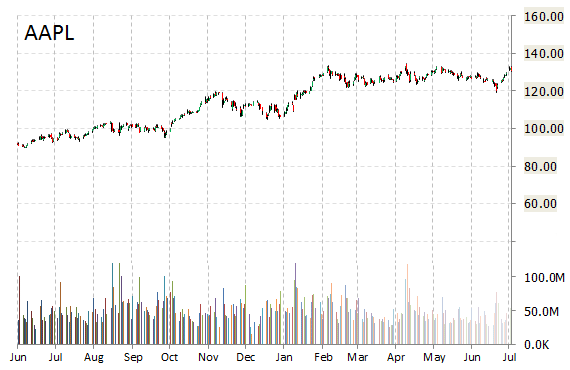

Analysts at Cowen downgraded Apple Inc. (AAPL) from ‘Outperform‘ to ‘Market Perform‘ in a research report issued to clients on Wednesday.

The target price for AAPL is lowered from $140 to $130.

On valuation measures, Apple Inc. stock it’s trading at a forward P/E multiple of 12.75x, and at a multiple of 15.52x this year’s estimated earnings. The t-12-month revenue at Apple is $212.16 billion. AAPL ‘s ROE for the same period is 38.37%.

Shares of the $719.21 billion market cap company are up 41.63% year-over-year and 19.42% year-to-date.

Apple Inc., currently with a median Wall Street price target of $150.00 and a high target of $195.00, dropped $5.90 to $124.85 in recent trading.

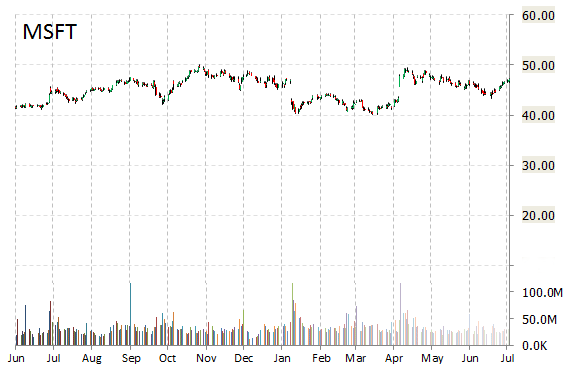

The chart below shows where the equity has traded over the past 52-weeks.

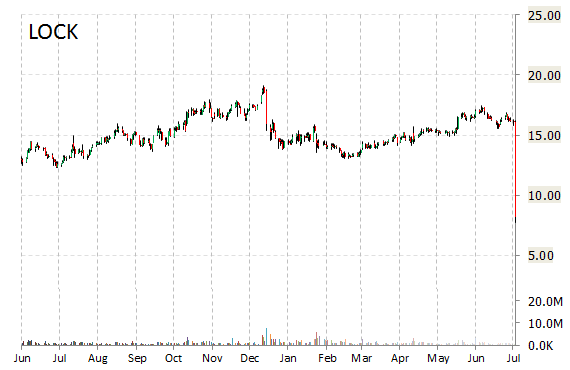

LifeLock, Inc. (LOCK) was downgraded from ‘Outperform‘ to ‘Sector Perform‘ and the price target was cut to $11 from $20 at RBC Capital Markets implying about 14% expected downside from the stock’s current price.

Shares have traded today between $8.39 and $9.84 with the price of the stock fluctuating between $8.39 to $19.15 over the last 52 weeks.

LifeLock Inc. shares have a trailing-12 price/sales ratio of 1.53. EPS for the same period registers at ($0.03).

LOCK shares have gained $1.33 to $9.48 in midday trading on Wednesday, giving it a market cap of roughly $894 million. The stock traded as high as $19.15 in December 31, 2014.

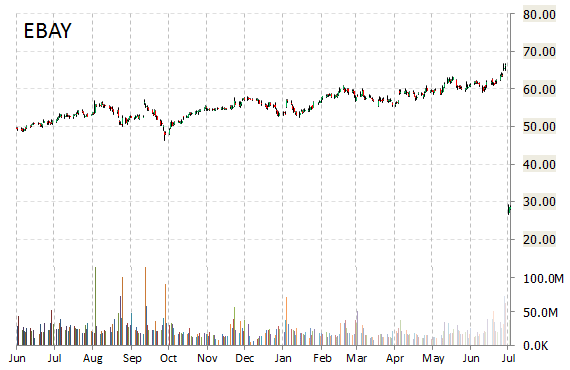

Raymond James reported on Wednesday that they have lowered their rating for eBay Inc. (EBAY). The firm has downgraded EBAY from ‘Outperform‘ to ‘Market Perform‘.

eBay Inc. recently traded at $28.46, a loss of $0.14 over Tuesday’s closing price. The name has a current market capitalization of $34.57 billion.

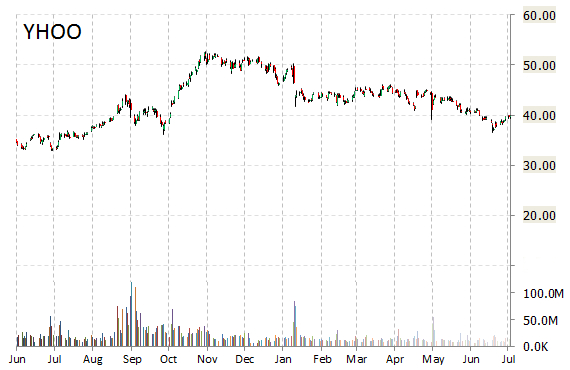

Yahoo! Inc. (YHOO) was reiterated a ‘Buy’ by MKM Partners analysts on Wednesday. The broker however, cut its price target on the web portal shares to $53 from $58.

YHOO shares recently lost $0.20 to $39.53.

Over the past year, shares of the Sunnyvale, California-based co. have traded between a low of $32.93 and a high of $52.62. Shares are up 19.38% year-over-year ; down 21.34% year-to-date.

Shares of Microsoft Corporation (MSFT) are down $1.81 to $45.47 in mid-day trading. Barclays reiterated its ‘Overweight’ rating and lowered its 12-month base case estimate on the name by 2 points to $51 a share.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply