The magazine The Economist has an article this week on the persistence of the current recession and whether output will return to its trend. The arguments that the article present are similar to those made in the Chapter 4 of the recent World Economic Outlook by the IMF (see our previous post on this matter): it is likely that the current recovery is not strong enough to bring output back to trend. In a recent NBER working paper, Cechetti, Kohler and Upper also provide empirical evidence suggesting that financial crisis leave long-lasting (negative) effects on output.

The question on the connection between recessions (or business cycles in general) and potential output (“the trend”) is one that has not been studied much in economics. Most of the models we use tend to think about the trend as being independent of business cycles – so recoveries always bring output back to the pre-crisis trend. Policy makers tend to use the concept of the output gap, the deviation of output from its potential, to think about the strength of the recovery under the assumption that in a “normal” year the output gap should be back to zero.

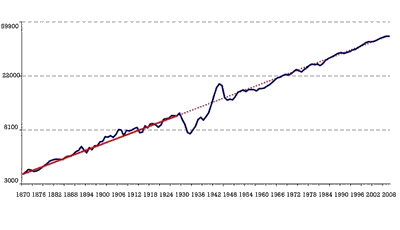

The strongest evidence one can find in favor of this hypothesis (that recessions are temporary) comes from the US economy. The US economy has displayed a surprising tendency to return to trend even after some major events such as the great depression, World War II or the recessions of the 70s. Below you can see a chart that shows the evolution of GDP per capita in the US during the period 1870-2008. The red line represents a (log-)linear trend using data up to 1928. It is remarkable how close the blue line is to the red line and how the economy recovers to return to trend.

The strongest evidence one can find in favor of this hypothesis (that recessions are temporary) comes from the US economy. The US economy has displayed a surprising tendency to return to trend even after some major events such as the great depression, World War II or the recessions of the 70s. Below you can see a chart that shows the evolution of GDP per capita in the US during the period 1870-2008. The red line represents a (log-)linear trend using data up to 1928. It is remarkable how close the blue line is to the red line and how the economy recovers to return to trend.

In fact, using 1870-1928 data, a prediction using that (log-)linear trend leads to an error of only 1% for the level of GDP per capita in 2008. Of course, the picture is misleading in the sense that in some cases it took a long time for the economy to come back to this trend, but it is still interesting that it returned to the same trend. It could have returned to the same growth rate but at a different level but that’s not what we see, we see that the output loss is always recovered after a number of years. This suggests that the supply side of the economy (innovation, technology) is unaffected by output fluctuations.

If one looks more carefully at the data, the evidence becomes much weaker. In contradiction to what we see in the picture above, empirical economists know that output fluctuations are very persistent. In fact, one cannot reject the hypothesis that all output fluctuations leave a permanent scar in the economy. If we suffer a recession, output never goes back to trend, it remains at a lower level forever (this is what is known in the academic literature as the existence of a “unit root” in output).

From a theoretical point of view, there are two ways to justify the fact that recessions always leave permanent effects:

1. Technological changes are the cause of business cycles. Recessions are period where we are not good at innovating and this causes both a recession and a permanent loss in output. This is what we know as “real business cycle theory”.

2. Innovation is affected by recessions. During recessions firms invest less and this lead to a temporary slowdown of technological progress, so the economy never returns to the same trend. It will go back to its normal growth rate but the temporary effects on growth will leave a permanent scar on the economy. This is the argument that we hear these days to support the fear that the current recovery will not be strong enough. A few years ago I wrote a couple of academic papers that presented this theory and some international evidence in favor of this hypothesis (the papers can be found here and here). This is an area of macroeconomics that I believe deserves more attention in terms of academic research (but I am biased, given that I have written on the subject). And it is not just about financial crisis but, more generally, about what happens to innovation, technology and growth during recessions.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply