YRC Worldwide Inc. (YRCW) is set to report Q2/15 earnings after today’s close. Wall Street analysts are on average expecting YRCW to post $1.31 billion in sales during the quarter. This would show a 10.08% increase from the Q1/15 revenue of $1.19 billion and an increase of 0.76% from the same period in Q1/14. EPS are expected to come in at $0.24 compared to ($0.16) per share a year earlier.

As a quick reminder, YRCW reported Q1/15 EPS of ($0.70) or $0.21 better than the Street’s consensus estimate of ($0.49). Revs declined 1.65% yoy from $1.21 billion to $1.19 billion vs. the $1.23 billion consensus.

On valuation measures, YRC Worldwide current year EPS growth estimate stands at 98.30% compared to the industry growth rate of 29.20%. The name has a t-12 price-to-sales ratio of 0.08. EPS for the same period registers at ($0.62).

In terms of share statistics, YRC Worldwide Inc. has a total of 32.75 million shares outstanding with 10.61% held by insiders and 88.60% held by institutions. The stock’s short interest currently stands at 7.21%, bringing the total number of shares sold short to 2.26 million.

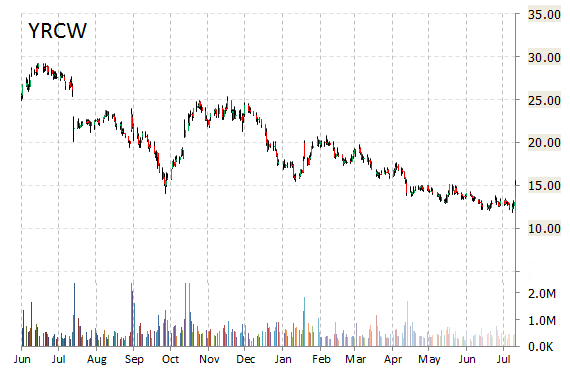

YRCW shares have declined 2.82% in the last 4 weeks while declining 21.72% in the past three months. Over the past 5 trading sessions the stock has lost 1.80%. The Overland Park, Kansas-based company, which is currently valued at $493.26 million, has a median Wall Street price target of $25.50 with a high target of $30.00. YRC Worldwide Inc. is down 51.38% year-over-year, compared with a 6.25% gain in the S&P 500.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply