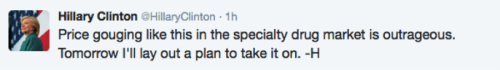

All hell is breaking loose in the stock market thanks to what at first glance looked like an innocuous tweet from presidential hopeful Hillary Clinton…

In her tweet, Clinton linked a New York Times article about a small biopharma that recently jacked up the price of a newly acquired treatment from $13.50 per tablet to $750. She called the action “outrageous” and promised to do something about it…

However, what started out as some canned campaign talking points on Twitter turned into a big problem for biotech investors. The S&P Biotech SPDR and the Biotech iShares began cratering just before lunch. And by the time the dust cleared, both lost more than 4% on the day.

Twitter’s stock might be in the gutter. But yesterday, 140 characters cost the biotech sector (and its investors) millions.

So what’s the deal? Will Hillary will get elected president, go to war with these evil capitalists over their outrageous drug prices and have the FDA shut down the entire biotech industry?

Probably not.

And I doubt anyone else really believes this little tale, either. So then why the heck did almost every single biotech stock on the market crater after a stupid tweet?

Because we are now in a market environment where investors will use almost any “event” as a reason to sell…

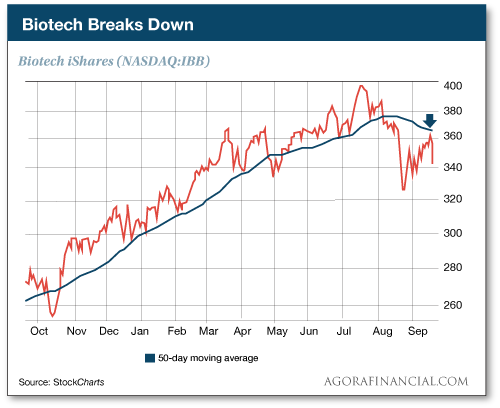

If we actually bother to look at the charts, we can clearly see the biotech sector has been in trouble since it peaked in late July. And after Monday’s action, we’re left with a lower high in the Biotech iShares as it knocks its head against a falling 50-day moving average.

Take a look for yourself:

Back in July, after what was then the worst day for U.S. stocks so far this year, we noted biotechs were the one group that not only stabilized but moved higher. Biotechs and health care names were helping to prop up the Nasdaq while the Dow and S&P suffered. But right now, we’re seeing the exact opposite effect. The Nasdaq was yesterday’s biggest loser—all thanks to the biotech selloff.

It’s no secret that the stock market has gone through a rough patch lately. However, it’s especially important to recognize the changes in character we’ve seen in former leader like biotech stocks. This sector is down about 15% from its all-time highs posted earlier this summer. And the Mr. Market’s giving you no reason to dive back in just yet.

With the broad market and biotech in correction mode, I expect lower prices over the next few weeks. Don’t believe me? Just check Twitter…

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply