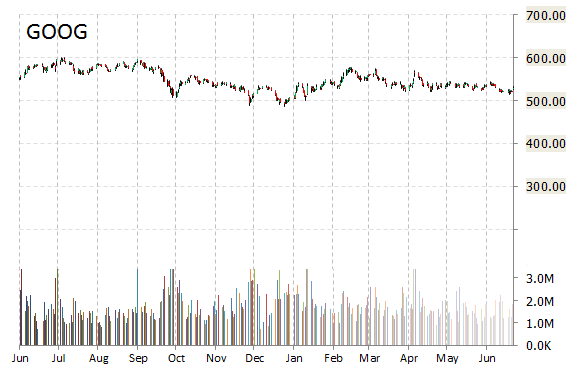

Analysts at Pivotal Research Group downgraded Google Inc. (GOOG) from ‘Buy‘ to ‘Hold‘ in a research report issued to clients on Monday.

The target price for GOOG is lowered from $640 to $570.

On valuation measures, Google Inc. stock it’s trading at a forward P/E multiple of 16.52x, and at a multiple of 25.63x this year’s estimated earnings. The t-12-month revenue at Google is $67.84 billion. GOOG ‘s ROE for the same period is 13.85%.

Shares of the $370.10 billion market cap search giant are down 7.17% year-over-year ; up 0.71% year-to-date.

GOOG, currently with a median Wall Street price target of $650.00 and a high target of $715.00, rose $12.75 to $542.80 in recent trading.

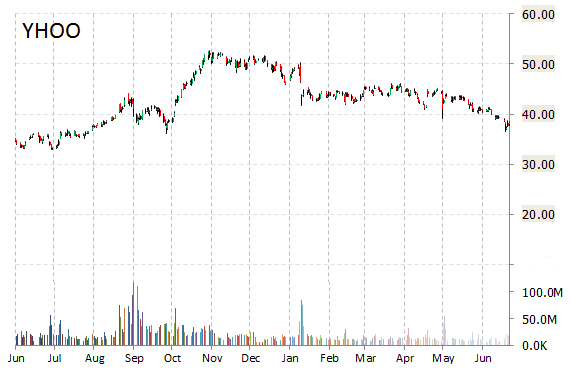

The chart below shows where the equity has traded over the past 52-weeks.

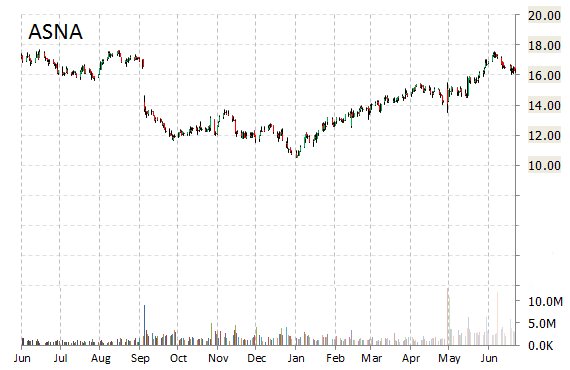

RBC Capital Markets today lowered their Ascena Retail Group Inc. (ASNA) price target to $18 from $20 noting disappointing guidance cut due to Justice and dressbarn shortfall in June.

Ascena shares have traded today between $13.80 and $14.40 with the price of the stock fluctuating between $10.50 to $17.61 over the last 52 weeks. On valuation measures, ASNA shares are currently changing hands at 22.53x this year’s forecasted earnings, compared to the industry’s 19.97x earnings multiple. Ticker has a t-12 price/sales ratio of 0.55. EPS for the same period registers at $0.63.

Shares of Ascena Retail Group have lost $2.20 to $14.17 in midday trading on Monday, giving it a market cap of roughly $2.30 billion. The stock traded as high as $17.61 in September 4, 2014.

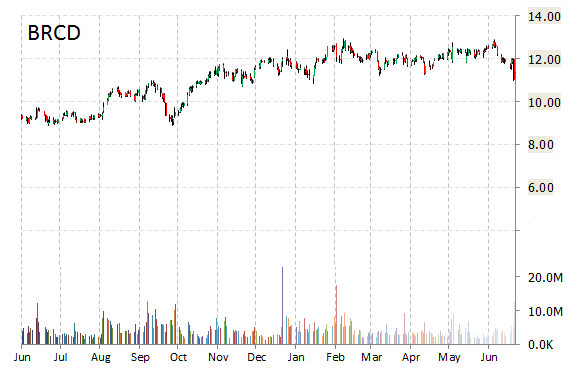

RBC Capital Markets reported on Monday that they have lowered their rating for Brocade Communications Systems, Inc. (BRCD). The firm has downgraded BRCD from ‘Outperform‘ to ‘Sector Perform‘ and lowered its price target to $12 from $13.

Brocade Communications Systems Inc. recently traded at $10.84, a loss of $0.48 over Friday’s closing price. The name has a current market capitalization of $4.50 billion.

As for passive income investors, the company pays shareholders $0.18 per share annually in dividends, yielding 1.60%.

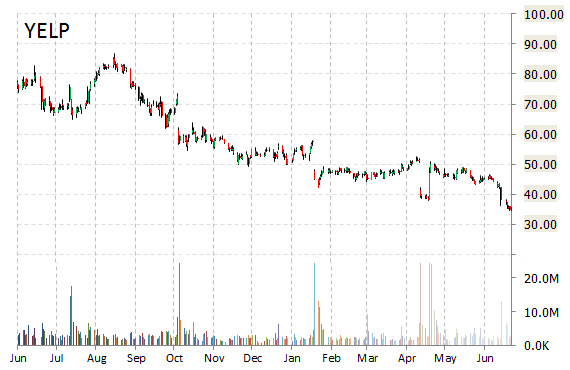

Shares of Yelp Inc. (YELP) – Northland Capital reiterated its ‘Underperform’ rating and cut its 12-month base case estimate on the name by 5.5 points to $29.50 a share.

YELP began trading this morning at $34.84 to currently traded 2.25% higher from the prior days close of $34.73. On an intraday basis it has gotten as low as $34.65 and as high as $35.65.

YELP shares are currently priced at 72.68x this year’s forecasted earnings, which makes them relatively expensive compared to the industry’s 22.31x earnings multiple. The company’s current year and next year EPS growth estimates stand at -7.10% and 276.90% compared to the industry growth rates of 16.90% and 23.40%, respectively. YELP has a t-12 price/sales ratio of 6.19. EPS for the same period registers at 0.49.

YELP’s shares have declined 21.88% in the last 4 weeks and 27.11% in the past three months. Over the past 5 trading sessions the stock has lost 9.04%. Shares of Yelp Inc. are down 36.54% this year.

Yahoo! Inc. (YHOO) – Pivotal Research Group lowered its price target on the web portal at the start of trading on Monday to $42 from $49, and reiterated a ‘Hold’ rating. The broker said this price target is lower than our previous PT update following last quarter’s earnings, driven both by a lower current trading price on Alibaba (BABA) as well as slightly higher risk related to the completion of Yahoo’s plans to divest this position.

YHOO shares recently gained $0.82 to $38.74. In the past 52 weeks, shares of Sunnyvale, Calif.-based company have traded between a low of $32.93 and a high of $52.62. Shares are up 8.56% year-over-year ; down 24.93% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply