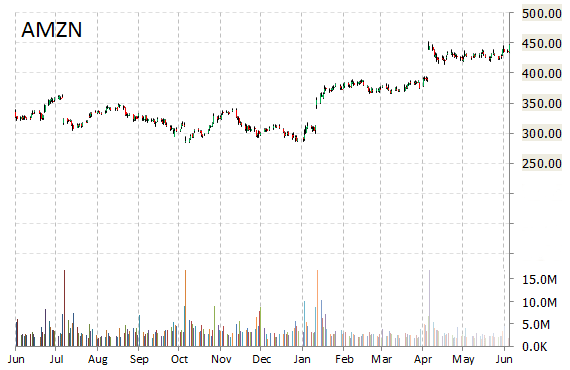

In a report published Wednesday, Axiom reiterated a ‘Buy’ rating on Amazon.com, Inc (AMZN), while raising the name’s PT by 40 points to $500. The firm believes Amazon Web Services’ scale, growth rates, and high margin profile make it an attractive asset that should provide sum-of-the-parts valuation support for share price. Firm now values AWS at $72 billion or $150/shr.

AMZN shares recently lost $3.59 to $442.40. In the past 52 weeks, shares of Seattle, Washington-based e-commerce giant have traded between a low of $284.00 and a high of $452.65. Shares are up 36.29% year-over-year and 43.71% year-to-date.

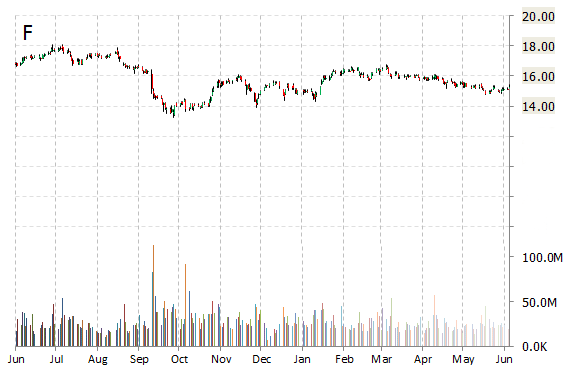

Analysts at Goldman (GS) are out with a report this morning upgrading shares of Ford Motor Co. (F) with a ‘Buy‘ from ‘Neutral‘ rating.

On valuation mesures, Ford Motor Co. shares are currently priced at 19.86x this year’s forecasted earnings. Ticker has a forward P/E of 8.28 and t-12 price-to-sales ratio of 0.43. EPS for the same period is $0.78.

Over the past year, shares of Dearborn, Michigan-based company have traded between a low of $13.26 and a high of $18.12 and are now at $15.55. Shares are down 6.14% year-over-year ; up 0.59% year-to-date.

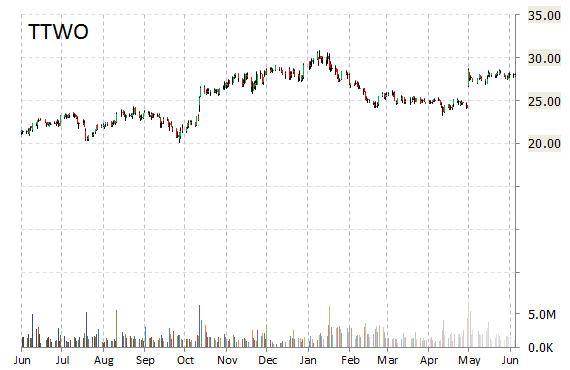

Analysts at Jefferies upgraded their rating on the shares of Take-Two Interactive Software Inc. (TTWO). In a research note published on Wednesday, the firm lifted the name with a ‘Buy‘ from ‘Hold‘ rating.

TTWO shares recently gained $0.59 to $28.61. The stock is up more than 30% year-over-year and has lost less than one percent year-to-date. In the past 52 weeks, shares of the New York-based firm have traded between a low of $20.13 and a high of $30.80.

Take-Two Interactive Software Inc. closed Tuesday at $28.01. The name has a current market cap of $2.42 billion.

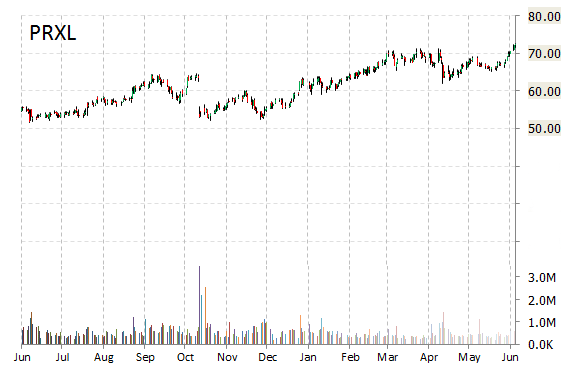

Parexel International Corporation (PRXL) was reiterated a ‘Buy’ by UBS analysts on Wednesday. The broker also raised its price target on the stock to $82 from $72.

PRXL shares recently lost $5.07 to $67.50. UBS’ target price suggests a potential upside of about 21% from the company’s current stock price.

In the past 52 weeks, shares of Waltham, Massachusetts-based biopharmaceutical outsourcing services company have traded between a low of $51.73 and a high of $72.69. Shares are up 32.77% year-over-year and 30.62% year-to-date.

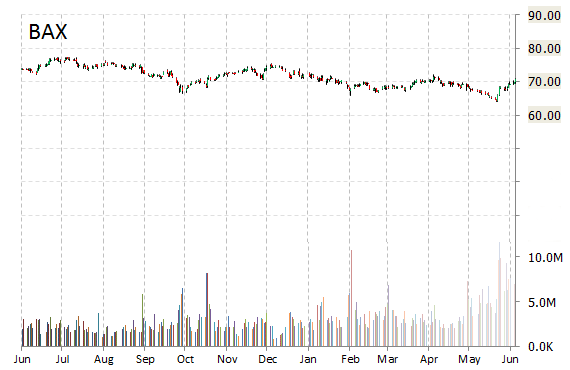

In a report published Wednesday, Goldman (GS) analysts initiated coverage on Baxter International Inc. (BAX) with a ‘Buy‘ rating.

On valuation measures, Baxter International Inc. shares currently have a PEG and forward P/E ratio of 4.93 and 17.65, respectively. Price/sales for the same period is 2.32 while EPS is $4.34. Currently there are 6 analysts that rate BAX a ‘Buy’, 9 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. BAX has a median Wall Street price target of $74.50 with a high target of $82.00.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply