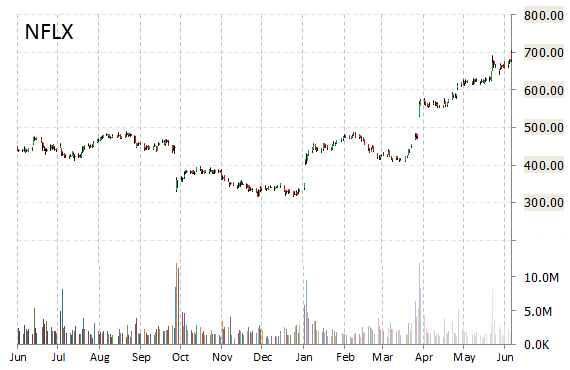

Analysts at Citigroup (C) downgraded Netflix, Inc. (NFLX) from ‘Buy‘ to ‘Neutral‘ in a research report issued to clients on Thursday. The downgrade was based on a valuation call.

“While we’ve presented an upside case of more than $950/share, we believe investors are unlikely to ascribe this full value until there are more signs of traction in recently launched markets, which may not be imminent,” Citigroup said in its report.

On valuation measures, Netflix Inc. stock it’s trading at a forward P/E multiple of 208.01x, and at a multiple of 171.91x this year’s estimated earnings. The t-12-month revenue at Netflix Inc. is $5.81 billion. NFLX ‘s ROE for the same period is 14.02%.

Shares of the $39.99 billion market cap company are up 55.52% year-over-year and 98.65% year-to-date.

Netflix Inc., currently with a median Wall Street price target of $605.00 and a high target of $950.00, dropped $18.76 to $659.6301 in recent trading.

The chart below shows where the equity has traded over the past 52-weeks.

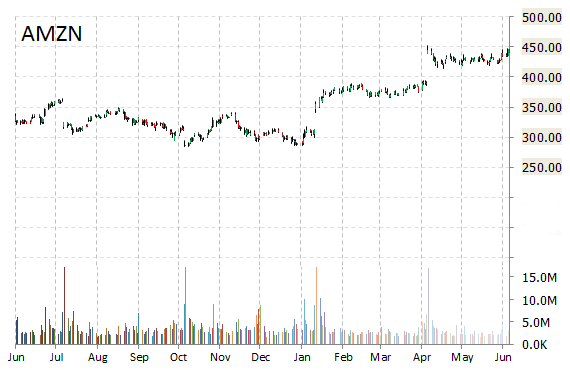

Amazon.com Inc. (AMZN) was downgraded to ‘Hold’ from ‘Buy’ at Evercore ISI. The firm, while maintaining the name’s $460 price target, attributed the downgrade to valuation concerns, saying its reduced rating recognizes the strong run in shares, now up 45% year-to-date.

AMZN has traded today between $436.39 and $439.50 with the price of the stock fluctuating between $284.00 to $452.65 over the last 52 weeks.

Shares of Amazon have lost $2.18 to $438.66 in morning trading on Thursday, giving it a market cap of roughly $204 billion. The stock traded as high as $452.65 in April 24, 2015.

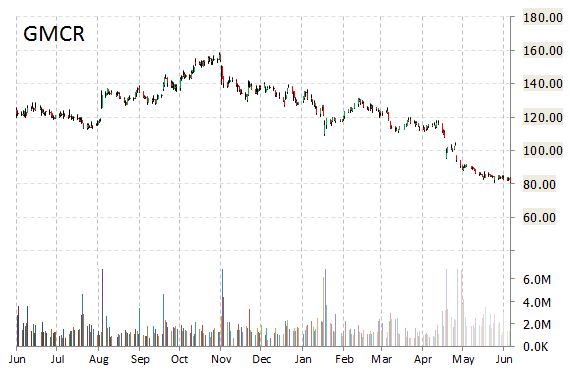

BofA/Merrill (BAC) reported on Thursday that they have lowered their Keurig Green Mountain Inc. (GMCR) price target to $95 from $117.

Keurig Green Mountain recently traded at $78.95, a loss of $2.23 over Wednesday’s closing price. The name has a current market capitalization of $12.16 billion.

As for passive income investors, the beverage company pays shareholders $1.15 per share annually in dividends, yielding 1.40%.

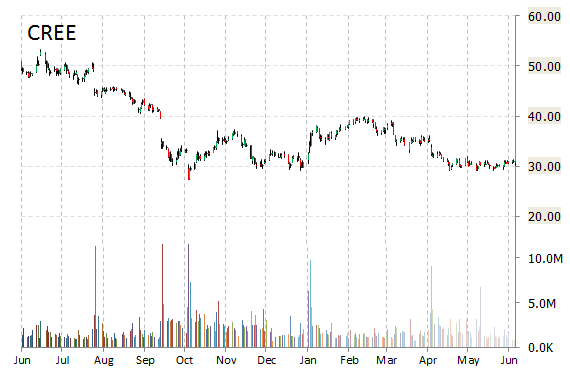

Cree, Inc. (CREE) was reiterated as ‘Neutral’ with a $30.50 from $35 price target on Thursday by UBS.

CREE shares recently lost $3.39 to $27.17. The stock is down more than 36% year-over-year and has lost roughly 5% year-to-date. In the past 52 weeks, shares of Durham, North Carolina-based company have traded between a low of $26.92 and a high of $53.33.

Cree, Inc. closed Wednesday at $30.56. The name has a current market cap of $2.97 billion.

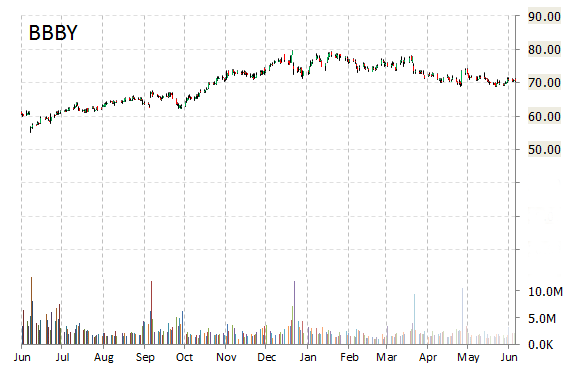

Bed Bath & Beyond Inc. (BBBY) had its ‘Neutral’ rating reiterated at UBS on Thursday. Following the company’s one-cent miss and Q2 earnings guidance below consensus estimates, the broker said it sees shares fairly valued at $73 from previous $75/shr estimate. Currently there are 5 analysts that rate BBBY a ‘Buy‘, 4 analysts rate it a ‘Sell‘, and 15 rate it a ‘Hold‘.

BBBY was down $1.76 at $68.58 in morning trade, moving within a 52-week range of $54.96 to $79.64. The name, valued at $11.88 billion, opened at $68.29.

On valuation measures, Bed Bath & Beyond Inc. shares are currently priced at 13.53x this year’s forecasted earnings. Ticker has a t-12 price/sales ratio of 1.01. EPS for the same period registers at $5.07.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply