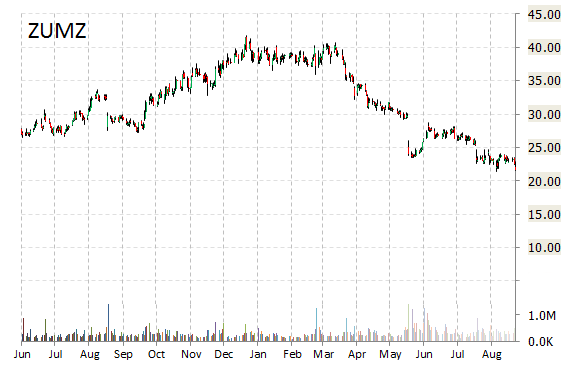

Zumiez, Inc. (ZUMZ) was reiterated a ‘Neutral’ by B. Riley & Co. analysts on Friday. The broker also cut its price target on the stock to $19 from $28.

The target price for ZUMZ is lowered from $28 to $19.

On valuation measures, Zumiez Inc. stock it’s trading at a forward P/E multiple of 8.84x, and at a multiple of 10.63x this year’s estimated earnings. The t-12-month revenue at Zumiez is $826.23 million. The name’s ROE for the same period is 12.63%.

Shares of the $455.32 million market cap company are down 25.23% year-over-year and 43.93% year-to-date.

Zumiez Inc., currently with a median Wall Street price target of $27.00 and a high target of $40.00, dropped $6.06 to $15.60 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

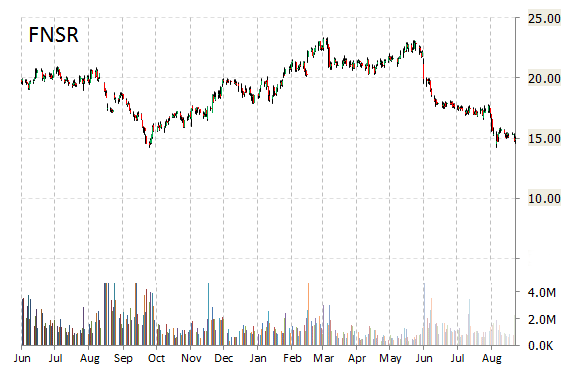

Finisar Corp. (FNSR) was reiterated as ‘Buy’ with a $18 from $25 price target on Friday by Needham. The PT decrease was atrributed to co.’s soft earnings and guidance.

On Thursday, the fiber optic component supplier reported first-quarter FY 2016 EPS of $0.23, compared to the consensus estimate of $0.26. Revenues decreased 1.9% from last year to $314 million. Analysts expected revenues of $318.66 million.

Looking to second quarter of fiscal 2016 Finisar said it expects EPS to be between $0.20 – $0.26 versus consensus of $0.28 per share. The company also issued revenue projection of $304 – $324 million, compared to the consensus revenue estimate of $327.87 million.

On valuation measures, Finisar Corp. shares, which currently have an average 3-month trading volume of 1.18 million shares, trade at a trailing-12 P/E of 110.55, a forward P/E of 8.19 and a P/E to growth ratio of 0.73. The median Wall Street price target on the name is $24.50 with a high target of $27.00. Currently ticker boasts 6 ‘Buy’ endorsements, compared to 8 ‘Holds’ and no ‘Sell’.

The stock is currently down $2.75 to $12.16 on 6.03 million shares.

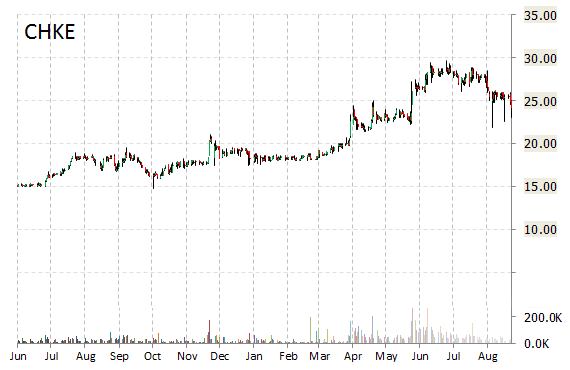

Cherokee Inc. (CHKE) rating of ‘Buy’ was reiterated today at Wunderlich. The firm however, cut its target on the name to $26 from $33 (versus a $24.11 previous close).

Shares have traded today between $15.26 and $17.54 with the price of the stock fluctuating between $14.77 to $29.72 over the last 52 weeks.

Cherokee Inc. shares are currently changing hands at 13.94x this year’s forecasted earnings, compared to the industry’s 22.71x earnings multiple. Ticker has a t-12 price/sales ratio of 5.93. EPS for the same period registers at $1.14.

Shares of Cherokee Inc. have lost $8.29 to $15.82 in midday trading on Friday, giving it a market cap of roughly $137 million. The stock traded as high as $29.72 in July 13, 2015.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply