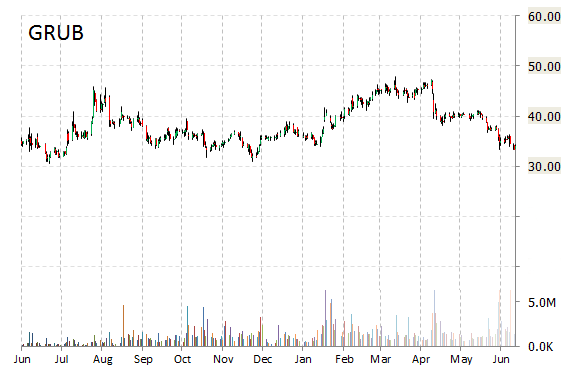

In a report published Wednesday, Guggenheim analysts initiated coverage on GrubHub Inc. (GRUB) with a ‘Buy‘ rating.

On valuation measures, GrubHub Inc. shares currently have a PEG and forward P/E ratio of 1.57 and 39.66, respectively. Price/sales for the same period is 10.09 while EPS is $0.36. Currently there are 16 analysts that rate GRUB a ‘Buy’, 2 rate it a ‘Hold’. No analyst rates it a ‘Sell’. GRUB has a median Wall Street price target of $50.00 with a high target of $56.00.

In the past 52 weeks, shares of Chicago, Illinois-based company have traded between a low of $30.62 and a high of $47.95 and are now at $32.40. Shares are down 3.78% year-over-year and 6.19% year-to-date.

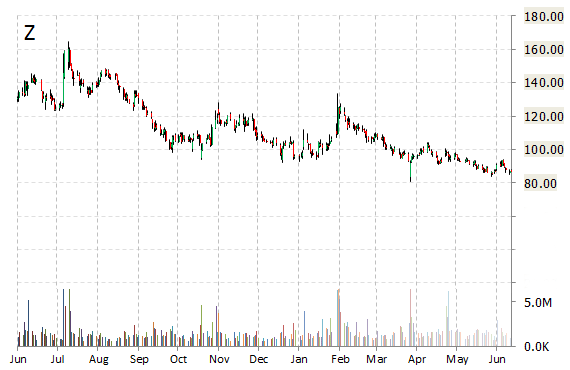

Investment analysts at Guggenheim initiated coverage on shares of Zillow Group, Inc. (Z) in a note issued to investors on Wednesday. The firm set a ‘Buy‘ rating on the stock.

Zillow Group Inc. Cl A, currently valued at $5.19 billion, has a median Wall Street price target of $105.00 with a high target of $135.00. Approximately 496K shares have already changed hands, compared to the stock’s average daily volume of 1.42 million.

In the past 52 weeks, shares of Seattle, Washington-based company have traded between a low of $81.07 and a high of $164.90 with the 50-day MA and 200-day MA located at $91.00 and $100.38 levels, respectively. Additionally, shares of Zillow have a Relative Strength Index (RSI) and MACD indicator of 46.03 and -1.07, respectively.

Zillow Group Inc. currently prints a year-to-date loss of around 18%.

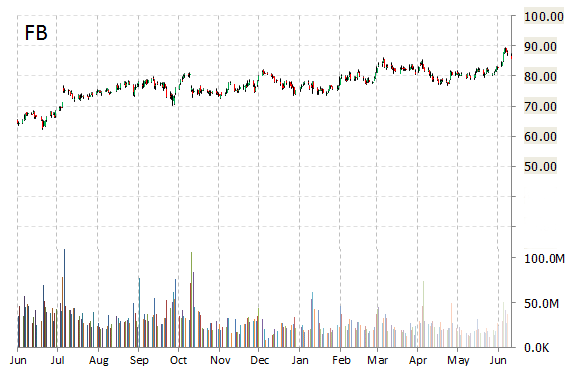

Facebook, Inc. (FB) was reiterated a ‘Buy’ by Cantor Fitzgerald analysts on Wednesday. The broker also raised its price target on the stock to $100 from $92.

FB shares recently gained $1.32 to $87.08. In the past 52 weeks, shares of the social networking giant have traded between a low of $62.21 and a high of $89.40. Shares are up 27.46% year-over-year and 9.93% year-to-date.

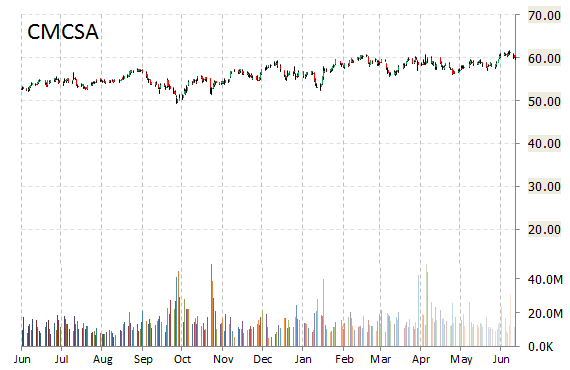

Comcast Corporation (CMCSA) was reiterated as ‘Buy’ with a $69 from $67 price target on Wednesday by Brean Capital.

Comcast Corporation shares are currently priced at 18.64x this year’s forecasted earnings. Ticker has a PEG and forward P/E ratio of 1.19 and 16.32, respectively. Price/Sales for the same period is 2.18 while EPS is 3.30. Currently there are 21 analysts that rate CMCSA a ‘Buy’, 5 rate it a ‘Hold’. No analyst rates it a ‘Sell’. CMCSA has a median Wall Street price target of $67.00 with a high target of $84.00.

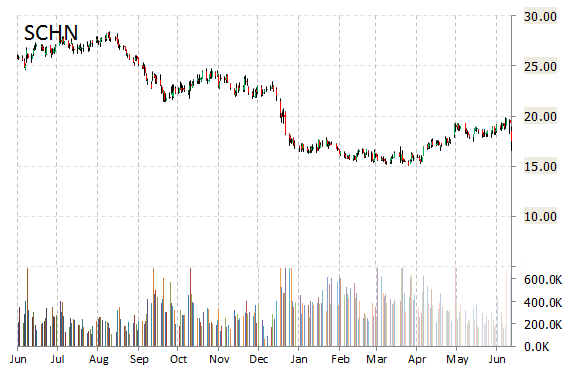

Schnitzer Steel Industries, Inc. (SCHN) was upgraded to ‘Buy‘ from ‘Underperform‘ by BofA/Merrill (BAC) analysts on Wednesday.

SCHN is currently printing a higher than average trading volume with the issue trading 967K shares, compared to the average volume of 314K. The stock began trading this morning at $19.12 to currently trade 15.51% higher from the prior days close of $17.47. On an intraday basis it has gotten as low as $18.85 and as high as $20.65.

Schnitzer shares have declined 3.96% in the last 4 weeks while advancing 11.38% in the past three months. Over the past 5 trading sessions the stock has lost 9.29%.

The Portland, Oregon-based company, which is currently valued at $540.54 million, has a median Wall Street price target of $17.00 with a high target of $25.00. Schnitzer Steel Industries Inc. is down 30.45% year-over-year, compared with a 4.48% gain in the S&P 500.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply