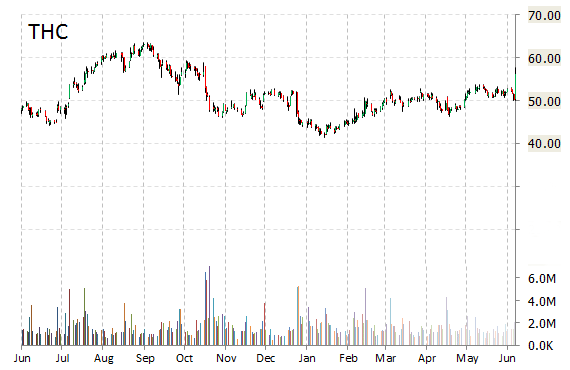

Analysts at Wells Fargo (WFC) are out with a report this morning upgrading shares of Tenet Healthcare Corp. (THC) with a ‘Outperform‘ from ‘Market Perform‘ rating.

Tenet Healthcare Corp. shares are currently priced at 63.54x this year’s forecasted earnings, which makes them expensive compared to the industry’s 14.96x earnings multiple. Ticker has a forward P/E of 20.62 and t-12 price-to-sales ratio of 0.33. EPS for the same period is $0.91.

In the past 52 weeks, shares of Dallas, Texas-based healthcare services company have traded between a low of $41.47 and a high of $63.61 and are now at $57.57. Shares are up 17.25% year-over-year and 10.93% year-to-date.

Analysts at Northcoast upgraded their rating on the shares of Chart Industries Inc. (GTLS). In a research note published on Friday, the firm lifted the name with a ‘Buy‘ from ‘Neutral‘ rating.

On valuation measures, Chart Industries Inc. shares have a PEG and forward P/E ratio of 0.90 and 16.63, respectively. Price/Sales for the same period is 0.92 while EPS is $2.47. Currently there are 8 analysts that rate GTLS a ‘Buy‘, 7 rate it a ‘Hold‘. No analyst rates it a ‘Sell‘. GTLS has a median Wall Street price target of $42.50 with a high target of $52.00.

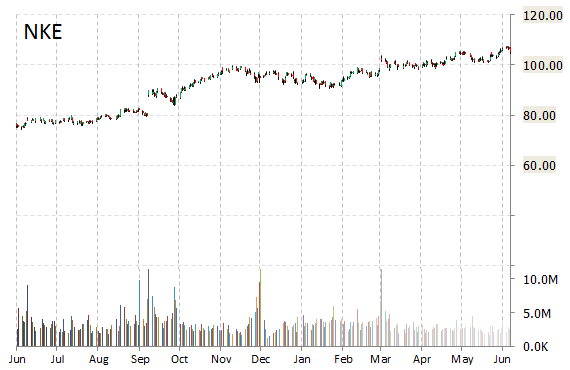

NIKE, Inc. (NKE) was reiterated a ‘Buy’ by Deutsche Bank (DB) analysts on Friday. The broker also raised its price target on the stock to $120 from $115.

NKE shares recently gained $4.14 to $109.36. DB’s target price suggests a potential upside of about 10% from the company’s current stock price.

In the past 52 weeks, shares of Beaverton, Oregon-based co. have traded between a low of $75.90 and a high of $110.34. Shares are up 39.19% year-over-year and 10.05% year-to-date.

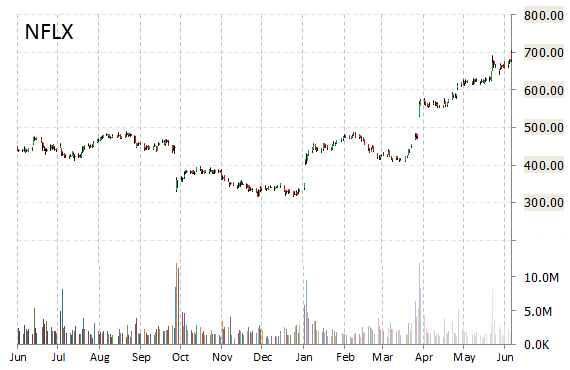

Analysts at MKM Partners raised their price target on shares of Netflix, Inc. (NFLX) to $885 from $690 in a research report issued to clients on Friday. The firm believes that the video streaming company has significant upside over the next few years. They see domestic penetration exceeding 60%, but see a more significant subscriber opportunity outside of the U.S.

Netflix shares closed at $664.24 yesterday. MKM’s target price suggests a potential upside of about 35% from the company’s current price.

NFLX shares recently lost $10.79 to $653.45. The stock is up more than 49% year-over-year and has gained roughly 95% year-to-date. In the past 52 weeks, shares of the $39.61 billion market Los Gatos, Calif.-based company have traded between a low of $315.54 and a high of $706.24.

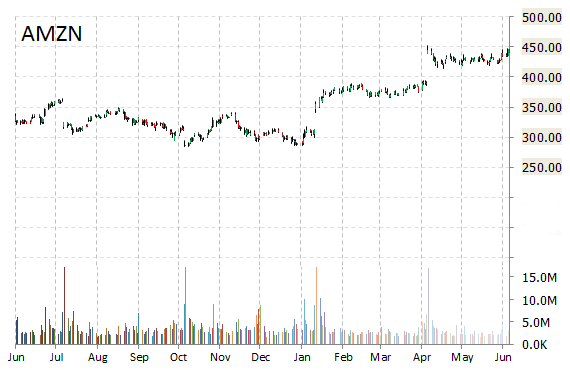

In a report published Friday, Mizuho analysts initiated coverage on Amazon.com Inc. (AMZN) with a ‘Buy‘ rating and $498 price target. Firm notes the e-commerce giant may be viewed as poorly run business with deteriorating fundamentals, but with $6/shr in cash on its balance sheet and positive core free cash flow is worth something more than the ‘zero’ implied by the current stock price after applying their sum-of-the-parts valuation analysis. Mizuho said it sees opportunity for fundamental improvement too.

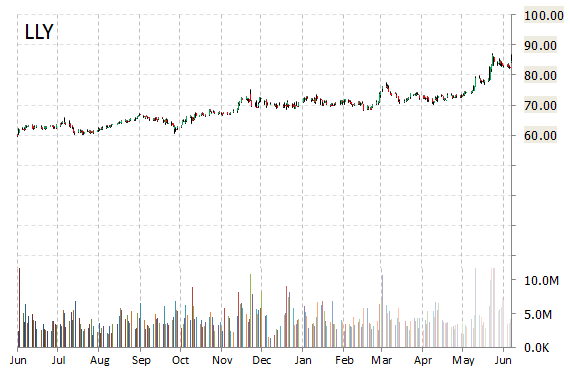

Eli Lilly and Company (LLY) was reiterated as ‘Outperform’ with a $92 from $77 price target on Friday by Leerink Partners.

LLY began trading this morning at $85.19 to currently trade 0.85% higher from the prior days close of $84.80. On an intraday basis it has gotten as low as $84.58 and as high as $85.86.

Eli Lilly & Co. shares are priced at 41.72x this year’s forecasted earnings, compared to the industry’s 1.58x earnings multiple. The company’s current year and next year EPS growth estimates stand at 13.70% and 11.40% compared to the industry growth rates of 48.90% and 90.00%, respectively. LLY has a t-12 price-to-sales ratio of 4.61. EPS for the same period registers at $2.05.

Eli Lilly shares have advanced 13.22% in the last 4 weeks and 16.27% in the past three months. Over the past 5 trading sessions the stock has gained 2.12%.

The Indianapolis, Indiana-based company, which is currently valued at $90.56 billion, has a median Wall Street price target of $80.00 with a high target of $101.00. Eli Lilly & Co. is up 38.60% year-over-year, compared with a 7.21% gain in the S&P 500.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply