Shares of tech giant Apple (AAPL) are printing a higher than average trading volume with the issue trading 88 million shares, compared to the average daily volume of 50.38 million. The stock began trading this morning at $95.17 to currently trade 1.45% lower from the prior days close of $105.76. On an intraday basis it has gotten as low as $92.00 and as high as $105.80.

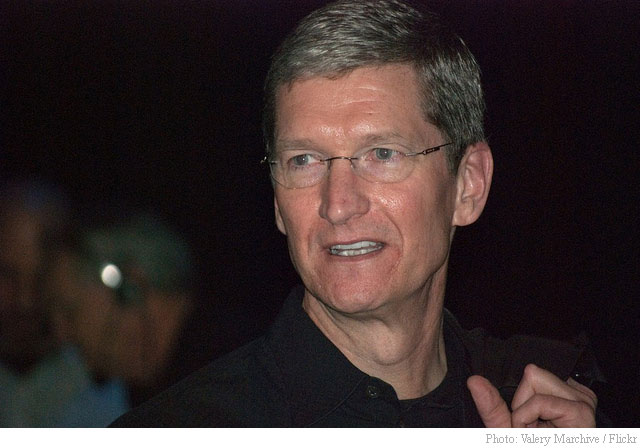

Apple plunged more than 7% before U.S. markets opened as Nas futures were also down about 5%. Ticker has rallied back however, following an email from Apple CEO Tim Cook to CNBC’s Jim Cramer where he addresses the company’s performance during the recent turmoil.

“As you know, we don’t give mid-quarter updates and we rarely comment on moves in Apple stock,” Cook wrote. “But I know your question is on the minds of many investors.”

On Friday, AAPL tumbled nearly 4% as investors worried about the outlook for the iPhone as well as on concerns about China’s economic health.

“I get updates on our performance in China every day, including this morning, and I can tell you that we have continued to experience strong growth for our business in China through July and August”, Cook wrote. “Growth in iPhone activations has actually accelerated over the past few weeks, and we have had the best performance of the year for the App Store in China during the last 2 weeks.”

“Obviously I can’t predict the future, but our performance so far this quarter is reassuring. Additionally, I continue to believe that China represents an unprecedented opportunity over the long term as LTE penetration is very low and most importantly the growth of the middle class over the next several years will be huge,” Cook added.

On valuation measures, AAPL shares are currently priced at 11.97x this year’s forecasted earnings, compared to the industry’s 12.34x earnings multiple. The company’s current year and next year EPS growth estimates stand at 41.60% and 7.10%, respectively. AAPL has a t-12 price/sales ratio of 2.69. EPS for the same period registers at $8.65.

Apple shares have declined 15.12% in the last 4 weeks and 19.84% in the past three months. Over the past 5 trading sessions the stock has lost 8.80%. The Cupertino, Calif.-based company, which is currently valued at $590.23 billion, has a median Wall Street price target of $150.00 with a high target of $195.00.

AAPL is up 6.95% year-over-year ; down 2.97% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply