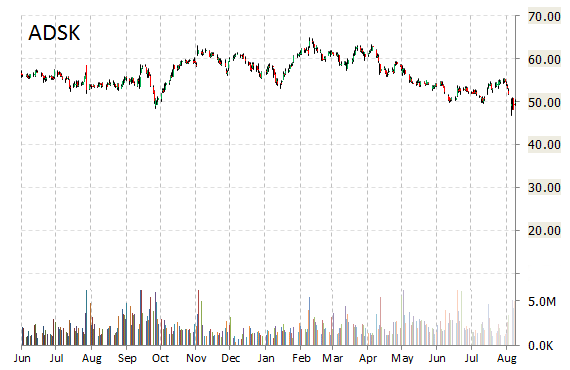

Autodesk, Inc. (ADSK) was reiterated a ‘Overweight’ by Barclays analysts on Friday. The broker however, cut its price target on the stock to $62 from $68.

On valuation measures, Autodesk Inc. stock it’s trading at a forward P/E multiple of 69.73x, and at a multiple of 150.84x this year’s estimated earnings. The t-12-month revenue at Autodesk Inc. is $2.57 billion. ADSK ‘s ROE for the same period is 3.22%.

Autodesk Inc., currently with a median Wall Street price target of $70.00 and a high target of $81.00, dropped $3.25 to $46.75 in recent trading.

Shares of the $10.65 billion market cap company are down 7.03% year-over-year and 16.75% year-to-date.

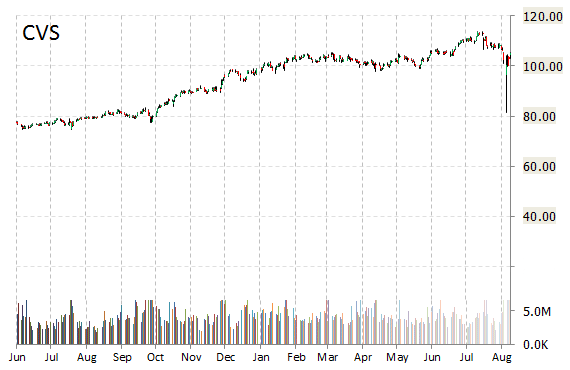

CVS Health Corporation (CVS) was reiterated as ‘Outperform’ with a $119 from $122 price target on Friday by Oppenheimer.

Shares have traded today between $103.38 and $105.46 with the price of the stock fluctuating between $77.40 to $113.65 over the last 52 weeks.

CVS Health Corp. shares are currently changing hands at 25.09x this year’s forecasted earnings, compared to the industry’s 18.52x earnings multiple. Ticker has a t-12 price/sales ratio of 0.81. EPS for the same period registers at $4.14.

Shares of CVS Health have lost $1.42 to $103.78 in midday trading on Friday, giving it a market cap of roughly $116 billion. The stock traded as high as $113.65 in July 29, 2015.

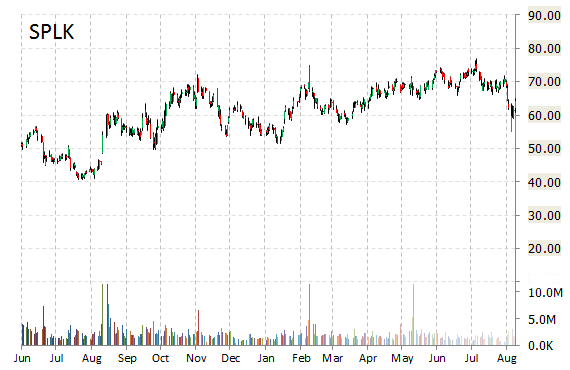

Splunk, Inc. (SPLK) rating of ‘Buy’ was reiterated today at UBS with a price target decrease of $76 from $82 (versus a $64.24 previous close).

Approximately 4.4 million shares have already changed hands, compared to the stock’s average daily volume of 1.89 million.

In the past 52 weeks, shares of San Francisco, Calif.-based company have traded between a low of $48.55 and a high of $76.85 with the 50-day MA and 200-day MA located at $69.06 and $66.77 levels, respectively. Additionally, shares of SPLK trade at a P/E ratio of 12.47 and have a Relative Strength Index (RSI) and MACD indicator of 37.48 and -3.16, respectively.

SPLK currently prints a one year return of about 40% and a year-to-date return of around 9%.

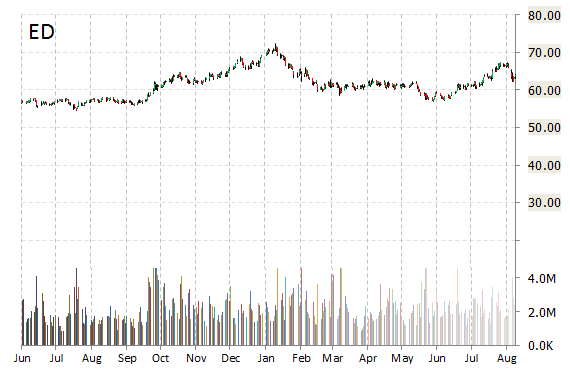

Consolidated Edison, Inc. (ED) had its rating lowered from ‘Buy’ to ‘Hold’ by analysts at Argus on Friday.

Currently there is 1 analyst that rates ED a ‘Buy’ versus 5 rating it a ‘Sell’, and 12 rating it a ‘Hold’.

ED was down $0.75 at $63.15 in midday trade, moving within a 52-week range of $55.80 to $72.25. The name, valued at $18.49 billion, opened at $63.50.

On valuation measures, Consolidated Edison Inc. shares are currently priced at 16.75x this year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 1.48. EPS for the same period registers at $3.77.

As for passive income investors, the firm pays stockholders $2.60 per share annually in dividends, yielding 4.15%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply