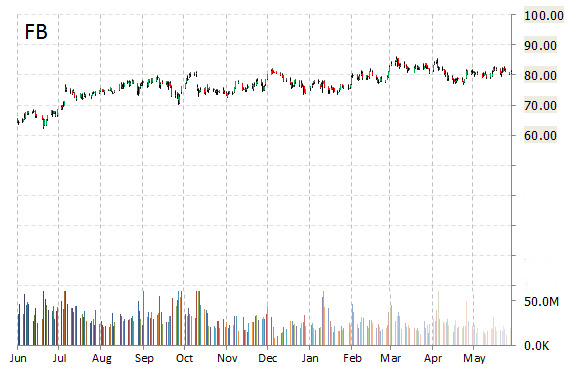

Facebook, Inc. (FB) was reiterated a ‘Buy’ by Brean Capital analysts on Wednesday. The broker also raised its price target on the stock to $108 from $100 noting their checks suggest that the budget shift to video ads and Instagram is coming from traditional advertising, in particular TV, and that budgets on Facebook Core are not being impacted.

Facebook, Inc. shares are currently priced at 79.10x this year’s forecasted earnings compared to the industry’s 22.72x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.44 and 30.88, respectively. Price/Sales for the same period is 16.85 while EPS is $1.03. Currently there are 39 analysts that rate FB a ‘Buy’, 6 rate it a ‘Hold’. No analyst rates it a ‘Sell’. FB has a median Wall Street price target of $95.00 with a high target of $114.00.

In the past 52 weeks, shares of Menlo Park, California-based social networking giant have traded between a low of $62.21 and a high of $86.07 and are now at $81.70. Shares are up 26.28% year-over-year and 3.90% year-to-date.

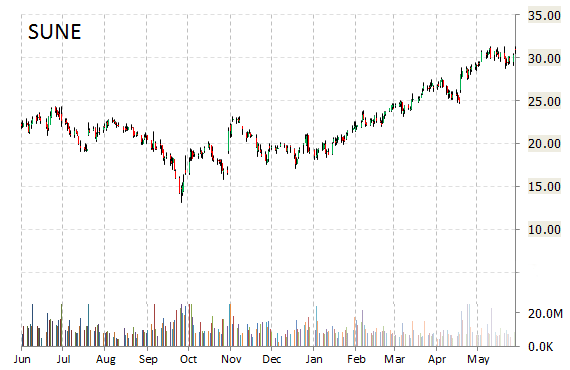

SunEdison, Inc. (SUNE) was reiterated as ‘Buy’ with a $36 from $34 price target on Wednesday by Needham.

On valuation measures, SunEdison Inc. shares have a PEG and price-to-book ratio of (6.08) and 71.83, respectively. T-12 price/sales is 3.44 while EPS is ($3.48). Currently there are 12 analysts that rate SUNE a ‘Buy‘, 1 rates it a ‘Hold‘. No analyst rates it a ‘Sell‘. SUNE has a median Wall Street price target of $35.50 with a high target of $44.00.

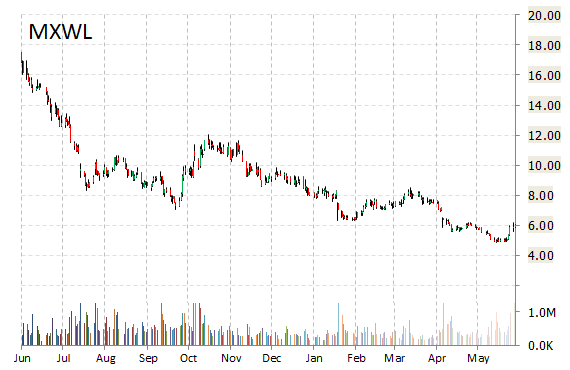

Maxwell Technologies, Inc. (MXWL) was raised to ‘Outperform‘ from ‘Market Perform‘ and it was given a $7 price target at Northland Capital on Wednesday.

MXWL is up $0.40 at $6.44 on heavy volume. Midway through trading Wednesday, 682K shares of Maxwell Technologies Inc. have exchanged hands as compared to its average daily volume of 458K shares. The stock has ranged in a price between $6.27-$6.68 after having opened the day at $6.33 as compared to the previous trading day’s close of $6.04.

In the past 52 weeks, shares of San Diego, Calif.-based company have traded between a low of $4.85 and a high of $17.61. Shares are down 64.86% year-over-year and 34% year-to-date.

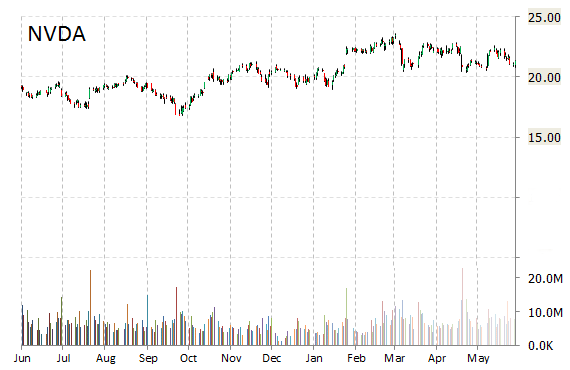

Analysts at Tigress Financial are out with a report this morning upgrading shares of NVIDIA Corporation (NVDA) with a ‘Buy’ from ‘Neutral’ rating.

NVDA shares are currently priced at 19.19x this year’s forecasted earnings, which makes them expensive compared to the industry’s 9.01x earnings multiple. Ticker has a forward P/E of 19.93 and t-12 price-to-sales ratio of 2.43. EPS for the same period is $1.12.

In the past 52 weeks, shares of Santa Clara, California-based firm have traded between a low of $16.77 and a high of $23.61 and are now at $21.50. Shares are up 11.39% year-over-year and 7.29% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply