As I await the employment report, I am reflecting on the flow of information over the past week and find myself somewhat dismayed by the apparent policy implications. The spate of FedSpeak in recent days leaves one with the uneasy feeling that monetary policymakers are more willing to use unconventional monetary policy to support Wall Street than Main Street. The most hawkish appear eager to normalize policy at the earliest opportunity possible, and even the dovish, grasping onto green shoots, appear to think they have done enough to support recovery. It is as if the FOMC has concluded that the risks are now entirely one-sided toward inflation. To be sure, Bernanke & Co. have shifted direction often during the past two years. But the FOMC looks to be developing something of a blind spot with regard to downside risks to the economy, suggesting that even if the economy stagnates in a jobless recovery, the bar to further easing is very high.

Governor Kevin Warsh fired the shot across the bow last week, first with a Wall Street Journal op-ed, followed by a speech that included the key paragraphs:

Ultimately, when the decision is made to remove policy accommodation further, prudent risk management may prescribe that it be accomplished with greater swiftness than is modern central bank custom. The Federal Reserve acted preemptively in providing monetary stimulus, especially in early 2008 when the economy appeared on an uneven, uncertain trajectory. If the economy were to turn up smartly and durably, policy might need to be unwound with the resolve equal to that in the accommodation phase. That is, the speed and force of the action ahead may bear some corresponding symmetry to the path that preceded it. Of course, if the economy remains mired in weak economic conditions, and inflation and inflation expectation measures are firmly anchored, then policy could remain highly accommodative.

“Whatever it takes” is said by some to be the maxim that marked the battle of the last year. But, it cannot be an asymmetric mantra, trotted out only during times of deep economic and financial distress, and discarded when the cycle turns. If “whatever it takes” was appropriate to arrest the panic, the refrain might turn out to be equally necessary at a stage during the recovery to ensure the Fed’s institutional credibility. The asymmetric application of policy ultimately could cause the innovative policy approaches introduced in the past couple of years to lose their standing as valuable additions in the arsenal of central bankers.

While Warsh does note that weak economic conditions would defer tightening, the message is clear: we are looking to tighten, and will do so aggressively when economic activity firms. Moreover, we will do so preemptively, which means we are looking for opportunities prior to the emergence of very solid data.

Note one of the concerns identified by Warsh:

In my view, if policymakers insist on waiting until the level of real activity has plainly and substantially returned to normal–and the economy has returned to self-sustaining trend growth–they will almost certainly have waited too long. A complication is the large volume of banking system reserves created by the nontraditional policy responses. There is a risk, of much debated magnitude, that the unusually high level of reserves, along with substantial liquid assets of the banking system, could fuel an unanticipated, excessive surge in lending. Predicting the conversion of excess reserves into credit is more difficult to judge due to the changes in the credit channel.

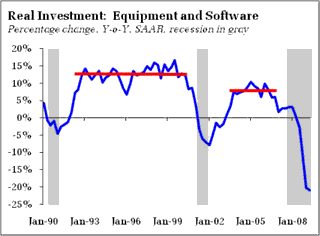

Are we really worried about a lending explosion by itself, or that the regulatory environment remains so weak that financial institutions will quickly repeat the experience of this decade’s debt bubble? Considering the question always draws me back to this chart, which for me epitomizes the difference between the 1990s and the 2000s.

Are we really worried about a lending explosion by itself, or that the regulatory environment remains so weak that financial institutions will quickly repeat the experience of this decade’s debt bubble? Considering the question always draws me back to this chart, which for me epitomizes the difference between the 1990s and the 2000s.

The 1990s saw a remarkable period of sustained, high levels of investment in equipment and software. In contrast, a sustained period of very low interest rates during this decade was barely able to coerce firms to invest in the high single digits. That, in my mind, is a critical problem, reflecting low expected returns to capital investment. In effect, the policy error might not have been low rates. Indeed, rates do not look to have been low enough to stimulate sufficient investment demand to absorb the productive capacity of the nation, the classic Keynesian problem:

This analysis supplies us with an explanation of the paradox of poverty in the midst of plenty. For the mere existence of an insufficiency of effective demand may, and often will, bring the increase of employment to a standstill before a level of full employment has been reached. The insufficiency of effective demand will inhibit the process of production in spite of the fact that the marginal product of labour still exceeds in value the marginal disutility of employment.

Moreover the richer the community, the wider will tend to be the gap between its actual and its potential production; and therefore the more obvious and outrageous the defects of the economic system. For a poor community will be prone to consume by far the greater part of its output, so that a very modest measure of investment will be sufficient to provide full employment; whereas a wealthy community will have to discover much ampler opportunities for investment if the saving propensities of its wealthier members are to be compatible with the employment of its poorer members. If in a potentially wealthy community the inducement to invest is weak, then, in spite of its potential wealth, the working of the principle of effective demand will compel it to reduce its actual output, until, in spite of its potential wealth, it has become so poor that its surplus over its consumption is sufficiently diminished to correspond to the weakness of the inducement to invest.

But worse still. Not only is the marginal propensity to consume weaker in a wealthy community, but, owing to its accumulation of capital being already larger, the opportunities for further investment are less attractive unless the rate of interest falls at a sufficiently rapid rate….

With the primary build out of the internet backbone complete, the US appeared to experience a dearth of traditional investment opportunities (I suspect that the need to expand production domestically was made moot by an international financial arrangement that favored the establishment of productive capacity overseas), and, like water flowing downhill, capital was thus allocated this decade to residential investment, which, we now know was more about consumption than investment, and the resulting economic activity was anemic by historical standards.

This line of argument leads one to believe that withdrawing monetary stimulus would be a significant policy error, especially if investment growth remains constrained as we saw this decade. In fact, it would lend additional credence to reports that the Fed needs to do much, much more – a massive, unsterilized expansion of the balance sheet – should they even hope to stimulate sufficient investment demand to absorb underutilized labor. Instead, FOMC members appear to be concerned that stimulative policy will be the root cause of the next financial crisis. That, however, appears to me to confuse monetary with regulatory policy. The former should speak to inducement to invest, while the latter speaks to protecting against significant misallocations of capital.

Following the Warsh speech, Vice Chair Donald Kohn looked to tamp down expectations of an imminent rise in rates:

Although economic conditions have apparently begun to improve–partly in response to the extraordinary steps the Federal Reserve and other authorities have taken–resource utilization is quite low, inflation is subdued, and continuing restraints on credit are likely to constrain the speed of recovery. For that reason, as the FOMC stated last week, exceptionally low interest rates are likely to be warranted for an extended period. Given the highly unusual economic and financial circumstances, judging when the time is appropriate to remove policy accommodation, and then calibrating that removal, will be challenging. Still, we need to be ready to take the necessary actions when the time comes, and we will be.

Still, like Warsh, Kohn looks determined to find an opportunity to remove accommodation. This despite expected high rates of unemployment. From Bloomberg:

Federal Reserve Chairman Ben S. Bernanke said U.S. economic growth next year probably won’t be strong enough to “substantially” bring down the jobless rate, which may remain above 9 percent at the end of 2010.

“Most forecasters including the Fed are currently looking at growth in 2010, but not growth so rapid as to substantially lower the unemployment rate,” Bernanke said in response to questions at a House Financial Services Committee hearing today in Washington. Growth of 3 percent means the rate would “still probably be above 9 percent by the end of 2010,” Bernanke said.

Interesting how the Fed is encouraging expectations of policy withdrawal even though unemployment rates will remain unacceptably high through 2010. And, if above 9 percent at the end of next year, certainly unacceptably high during 2011 as well. Richmond Federal Reserve President Jeffrey Lacker even goes one step further in a Bloomberg interview:

The Federal Reserve will need to raise interest rates when the economic recovery is “firmly” in place, even if unemployment lingers near 10 percent, Federal Reserve Bank of Richmond President Jeffrey Lacker said.

“I am going to be looking for when growth reestablishes itself firmly enough that it is clear real interest rates need to rise,” Lacker said today in a Bloomberg Radio interview. “I think the growth outlook, particularly the consumer spending outlook, are more fundamental than labor-market conditions.”

Seriously, raising rates even if unemployment is 10%? LACKER SAYS THIS ON THE DAY WE GET CORE PCE INFLATION SLIDING TO 1.3% Y-O-Y! This redefines the term “hawk.”

From where does this fear of inflation emanate? That brings us to perma-hawk Philadelphia Fed President Charles Plosser:

Unfortunately, slack was poorly measured and turned out to be not as significant as first estimated. Thus, the Fed’s monetary expansion led to rising inflation for the balance of the 1970s. One lesson learned during this episode is that inflation expectations can matter a great deal, and if they become unanchored — that is, if the public comes to believe that the Fed will not do what is necessary to preserve price stability — then inflation can rise quickly regardless of the amount of so-called slack in the economy. The price we paid to regain control of inflation and the Fed’s credibility to do so came in the form of the 1981-82 recession and was a steep one.

Consequently, just as the Fed has taken aggressive steps in flooding the financial markets with liquidity during this crisis to reduce the possibility of a second Great Depression, it will also have to take the necessary steps to prevent a second Great Inflation. Our credibility depends on it. As the economy and financial markets improve, the Fed will need to exit from this period of extraordinarily low interest rates and large amounts of liquidity. We recognize the costs that significantly higher inflation and the ensuing loss of credibility will impose on the economy if we fail to act promptly, and perhaps aggressively, when the time comes to do so. The Fed will need courage because I believe we will need to act well before unemployment rates and other measures of resource utilization have returned to acceptable levels. The issues of when and the pace at which we unwind the extraordinary measures taken during the financial crisis and recession are ones that are high on my list of priorities and are the subject of ongoing discussions within the Fed.

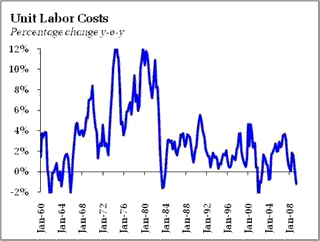

The experience of the 1970s is such a tired and faulted analogy. To generate a wage-price inflation spiral, you need to explain the mechanism by which rising inflation expectations (which don’t exist anyway) get translated into high wages. I do not see that current institutional arrangements in the US allow this; nor do we see it in the data.

The experience of the 1970s is such a tired and faulted analogy. To generate a wage-price inflation spiral, you need to explain the mechanism by which rising inflation expectations (which don’t exist anyway) get translated into high wages. I do not see that current institutional arrangements in the US allow this; nor do we see it in the data.

One could at least wait for significant – or any, for that matter – year over year gains in unit labor costs before declaring that we are at the doorstep of the 1970’s. Moreover, the seeds of that inflation did not sprout overnight; the signs were evident but ignored in the late 1960’s. Only in Plosser’s mind exists the need for an imminent withdrawal of policy.

Bottom Line: The data this week has not been supportive of a rapid exit from accommodative policy. Indeed, the opposite could very well be the case. Despite this, Fed officials, albeit to varying degrees, are uniformly signaling that the actions to expand the balance sheet are only temporary and will be reversed absolutely as soon as possible, which only undermines the stimulative potential of those actions. This is definitely not quantitative easing, and uncomfortably harkens back to the fear of inflation that constrained policy at the Bank of Japan. It is interesting that Fed Chairman Ben Bernanke has worked so hard to avoid a repeat of that experience yet appears ready to risk repeating it nonetheless.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply